We Finance! 2009 Mitsubishi Eclipse Gs Fwd Power Sunroof on 2040-cars

Bedford, Ohio, United States

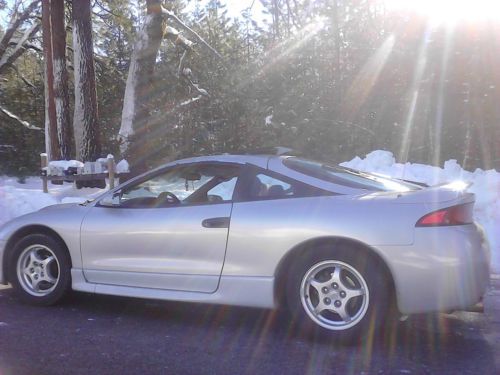

Mitsubishi Eclipse for Sale

Red sports car, tint windows, recently paint, in great conditions, good mileage(US $4,900.00)

Red sports car, tint windows, recently paint, in great conditions, good mileage(US $4,900.00) 1998 mitsubishi eclipse, no reserve

1998 mitsubishi eclipse, no reserve 1998 mitsubishi eclipse gs(US $3,300.00)

1998 mitsubishi eclipse gs(US $3,300.00) 2009 mitsubishi eclipse gs coupe 2-door in copper pearl(US $11,500.00)

2009 mitsubishi eclipse gs coupe 2-door in copper pearl(US $11,500.00) Low 34000 miles v6 mitsubishi eclipse gt sports edition *fully loaded 6sp manual

Low 34000 miles v6 mitsubishi eclipse gt sports edition *fully loaded 6sp manual 2001 mitsubishi eclipse gt coupe 2-door 3.0l

2001 mitsubishi eclipse gt coupe 2-door 3.0l

Auto Services in Ohio

West Side Garage ★★★★★

Wally Armour Chrysler Dodge Jeep Ram ★★★★★

Valvoline Instant Oil Change ★★★★★

Tucker Bros Auto Wrecking Co ★★★★★

Tire Discounters Inc ★★★★★

Terry`s Auto Service ★★★★★

Auto blog

The 100,000th EV sold in the US is... a Mitsubishi i-MiEV

Fri, 12 Jul 2013The news here isn't that 100,000 EVs have been sold in the US, although that's quite the accomplishment. It's that the 100,000th car is a Mitsubishi i-MiEV - a car that takes nearly a full day to recharge on a standard outlet and can only travel about 62 miles per charge (according to the car's Monroney).

Jabs at the Mitsubishi aside, the fact that US dealers have moved 100,000 electric cars is made more impressive in that it's only been done since the latest generation of EVs arrived, typified by the Nissan Leaf, Ford Focus Electric and aforementioned i-MiEV. Chronologically, that means roughly the last two years. It's a number that we can only expect to climb, as EVs gain a stronger foothold among manufacturers and consumers.

Plug In America, an EV advocacy group, crunched the numbers for a contest called #PIA100K, to find the lucky buyer, who would be given a ClipperCreek Level 2 charger (which takes the i-MiEV's recharge time down to just seven hours). The winner, Rich Salmon of Grand Bay, Alabama, picked up his i-MiEV from Pete Moore Mitsubishi.

Ghosn's legacy: one of the auto industry's most effective execs

Wed, Nov 21 2018"Bob Lutz ... estimated that carrying out the Nissan operation would be the equivalent, for Renault, of putting $5 billion in a container ship and sinking it in the middle of the ocean." So wrote Carlos Ghosn in "SHIFT: Inside Nissan's Historic Revival," which was published in the U.S. in late 2004. Two points about that observation: It is in keeping with Lutz's "Often wrong but never in doubt." It shows that Ghosn is a remarkable executive, given that he was able to take Nissan from the edge of financial oblivion to one of the foremost automotive companies (although with alliance partners Renault and, more recently, Mitsubishi). In 1999, Ghosn created what was named the "Nissan Revival Plan." It could have just as well been called the "Nissan Resuscitation Plan." Things were that bad. Now Ghosn is in the midst of legal trouble, accused of financial improprieties of some sort. There is no indication that this is at anything near the scale of what happened at Volkswagen Group. There's malfeasance. And then there's malfeasance. It is likely that this is going to be the end of Ghosn's career, but at age 64, and as a man who has spent nearly the past quarter-century essentially on airplanes, it is probably a good time to leave the stage. What his next act will be — to court or even prison — is an open question. But arguably, Ghosn's performance in the transformation of Nissan and Renault, which also needed some strong medicine to keep it from collapse in the early '00s (although one suspects that the French government would have done its damnedest to keep it propped up), makes him one of the all-time most-notable executives in the auto industry. Ghosn closed plants in both France and Japan and he worked to dismantle the Nissan keiretsu network of interlocked companies, things that were absolutely unthinkable. He established plans with stretch goals in their titles, like the "20 Billion Franc Cost-Reduction Plan," and worked with his people to achieve them, despite the pushback that seemed to come along with the announcement of the plan. As in, as he recalled in SHIFT, "Some people said, 'He's off the deep end. He's raving mad. Doesn't he know that at Renault you set the most conservative goals possible so you can be certain to reach them?' My answer to that sort of thinking was 'You're going to get what you ask for. If you set the bar too low, you'll be a low-level performance.

Why a Renault-FCA merger could be good news for Nissan, Mitsubishi

Fri, May 31 2019TOKYO — Nissan's advanced technologies including platforms and electric powertrains could give it leverage in a merger involving Renault and Fiat Chrysler, thanks to a royalty system it has with the former, two people with knowledge of the matter said. A merged Renault-Fiat Chrysler could face an extra hurdle each time it uses technology developed by Nissan or Mitsubishi Motors, while the two Japanese automakers stand to gain a client in Fiat Chrysler (FCA), one of the people said. Both sources declined to be identified because of the sensitivity of the matter. Nissan's technology, particularly in electrification and emissions reduction, could give it some sway in the $35 billion potential tie-up between Renault and FCA, even as its stake in the newly formed company would be diluted. Currently Renault SA pays less for technology developed by Nissan than the Japanese automaker pays for French technology, a third person said. This has long been a sticking point for Nissan, and an area where Nissan could seek more favorable terms. "Whenever Nissan transfers platform, powertrain or other technology to Renault, there is a margin or royalty which Renault has to pay for use of that tech," one of the people said. "In that sense, FCA, if everything went well, would become another 'client' of ours and that's good. More business for us." A Nissan spokesman declined to comment on its royalty system. The potential Renault-FCA deal has complicated the Japanese automaker's already uneasy alliance with Renault. A further deal with Fiat Chrysler looks likely at least in the near term to weaken Nissan's influence in the 20-year-old partnership. Renault owns a 43.4% stake in Nissan and is its top shareholder. Nissan holds a 15% non-voting stake in Renault and would see that diluted to 7.5% after the FCA deal, albeit with voting rights. The imbalance between the two has long rankled Nissan, which is by far the larger company. Alliance imbalance Renault had previously angled for a merger with Nissan but has been rebuffed by CEO Hiroto Saikawa. Securing benefits from the merger deal will be important for Saikawa, who is grappling with poor financial performance while he struggles to right the company after the ouster of former chairman Carlos Ghosn last year.