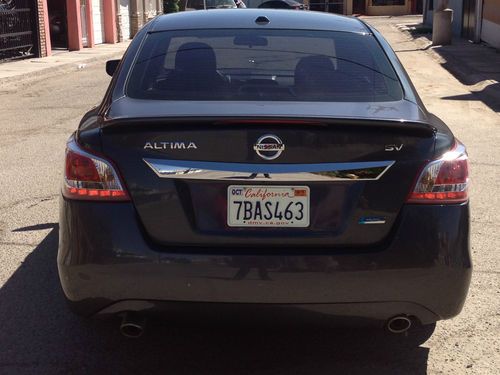

Nissan Altima for Sale

2000 nisan altima(US $3,000.00)

2000 nisan altima(US $3,000.00) 2002 nissan altima base sedan 4-door 2.5l

2002 nissan altima base sedan 4-door 2.5l 2000 nissan altima great condition!(US $2,950.00)

2000 nissan altima great condition!(US $2,950.00) 2012 nissan altima s sedan 4-door 2.5l(US $13,000.00)

2012 nissan altima s sedan 4-door 2.5l(US $13,000.00) Se-r v6 5 speed leather bose alloys local trade runs great no reserve!

Se-r v6 5 speed leather bose alloys local trade runs great no reserve! No reserve in az - 2009 nissan altima sl off corporate lease clean title

No reserve in az - 2009 nissan altima sl off corporate lease clean title

Auto blog

Infiniti to move forward with 'Nissan-plus' strategy for its future cars

Mon, Jun 1 2020Sales at Infiniti in 2019 were down in the dumps. While the market as a whole fell 1.2%, Infiniti brand sales were down 21%. Nissan wasn’t too far behind, with its sales sliding 9.9% year-to-year. None of those numbers look great, but Nissan COO Ashwani Gupta still sees a path forward for NissanÂ’s luxury brand, Infiniti. “We will bring back Infiniti as Nissan-plus, in terms of product and technology," Gupta told Automotive News. “Infiniti will be great again.” Historically-speaking, Infiniti has been “Nissan-plus” for a long time over the years. Many vehicles in its lineup have been re-skinned versions of Nissans with some luxury thrown into the mix, and thatÂ’s not necessarily a bad thing. There have been some standouts, namely the original Q45 with its pioneering active suspension and shockingly sporty dynamics. And then there are the G coupes and sedans, vehicles that are still desirable to enthusiasts today. View 31 Photos InfinitiÂ’s current enthusiast offerings revolve around the Q50 sedan and Q60 coupe, both of which are rear-wheel-drive (or all-wheel-drive) cars with sporting intentions. ThereÂ’s no equivalent Nissan sold in America, but the Q50 is the Nissan Skyline in Japan. ItÂ’s impossible to know what the fate of these rear-drive-based cars will be, but a few possibilities lie ahead. Infiniti could really lean in to the “Nissan-plus” nomenclature and repurpose the new Altima as an Infiniti sedan. More likely, however, is a move to electrification. The Nissan IMs Concept and Infiniti Q Inspiration Concept both suggest that the company is interested in creating electric sedans. A “Nissan-plus” electric sedan sure sounds a whole lot better than a front-drive-based rebadged Nissan. InfinitiÂ’s biggest problem at this second is the lack of new product on the market. Its QX50 crossover is the most recent big redesign weÂ’ve been witness to, but it needed replacements yesterday for the QX60, Q50 and Q60 to be competitive with others in those segments. Both Lexus and Acura are outpacing Infiniti by a wide margin. The path forward as “Nissan-plus” also suggests Infiniti aims to be a premium brand, rather than a full-fledged luxury brand competing toe-to-toe with Audi, BMW and Mercedes-Benz. ThatÂ’s consistent with how the brandÂ’s cars have stacked up in recent years, even as it collaborated with Mercedes to put an Infiniti badge on the GLA crossover.

2013 Nissan NV200 hauls itself into McCormick Place

Thu, 07 Feb 2013Nissan has already announced that its NV200 will be New York City's Taxi of Tomorrow, but now small businesses can also take advantage of the compact commercial van when it goes on sale this April. Unveiled at the Chicago Auto Show, the Nissan NV200 bound for North America has been stretched by almost eight inches compared to the same van that has been on sale in other global markets since 2009. The 2013 Nissan NV200 will be built in Cuernavaca, Mexico and sold at select Nissan dealerships with a starting price of $19,990 (*excluding the $845 destination charge).

At that price, the NV200 costs thousands less than lead competitors like the Ford Transit Connect and the Ram C/V Tradesman, although it does deliver less cargo volume than both as well. Despite its longer body, the NV200's 122.7 cubic feet of volume comes in just under the 129.6 cu-ft for the Ford and well under the Ram's 155.5 cu-ft cargo capacity. The split rear doors and dual side sliding side doors will give plenty of access to the NV200's cargo area, however, and Nissan says the van is wide enough to accommodate a standard pallet.

The NV200 was designed as much to be a mobile office as it is a hauler, so Nissan made the cabin as such. The passenger seat back can fold down creating a flat space for a laptop, and the center console has been specifically designed for hanging file folders. The base NV200S includes power windows, a two-speaker AM/FM/CD audio system and a 12-volt power outlet, while the NV200 SV (starting at $20,980) adds features such as cruise control, six floor-mounted cargo tie downs, power mirrors and door locks and remote keyless entry. Options include the $950 Technology Package (available on SV only and adds navigation, backup camera and satellite radio), $250 for Bluetooth and $190 for glass added to the rear cargo doors.

Nissan GT-R and Jaguar F-Type meet for time trial battle [w/poll]

Fri, 13 Jun 2014It seems that the Jaguar F-Type Coupe R is the performance coupe du jour. First, Motor Trend challenged it against a Porsche 911 on video to see how it fared. Now, Autocar in the UK is pitting the Jag against the latest iteration of the Nissan GT-R around a small course in a time trial battle.

On paper, it certainly looks like the F-Type Coupe is the clear winner. The two performance cars boast the same 542 horsepower (at least by UK specs), but the Jaguar does it with more torque, less weight and an eight-speed gearbox, compared to the six-speed in the GT-R. That seems like an automatic recipe for victory. However, the Nissan claims a faster sprint to 62 miles per hour and all-wheel drive. Nobody wants to watch a video of the new car running away into the sunset, and once the two of them make it to the track, the playing field appears much more level.

So which would you rather have? Keep in mind, that while the GT-R is cheaper than the F-Type Coupe R by a few thousand pounds in the UK, in the US a base R starts at $99,000, and the Nissan has a base price of $101,770. Scroll down to watch the video, and then make your choice in the poll, below.