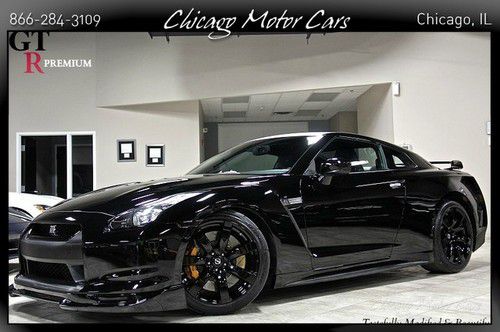

2009 Nissan Gt-r Premium Coupe With Alpha 9 Kit on 2040-cars

Portland, Oregon, United States

For Sale By:Dealer

Transmission:Automatic

Body Type:Coupe

Vehicle Title:Clear

Engine:6 cyl twin turbo

Power Options: Navigation

Sub Model: Alpha 9

Exterior Color: Black

Interior Color: Black

Number of Doors: 2

Number of Cylinders: 6

Year: 2009

Make: Nissan

Model: GT-R

Warranty: Vehicle does NOT have an existing warranty

Trim: premium

Options: 4-Wheel Drive

Drive Type: awd

Safety Features: Anti-Lock Brakes

Nissan GT-R for Sale

2009 nissan gt-r premium w/upgrade$ carbon fiber exhaust 19k mls loaded perfect(US $82,800.00)

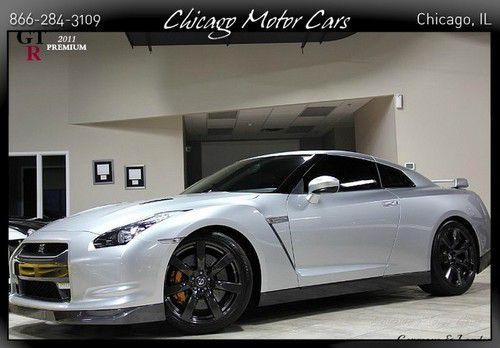

2009 nissan gt-r premium w/upgrade$ carbon fiber exhaust 19k mls loaded perfect(US $82,800.00) 2011 nissan gt-r premium super silver 6,400 miles pristine 1owner ipod loaded $$(US $77,800.00)

2011 nissan gt-r premium super silver 6,400 miles pristine 1owner ipod loaded $$(US $77,800.00) 2013 nissan gtr "black edition" - best priced on market! brand new!! call!!!

2013 nissan gtr "black edition" - best priced on market! brand new!! call!!! 2009 super silver nissan gt-r gtr - premium(US $63,499.00)

2009 super silver nissan gt-r gtr - premium(US $63,499.00) 2009 nissan gt-r 2dr cpe premium skyline gtr like 2010,(US $59,500.00)

2009 nissan gt-r 2dr cpe premium skyline gtr like 2010,(US $59,500.00) 2014 nissan gtr black new be 1 of the first 2 own(US $110,615.00)

2014 nissan gtr black new be 1 of the first 2 own(US $110,615.00)

Auto Services in Oregon

Westgate Auto Ctr ★★★★★

University Honda ★★★★★

Trademark Transmissions ★★★★★

Tlk Automotive Repair ★★★★★

Shelby`s Auto Electric ★★★★★

Sears Auto Center ★★★★★

Auto blog

Nissan gives a better look at its Vision Gran Turismo concept

Wed, 11 Jun 2014Just the other day, Nissan released an image showing all of its cars you can drive in Gran Turismo, with one little mystery hiding in the bottom right corner: a draped shape with the date June 10, 2014 - suggesting that it would reveal its Vision Gran Turismo on that date. Well, if you look at that calendar you'll realize that June 10 came and went yesterday, and Nissan didn't reveal the car.

As it turns out, what the folks at Nissan meant when they indicated June 10 was that they'd release the next teaser on that date, and that's what we have here. The teaser hints at one menacing-looking futuristic chunk of virtual performance meta, but "the next chapter" won't be revealed until next week on Monday, June 16. At that point we hope Nissan will actually reveal the full thing and not another teaser, but one way or another the finished product is expected to be present in the flesh (or sheet metal) for the Goodwood Festival of Speed at the end of the month.

2015 Nissan Versa Sedan continues to prioritize space and price over looks

Wed, 16 Apr 2014Nissan's refresh of its cavernous Versa Sedan is on hand today at the 2014 New York Auto Show. While we continue to appreciate the Versa for its space and low price, this slight restyling of the four-door sedan hasn't done much for its uninspiring appearance.

Newly enlarged headlights and a reworked, more Altima-like grille are the biggest changes to the front of this Versa, although Nissan has also added some brightwork around the revised foglight housings. Integrated turn signals liven up the mirrors, while the rear of the car wears a new and almost strangely sporty bumper.

Perhaps more importantly for prospective owners, Nissan has also made a few interior tweaks, with a new steering wheel and a revised center stack leading the change. There's some new available tech on the top-end SL model, as well.

Ford Mustang chief engineer, mid-engine Corvette | Autoblog Podcast #488

Fri, Sep 16 2016Note: There were some technical difficulties that prevented some of you from downloading this week's podcast. The player and link below should be working now, and the file has reached iTunes and other feeds as well. Thanks to everyone who wrote in to let us know of the issues! On the podcast this week, we have some questions for Ford Chief Engineer Carl Widman. Plus, Associate Editor Reese Counts joins Mike Austin to talk about the latest news, most notably the spy photos of the upcoming mid-engine Corvette. We also chat about the Jaguar F-Type Coupe, the Nissan Armada, and why 0-60 mph is a stupid performance figure. And, of course, we get into some Spend My Money advice, telling strangers what car to buy. And new this week is a cost-no-object what-cars-would-you-buy game. The rundown is below. And don't forget to send us your questions, money-spend or otherwise, to podcast at autoblog dot com. Autoblog Podcast #488 The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics and stories we mention Mid-engine Chevrolet Corvette spied Chevy Bolt EV comes with 238 miles of range Ford will sell self-driving cars by 2025 Jaguar F-Type Coupe 2017 Nissan Armada (yes, Mike knows it's not a Patrol) Ford Mustang Chief Engineer Carl Widman interview Spend My Money - we give purchase advice Why 0–60 mph is a stupid performance test Rundown Intro - 00:00 The news - 03:30 What we've been driving - 16:20 Carl Widman - 26:44 Spend my money - 37:03 New fun game - 51:48 0–60 mph is overrated - 56:50 Total Duration: 1:04:57 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show in iTunes Podcasts Chevrolet Ford Jaguar Nissan Car Buying nissan armada mid-engine corvette jaguar f-type coupe