2003 Mitsubishi Evolution Evo 8 Viii 27k Miles! Super Clean! Best Condition Evo! on 2040-cars

Bloomington, Indiana, United States

Body Type:Sedan

Vehicle Title:Clear

Engine:2.0L Turbocharged 4-cyl

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 4

Make: Mitsubishi

Model: Evolution

Trim: Evolution 8

Options: Sunroof, 4-Wheel Drive, CD Player

Drive Type: AWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 27,289

Power Options: Air Conditioning, Power Locks, Power Windows

Sub Model: LOW MILES! BEST CONDITION POSSIBLE! SUPER CLEAN!

Exterior Color: Black

Interior Color: Gray

Number of Doors: 4

Mitsubishi Evolution for Sale

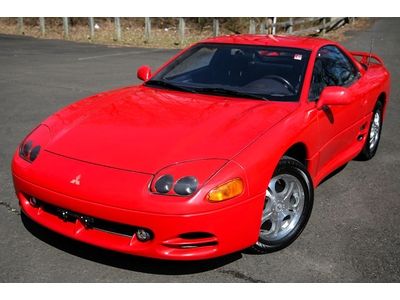

1995 mitsubishi 3000gt 5speed manual super low 54k miles v6(US $12,950.00)

1995 mitsubishi 3000gt 5speed manual super low 54k miles v6(US $12,950.00) 2010 mitsubishi lancer gts sportsback(US $11,500.00)

2010 mitsubishi lancer gts sportsback(US $11,500.00) 2000 mitsubishi montero sport xls sport utility 4-door 3.0l

2000 mitsubishi montero sport xls sport utility 4-door 3.0l 2003 mitsubishi lancer evolution sedan 4-door 2.0l

2003 mitsubishi lancer evolution sedan 4-door 2.0l Es manual 2.0l 2 liter inline 4 cylinder dohc engine 4 doors 4-wheel abs brakes(US $14,600.00)

Es manual 2.0l 2 liter inline 4 cylinder dohc engine 4 doors 4-wheel abs brakes(US $14,600.00) 2004 mitsubishi lancer ralliart sedan 4-door 2.4l

2004 mitsubishi lancer ralliart sedan 4-door 2.4l

Auto Services in Indiana

Westfalls Auto Repair ★★★★★

Trinity Body Shop ★★★★★

Tri-County Collision Center & Towing ★★★★★

Tom O`Brien Chrysler Jeep Dodge Ram-In ★★★★★

TJ`s Auto Salvage ★★★★★

Tire Central and Service Southern Plaza ★★★★★

Auto blog

Mitsubishi Motors posts surprise loss as car sales slide

Fri, Jan 31 2020TOKYO — Mitsubishi Motors on Friday posted a surprise operating loss in the third quarter, its worst quarterly performance in more than three years, hurt by falling sales in China, Japan and Southeast Asia, as well as a stronger yen. The carmaker posted an operating loss of 6.6 billion yen ($60.2 million) for the October-December quarter, widely missing an average forecast for a profit of 11.6 billion yen, based on analyst estimates compiled by Refinitiv. It was the firm's biggest loss since the July-September 2016 quarter, when a mileage cheating scandal sapped profits. However, Mitsubishi stuck to an earlier forecast for a 73% drop in full-year operating profit to 30 billion yen in the fiscal year ending in March. The automaker's net loss for the quarter just ended came in at 14.4 billion yen. The fall in quarterly sales was worst in China and at home, while sales also slipped in ASEAN countries, traditionally a stronghold, leading to a 16% fall in global vehicle sales to 320,000 units. The automaker also said it would keep some of its offices in China closed through Feb. 9, as a new coronavirus spreads throughout the country and beyond. The automaking alliance of Mitsubishi, Renault and Nissan on Thursday said they had "no other option" but to drastically improve their joint operations to remain competitive in the fast-changing global auto industry. Related Video: Â Â Â Â Â (Reporting by Naomi Tajitsu; editing by Richard Pullin) Earnings/Financials Mitsubishi

Mitsubishi's first US chairman since 2007 charged with revitalizing brand

Fri, 02 Nov 2012Have a look at Mitsubishi North America's vehicle page and you'll find seven cars in four model lines: i-MiEV electric hatch, Lancer sedan, Lancer Evolution and Sportback, Outlander and Outlander Sport, and Galant sedan. The Galant has 3.9 tires in the automotive grave, and the only hope for mainstream excitement, the Eclipse coupe and Spyder, had hemlock poured down their crankcases last year. Increasing the quotient of bleak, the Lancer isn't due for a refresh until 2014, the coming Outlander PHEV will sell in miniscule numbers when it does arrive, a little sports car has been nixed and the only other Mitsu being considered for our landmass is the Colt, which, for its stellar fuel economy numbers, looks like a car designed by Pikachu. There's also that matter of declining NA market share in a rising overall market, Mitsubishi's piece of the total pie currently hovering around the 0.4-percent mark according to Automotive News.

The company has decided to do more about it, reassigning Executive Vice President and Head Officer of the Headquarters Product Projects & Strategy Group Gayu Uesugi to be the new chairman of Mitsubishi Motors North America. It will be the first time in five years that someone has filled the chairman position at MMNA.

The hope is that with Uesugi's 35 years with the company, his experience in the company's global product plan and his success in emerging market strategy, he's the man to "[develop] a product plan and growth strategy for the US market" that will put things right. Or at least better. He will work with Yoichi Yokozawa, who has been CEO of MMNA since last year. There are more details on the move in the press release below.

Why a Renault-FCA merger could be good news for Nissan, Mitsubishi

Fri, May 31 2019TOKYO — Nissan's advanced technologies including platforms and electric powertrains could give it leverage in a merger involving Renault and Fiat Chrysler, thanks to a royalty system it has with the former, two people with knowledge of the matter said. A merged Renault-Fiat Chrysler could face an extra hurdle each time it uses technology developed by Nissan or Mitsubishi Motors, while the two Japanese automakers stand to gain a client in Fiat Chrysler (FCA), one of the people said. Both sources declined to be identified because of the sensitivity of the matter. Nissan's technology, particularly in electrification and emissions reduction, could give it some sway in the $35 billion potential tie-up between Renault and FCA, even as its stake in the newly formed company would be diluted. Currently Renault SA pays less for technology developed by Nissan than the Japanese automaker pays for French technology, a third person said. This has long been a sticking point for Nissan, and an area where Nissan could seek more favorable terms. "Whenever Nissan transfers platform, powertrain or other technology to Renault, there is a margin or royalty which Renault has to pay for use of that tech," one of the people said. "In that sense, FCA, if everything went well, would become another 'client' of ours and that's good. More business for us." A Nissan spokesman declined to comment on its royalty system. The potential Renault-FCA deal has complicated the Japanese automaker's already uneasy alliance with Renault. A further deal with Fiat Chrysler looks likely at least in the near term to weaken Nissan's influence in the 20-year-old partnership. Renault owns a 43.4% stake in Nissan and is its top shareholder. Nissan holds a 15% non-voting stake in Renault and would see that diluted to 7.5% after the FCA deal, albeit with voting rights. The imbalance between the two has long rankled Nissan, which is by far the larger company. Alliance imbalance Renault had previously angled for a merger with Nissan but has been rebuffed by CEO Hiroto Saikawa. Securing benefits from the merger deal will be important for Saikawa, who is grappling with poor financial performance while he struggles to right the company after the ouster of former chairman Carlos Ghosn last year.