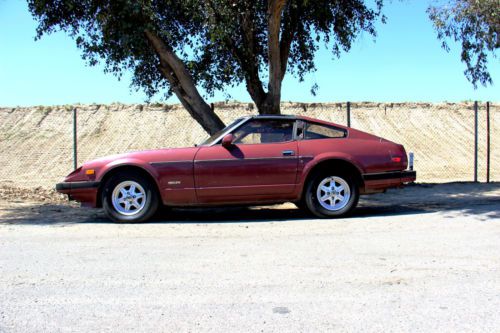

Rare Barn Find-1983 280zx Coupe-stick-t-tops-loaded-ready To Restore-no Reserve on 2040-cars

Rialto, California, United States

Nissan 280ZX for Sale

1983 datsun, 280 zx turbo,t-tops

1983 datsun, 280 zx turbo,t-tops 1 owner rust free az 1983 nissan 280zx 5 spd datsun non turbo fairlady t tops

1 owner rust free az 1983 nissan 280zx 5 spd datsun non turbo fairlady t tops 1982 280zx coupe, 5 speed. drive across country. drive anywhere. 1 owner.

1982 280zx coupe, 5 speed. drive across country. drive anywhere. 1 owner. Nissan 1981 280zx w/ rb20det red top motor from nissan 200zr(US $14,750.00)

Nissan 1981 280zx w/ rb20det red top motor from nissan 200zr(US $14,750.00) Rare nice rust free az 1978 nissan 280zx ac 4 spd s30 datsun non turbo fairlady

Rare nice rust free az 1978 nissan 280zx ac 4 spd s30 datsun non turbo fairlady 2004 nissan 350z touring auto htd leather nav 25k miles texas direct auto(US $16,980.00)

2004 nissan 350z touring auto htd leather nav 25k miles texas direct auto(US $16,980.00)

Auto Services in California

Zip Auto Glass Repair ★★★★★

Woodland Motors Chevrolet Buick Cadillac GMC ★★★★★

Willy`s Auto Repair Shop ★★★★★

Westside Body & Paint ★★★★★

Westcoast Autobahn ★★★★★

Westcoast Auto Sales ★★★★★

Auto blog

How did Nissan tweet a response to the Royal Baby announcement so quickly?

Sun, 14 Sep 2014A mere seven minutes after the Duke and Duchess of Cambridge announced they were pregnant with their second child, Nissan had the perfect post circulating on the Twittersphere. How did Nissan know to expect Kate and William were expecting? By paying attention to the Internet zeitgeist.

It could be triplets and there would *still* be enough room for the Queen... #XTrail #SevenSeats #RoyalBaby pic.twitter.com/k4HiNAb7lq

- NissanUK (@NissanUK) September 8, 2014

Renault to propose joint holding company with Nissan, Nikkei reports

Fri, Apr 26 2019TOKYO — Renault SA will propose to Nissan Motor Co a plan to create a joint holding company that would give both firms equal footing as the French automaker seeks further integration with its Japanese partner, the Nikkei newspaper reported on Friday. Under the proposal, both firms would nominate a nearly equal number of directors to the new company in which ordinary shares in both Nissan and Renault would be transferred on a balanced basis, the newspaper said, without citing sources. This would effectively dilute the stake held by the French government in Renault to around 7-8 percent, from its current 15 percent, it added. The new company would be headquartered in a third country, such as Singapore. Renault plans to make the proposal to Nissan soon, the Nikkei said, having modified an earlier merger idea that Nissan rejected on April 12. Nissan declined to comment on the issue. The Financial Times newspaper reported that both Nissan and the Japanese government have refused to engage in merger talks with Renault. The report of the proposal comes as the outlook for the alliance — one of the world's top automaking partnerships — has clouded since the arrest in November of its main architect, Carlos Ghosn, for suspected financial misconduct. It also comes as Nissan's financial performance struggles following years of focusing on volume sales over building its brand, particularly in the United States, its biggest market. Nissan slashes its forecast This week, the Japanese automaker slashed its profit forecast for the year just ended to its lowest in nearly a decade, citing weakness in its U.S. operations. Renault for years has been vying for a closer merger with Nissan, which it rescued from the brink of bankruptcy two decades ago. Ghosn had been working to achieve a deeper integration before his arrest on financial misconduct charges in November last year. While the automakers have been consolidating many of their operations over the past decade, including procurement and production, many executives at Nissan have opposed an all-out merger with Renault. Instead, Nissan has argued for a more equal footing with Renault, which holds a 43 percent stake in its bigger partner. Nissan holds a 15 percent stake in Renault. It was unclear whether Renault would hold the casting vote in major decisions at the new company, as it did in Renault-Nissan B.V., a strategic management company jointly held by both companies that oversaw operations for the partnership.

FCA scion John Elkann tries to pull off a Marchionne-sized merger

Tue, May 28 2019MILAN, Italy — When John Elkann lost his ally last year with the sudden death of Sergio Marchionne, some questioned whether the softly-spoken scion of the Agnelli clan would be able to emerge from his shadow to ensure Fiat Chrysler's future. But New York-born Elkann, who became Fiat chairman in 2010, acted decisively to fill the vacuum left by the larger-than-life Marchionne and get closer to the big merger deal the legendary executive was unable to deliver. At just 28, Elkann was thrust into the role of Fiat vice chairman after the deaths of his grandfather and great-uncle "because there was really nobody else" to take the wheel. For Elkann, who got his first taste of the car industry as an intern at a factory producing headlights in Birmingham, England, the first 18 months with responsibility for the family-owned carmaker and its long heritage were "terrible." But from that low point, Elkann, 43, is now trying to merge Fiat Chrysler (FCA) with French rival Renault to form the world's third largest carmaker and tackle new challenges facing the industry. Elkann will become chairman of the merged FCA-Renault if the deal goes ahead, ensuring the Agnelli dynasty plays a central role in the next chapter of automotive history. At an event in Milan on Monday, the usually-shy Elkann looked happy and confident. His first big break came with an instrumental role in persuading Marchionne, who was running one of the businesses owned by the Agnelli family, to become chief executive in 2004 and give Fiat "a new start," Elkann said in a "Masters of Scale" podcast last year. Fiat was at the time almost on the brink of collapse. This involved a "very long night ... and many grappas" but proved to be a turning point in the fortunes of the Italian company founded by Elkann's great-great-grandfather Giovanni Agnelli, which built its first car in 1899. In 2005, Elkann backed Marchionne in negotiating the breakup of an alliance Fiat had entered into with General Motors in 2000, receiving $2 billion from GM in return for canceling a deal that could have required GM to buy the remainder of Fiat Auto. Marchionne then used GM's money to fund a turnaround at Fiat, which involved taking the Italian carmaker into a transformation alliance and then full-blown merger with U.S. automaker Chrysler as Elkann agreed to the Agnellis loosening their grip.