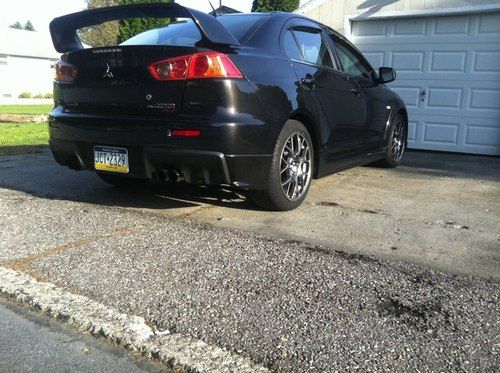

2008 Mitsubishi Lancer Evolution Mr Sedan 4-door 2.0l on 2040-cars

Wind Gap, Pennsylvania, United States

Trim: MR

Model: Evolution

Mileage: 42,000

Year: 2008

This is a clean title clean carfax no accidents or issues. selling to loose monthly payment my loss is your gain. This car is fully loaded with touch screen navigation factory upgraded sound system BBS wheels. Car also has an AMS kit including: AMS intake, charge pipes and upgraded intercooler also has a Cobb exhaust. Book value is way above my price i am just looking to flip this car because i am buying a new house any questions feel free to call or text me 484 nine zero three 8802

Mitsubishi Evolution for Sale

2005 mitsubishi lancer evolution mr sedan 4-door 2.0l(US $23,000.00)

2005 mitsubishi lancer evolution mr sedan 4-door 2.0l(US $23,000.00) Salvage 2012 mitsubishi galant fe(US $6,800.00)

Salvage 2012 mitsubishi galant fe(US $6,800.00) No reserve 2008 mitsubishi lancer de only 50k miles 4 doors sedan 2.0l

No reserve 2008 mitsubishi lancer de only 50k miles 4 doors sedan 2.0l 2009 mitsubishi lancer 4dr sedan 5 speed manual kenwood cd alloys tint

2009 mitsubishi lancer 4dr sedan 5 speed manual kenwood cd alloys tint 2003 mitsubishi galant de sedan 4-door 2.4l clean title

2003 mitsubishi galant de sedan 4-door 2.4l clean title 2009 mitsubishi gts(US $13,995.00)

2009 mitsubishi gts(US $13,995.00)

Auto Services in Pennsylvania

Valley Tire Co Inc ★★★★★

Trinity Automotive ★★★★★

Total Lube Center Plus ★★★★★

Tim Howard Auto Repair ★★★★★

Terry`s Auto Glass ★★★★★

Spina & Adams Collision Svc ★★★★★

Auto blog

2014 Mitsubishi Outlander earns Top Safety Pick+ award [w/video]

Fri, 02 Aug 2013The Mitsubishi Outlander officially is a safe vehicle, earning a good rating in all of the Insurance Institute for Highway Safety crash test categories - good enough for the agency to give it the Top Safety Pick+ award. The small sport utility vehicle's little sibling, the Outlander Sport, received the Top Safety Pick award earlier this year.

According to the IIHS, to earn the Top Safety Pick+ rating vehicles must be rated good in at least four out of the five crash tests (including the difficult small overlap front test) and earn no less than acceptable in the rear crash test. The Top Safety Pick rating requires that vehicles be rated good in the moderate overlap front, side, rollover and rear tests, but there's no minimum rating on the small overlap front crash test.

Mitsubishi designed the Outlander to have greater roof strength (the roof now can support up to five times the SUV's weight) and to withstand the moderate overlap front crash test and the recently introduced small overlap front crash test, both of which evaluate the ability of vehicles to protect their occupants in crashes that bypass the traditional front crumple zone. Crumple zones are designed into vehicles to allow them to deform in a way that protects passengers in the event of a crash. The Outlander was one of two small SUVs to earn a good rating in the small overlap test, the other being the 2014 Subaru Forester. The Subaru earned a Top Safety Pick rating.

Bhutan asks Nissan, Mitsubishi for help with massive EV-only plan

Mon, Jul 7 2014Originally, the somewhat modest plan was to introduce 2,000 electric vehicles to the capital of Bhutan. Then things got bigger when Renault-Nissan CEO Carlos Ghosn paid the country a visit and the Prime Minister of Bhutan, Tshering Tobgay, said his country, "will commit to a program to achieve zero emissions as a nation by a certain target date." Now we're approaching "holy huge" territory. Last week, Tobgay visited Japan to ask Nissan and Mitsubishi for help in possibly replacing every combustion vehicle with an all-electric option. "Gasoline is expensive and unfriendly to the environment." – Bhutan's Prime Minister At the very least, Bhutan wants to make more eco-friendly vehicles available. Tobgay told AsiaNews that, "Gasoline is expensive and unfriendly to the environment. Sustainable transportation will bring citizens happiness," which is something that a country that measures its Gross National Happiness is eager to track. Switching to electric vehicles makes complete sense in Bhutan, since the mountainous Asian nation produces more renewable hydro-electricity than it can use. Ninety-five percent of the zero-emission energy is exported to India, and Bhutan uses the profits to buy fuel from India to then power its vehicles. You can probably figure out for yourself how there's a simpler way to do this. News Source: AsiaNews.it Green Mitsubishi Nissan Green Culture Electric

Mitsubishi Mirage G4 Sedan in Montreal could mean US debut soon

Fri, Jan 17 2014The official word on the North American plans for the Mitsubishi Mirage G4 Sedan is that the Japanese company wants to ask Canadians what they think of the four-door, three-cylinder before deciding if the car will go on sale here. There are hints, though, that the plan is a bit more set in stone than Mitsubishi is letting on. Speaking with AutoGuide, Mitsubishi manager of product communications, Roger Yasukawa, said that, "We are considering making it into a North American car but are still working on the timing of the launch." If they're already figuring out timing, it sounds like this is a question of when, not if. The Mirage G4 is built in Thailand and is sold throughout Asia as the Attrage. It just made its North American debut at the 2014 Montreal Motor Show, a move that could preview a US debut as well, since that's how the Mirage hatchback was introduced. We were not all that impressed with the hatch, but sometimes you just want a highly efficient car for not a lot of money. The car does get 37 miles per gallon in the city and 44 mpg on the highway, all for $12,995, after all. We'll see what the news is when the New York Auto Show starts up in April. Mitsubishi Reveals Mirage G4 Sedan Consumer Feedback to Influence Launch Plans Montreal, Quebec (Jan. 16, 2014) – Mitsubishi Motor Sales of Canada (MMSCAN) will ask auto show visitors here and across Canada to offer opinions on the look, feel, cost and features of a new subcompact sedan before it gets the green-light for sale in Canada. The Mirage G4, Mitsubishi's Thailand-built four-door, three-cylinder sedan, will make its North American debut today at the 2014 Salon International de l'auto de Montreal. But company president and CEO, Kenichiro "Kenny" Yamamoto said its future availability in Canada will be based, in part, on consumer opinion. "Our plan is to showcase the Mirage G4 and gauge what Canadians think of it and what they expect from subcompact sedans in general," he said. "A solid business case for Mirage was confirmed by the successful 2013 launch of the Mirage hatchback model; with G4, we're indicating our intention to grow the Mirage line up in Canada." When it was launched last September, the 2014 Mirage hatchback became MMSCAN's first subcompact car. Since then, Mitsubishi dealerships have reported Mirage's top fuel economy, low entry price and leading warranty are resonating well with customers.