2002 Mitsubishi Montero Sport, No Reserve on 2040-cars

Orange, California, United States

Body Type:SUV

Engine:6

Vehicle Title:Clear

Fuel Type:Gasoline

Number of Cylinders: 6

Model: Montero

Trim: 4X4 SUV

Drive Type: UNKNOWN

Options: CD Player

Mileage: 161,212

Power Options: Cruise Control, Power Locks, Power Windows

Sub Model: XLS

Exterior Color: White

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Tan

Year: 2002

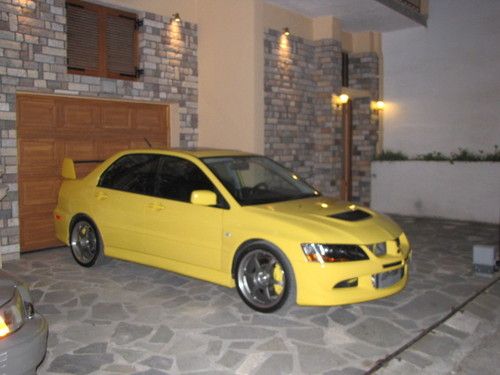

Mitsubishi Evolution for Sale

2006 mitsubishi lancer evolution ix mr fully built 700 hp must see no reserve!

2006 mitsubishi lancer evolution ix mr fully built 700 hp must see no reserve! 2003 mitsubishi evo lancer viii(US $18,500.00)

2003 mitsubishi evo lancer viii(US $18,500.00) 1995 mitsubishi mirage s coupe automatic 4 cylinder no reserve

1995 mitsubishi mirage s coupe automatic 4 cylinder no reserve 2002 mitsubishi montero xls sport utility 4-door 3.5l

2002 mitsubishi montero xls sport utility 4-door 3.5l 2007 mitsubishi fuso fe145 crew cab(US $23,000.00)

2007 mitsubishi fuso fe145 crew cab(US $23,000.00) *2003 mitsubishi montero sport/awd/excellant condition/mechanic owned*(US $3,199.00)

*2003 mitsubishi montero sport/awd/excellant condition/mechanic owned*(US $3,199.00)

Auto Services in California

Z Best Body & Paint ★★★★★

Woodman & Oxnard 76 ★★★★★

Windshield Repair Pro ★★★★★

Wholesale Tube Bending ★★★★★

Whitney Auto Service ★★★★★

Wheel Enhancement ★★★★★

Auto blog

Carlos Ghosn was on verge of release — so prosecutors file new allegation

Fri, Dec 21 2018TOKYO — Japanese prosecutors added a new allegation of breach of trust against Nissan's former chairman Carlos Ghosn on Friday, dashing his hopes for posting bail quickly. Ghosn and another former Nissan executive, Greg Kelly, were arrested Nov. 19 and charged with underreporting Ghosn's income by about 5 billion yen ($44 million) in 2011-2015. They also face the prospect of more charges of underreporting Ghosn's income for other years by nearly 10 billion ($80 million) in total. The breach of trust allegations were filed a day after a court rejected prosecutors' request for a longer detention of both men. The new allegation only applies to Ghosn, and Kelly could still be bailed out. A request for bail by Kelly's lawyer is pending court approval, according to the Tokyo District Court, but his release will have to wait until next week since the request was still in process after office hours Friday. Prosecutors in a statement Friday alleged that Ghosn in 2008 transferred a private investment loss worth more than 1.8 billion yen ($16 million) to Nissan by manipulating an unspecified "swap" contract. Ghosn also profited by having the company transfer a total of $14.7 million to another company to benefit himself and that company's owner, who helped in the contract manipulation, prosecutors said. Shin Kukimoto, deputy chief prosecutor at the Tokyo District Prosecutors Office, refuse to say if the two transactions were related or how Ghosn illegally profited. He also declined to identify the collaborator or whether the transactions were made overseas. Ghosn and Kelly are only charged with underreporting Ghosn's pay over five years, in violation of the Financial Instruments and Exchange Act. They have not been formally charged with an additional allegation of underreporting another 4 billion yen ($36 million) for 2016-2018, for which their first 10-day detention was to expire Thursday. Prosecutors have been criticized for separating the allegations as a tactic to detain Ghosn and Kelly longer. They say Ghosn and Kelly are flight risks. The maximum penalty for violating the financial act is up to 10 years in prison, a 10 million yen ($89,000) fine, or both. Breach of trust also carries a similar maximum penalty. The conviction rate in Japan is more than 99 percent for any crime. Ghosn was sent by Renault in 1999 to turn around Nissan, then on the verge of bankruptcy, and he led its rise to become the world's second-largest automaker.

Why a Renault-FCA merger could be good news for Nissan, Mitsubishi

Fri, May 31 2019TOKYO — Nissan's advanced technologies including platforms and electric powertrains could give it leverage in a merger involving Renault and Fiat Chrysler, thanks to a royalty system it has with the former, two people with knowledge of the matter said. A merged Renault-Fiat Chrysler could face an extra hurdle each time it uses technology developed by Nissan or Mitsubishi Motors, while the two Japanese automakers stand to gain a client in Fiat Chrysler (FCA), one of the people said. Both sources declined to be identified because of the sensitivity of the matter. Nissan's technology, particularly in electrification and emissions reduction, could give it some sway in the $35 billion potential tie-up between Renault and FCA, even as its stake in the newly formed company would be diluted. Currently Renault SA pays less for technology developed by Nissan than the Japanese automaker pays for French technology, a third person said. This has long been a sticking point for Nissan, and an area where Nissan could seek more favorable terms. "Whenever Nissan transfers platform, powertrain or other technology to Renault, there is a margin or royalty which Renault has to pay for use of that tech," one of the people said. "In that sense, FCA, if everything went well, would become another 'client' of ours and that's good. More business for us." A Nissan spokesman declined to comment on its royalty system. The potential Renault-FCA deal has complicated the Japanese automaker's already uneasy alliance with Renault. A further deal with Fiat Chrysler looks likely at least in the near term to weaken Nissan's influence in the 20-year-old partnership. Renault owns a 43.4% stake in Nissan and is its top shareholder. Nissan holds a 15% non-voting stake in Renault and would see that diluted to 7.5% after the FCA deal, albeit with voting rights. The imbalance between the two has long rankled Nissan, which is by far the larger company. Alliance imbalance Renault had previously angled for a merger with Nissan but has been rebuffed by CEO Hiroto Saikawa. Securing benefits from the merger deal will be important for Saikawa, who is grappling with poor financial performance while he struggles to right the company after the ouster of former chairman Carlos Ghosn last year.

Nissan didn't have much say in merger talks, but it had what FCA wanted

Fri, Jun 7 2019TOKYO — Nissan wasn't consulted on the proposed merger between its alliance partner Renault and Fiat Chrysler, but the Japanese automaker's reluctance to go along may have helped bring about the surprise collapse of the talks. While Nissan Motor Co. had a weaker bargaining position from the start, with its financial performance crumbling after the arrest last year of its star executive Carlos Ghosn, it still had as its crown jewel the technology of electric vehicles and hybrids that Fiat Chrysler wanted. The board of Renault, meeting Thursday, didn't get as far as voting on the proposal, announced last week, which would have created the world's third biggest automaker, trailing only Volkswagen AG of Germany and Japan's Toyota Motor Corp. When the French government, Renault's top shareholder with a 15% stake, asked for more time to convince Nissan, Fiat Chrysler Chairman John Elkann abruptly withdrew the offer. Although analysts say reviving the talks isn't out of the question, they say trust among the players appears to have been broken. "The other companies made the mistake of underestimating Nissan's determination to say, 'No,' " said Katsuya Takeuchi, senior analyst at Mitsubishi UFJ Morgan Stanley Securities in Tokyo. The Note, an electric car with a small gas engine to charge its battery, was Japan's No. 1 selling car, the first time in 50 years that a Nissan beat Toyota and Honda. Renault and Fiat Chrysler highlighted possible synergies that come from sharing parts and research costs as the benefits of the merger. But what Fiat Chrysler lacks and really wanted was what's called in the industry "electrification technology," Takeuchi said. With emissions regulations getting stricter around the world, having such technology is crucial. Yokohama-based Nissan makes the world's best-selling electric car Leaf. Its Note, an electric car equipped with a small gas engine to charge its battery, was Japan's No. 1 selling car for the fiscal year through March, the first time in 50 years that a Nissan model beat Toyota and Honda Motor Co. for that title. Nissan is also a leader in autonomous-driving technology, another area all the automakers are trying to innovate. "Although Nissan had no say, its cautionary stance on the merger ended up being very meaningful," Takeuchi said.