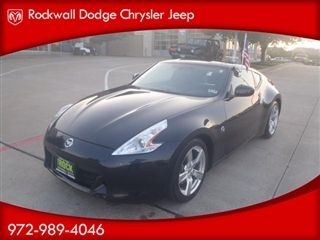

2012 Nissan 370z 2dr Cpe Auto Touring on 2040-cars

Rockwall, Texas, United States

Vehicle Title:Clear

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Make: Nissan

Vehicle Inspection: Vehicle has been Inspected

Model: 370Z

CapType: <NONE>

Mileage: 12,613

FuelType: Gasoline

Sub Model: Cpe Auto

Listing Type: Pre-Owned

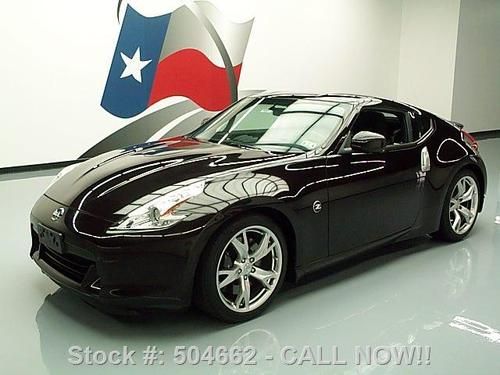

Exterior Color: Black

Sub Title: 2012 NISSAN 370Z 2dr Cpe Auto Touring

Interior Color: Black

Certification: None

Warranty: Unspecified

BodyType: Coupe

Cylinders: 6 - Cyl.

Options: CD Player

DriveTrain: REAR WHEEL DRIVE

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Nissan 370Z for Sale

Navigation touring leather heated seats 18" pioneer 370z 370 z automatic nav usb(US $28,988.00)

Navigation touring leather heated seats 18" pioneer 370z 370 z automatic nav usb(US $28,988.00) 2010 nissan 370z 6speed sport xenons 19" wheels 20k mi texas direct auto(US $26,780.00)

2010 nissan 370z 6speed sport xenons 19" wheels 20k mi texas direct auto(US $26,780.00) 2014 nissan 370z touring sport roadster "fresh off the truck" new(US $51,810.00)

2014 nissan 370z touring sport roadster "fresh off the truck" new(US $51,810.00) 2011 2dr roadster auto used 3.7l v6 24v automatic rwd convertible premium

2011 2dr roadster auto used 3.7l v6 24v automatic rwd convertible premium 2012 nissan 370z touring 6-speed manual leather(US $34,995.00)

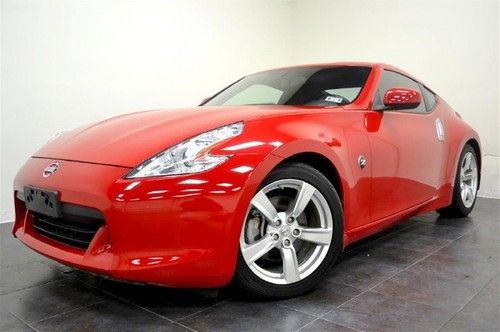

2012 nissan 370z touring 6-speed manual leather(US $34,995.00) 2011 nissan 370z racing red~backup cam~we finance!!(US $28,995.00)

2011 nissan 370z racing red~backup cam~we finance!!(US $28,995.00)

Auto Services in Texas

Wynn`s Automotive Service ★★★★★

Westside Trim & Glass ★★★★★

Wash Me Car Salon ★★★★★

Vernon & Fletcher Automotive ★★★★★

Vehicle Inspections By Mogo ★★★★★

Two Brothers Auto Body ★★★★★

Auto blog

ROEV lets you use multiple charging networks with one account

Thu, Nov 19 2015It may be a textbook case of a first-world problem, but any EV driver who doesn't want to carry two or three plug-in vehicle charging station cards when one would do is about to get a little smile on their face. This morning at the LA Auto Show, the new ROEV Association was announced that will let EV drivers carry just the one card. While you would think the all-caps ROEV stands for something, none of the pre-announcement materials nor the website explain it that way. Instead, it seems to just be a play on rove, which makes a lot of sense. There are three charging networks involved in ROEV: Blink, ChargePoint, and EVgo. Conveniently, these are the three largest in the US and have a combined 17,500 public chargers across the country. If you've got an account with one of these three networks, once ROEV goes into effect (expected in the spring of 2016), you'll be able to use that card at any participating charger without signing up for another account. Your personal details are kept private, ROEV says, and the companies coordinate behind the scenes to make it work. Pricing details were not disclosed. Besides the three main charging networks, two automakers are also founding members of ROEV: BMW and Nissan. ROEV says that Audi and Honda have also have already joined the Association and the organization wants to pull in all EV stakeholders to make electric vehicle charging easy. Fans of EV technology will note that ROEV has nothing to do with promoting either the CHAdeMO or the SAE Combo (CCS) fast charging standard. The Leaf is a CHAdeMO car while the i3 uses CCS, for example. The charging networks, of course, provide both kinds of plugs and don't promote one over the other. Tesla and its Supercharger network are not involved in ROEV, but Tesla drivers can, of course, participate in ROEV.

Why China will soon lead the electric vehicle market

Sat, Jan 16 2016China could be the world's largest electric vehicle market by 2020, thanks to significant government subsidies and the major drawbacks of owning an internal combustion model there. The country's populace registered 75,000 EVs in 2014, and sales figures in 2015 looked even better. In a new video, Renault-Nissan examines the trend and why it happened. Chinese cities heavily encourage buyers to go green through vehicle incentives, but they also make it a hassle to be a polluter. In some places, there's a lottery to limit vehicle registrations and alternating driving bans for even or odd license plate numbers. However, these limits don't apply to EVs, and the country's automakers have benefited from the regulations by introducing small, inexpensive electric models, albeit with sometimes hilarious styling. China's emissions regulations will get even tighter in the coming years. In fact, a Honda exec recently predicted the company wouldn't be able to sell any models there without some form of electric assistance by 2025. Get a better look at the country's electric push to clean up vehicle pollution in Renault-Nissan's video. Related Video:

Mercedes to build CLA at Nissan plant in Mexico [w/poll]

Wed, 25 Jun 2014Volkswagen may have paved the way for American customers to get used to the idea of German cars produced in Mexico, but it won't be the only one for long. BMW is said to be considering production of the 1 Series, 3 Series and Mini south of the border, Audi is working on its own factory in San Jose Chiapa, and now Mercedes-Benz is reported to be following suit as well. Only instead of building its own plant, Daimler is tipped to use a Nissan factory in Aguascalientes.

According to a report in Manager Magazin recently cited by Automotive News Europe, that's where Mercedes is considering building the GLA, CLA and another A-Class sedan. Just what the point would be of another sedan based on the A-Class in addition to the CLA, we're not sure, but if Benz can produce the larger CLS in addition to the E-Class and S-Class sedans, we suppose there'd be room for an A-Class sedan alongside the CLA as well.

We're still waiting on confirmation and comment from Mercedes on the prospect, but one way or another, the increase in Mexican production of German automobiles seems to be a foregone conclusion.