Mitsubishi Eclipse Rs 5 Speed on 2040-cars

Mechanicsburg, Pennsylvania, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:2.0L 1997CC 122Cu. In. l4 GAS DOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Mitsubishi

Model: Eclipse

Trim: RS Hatchback 2-Door

Options: Sunroof, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Drive Type: FWD

Power Options: Air Conditioning, Cruise Control

Mileage: 152,097

Exterior Color: Silver

Interior Color: Blue

Disability Equipped: No

Number of Cylinders: 4

Warranty: Vehicle does NOT have an existing warranty

This auction is for a 1997 Mitsubishi Eclipse RS. It is not running. It may be a timing belt snap I dont know. I do have a new create engine available for 1400.00 which is not part of this auction. I just dont have the time or energy to do the swap. It has blue cloth interior, sunroof, Sony CD Player, Nice rims and relay nice tires which came off a 1999 Spider. It has an OBX Stainless Header pipe AEM Intake, Red Translucent Powder coated valve cover, New D/S and P/S Axels, Hubs and Shocks. New Clutch and Pressure plate. Break pads and Rotors, New Starter. All these things were done within 340 miles of the engine stopping. My Loss is your gain. I have title in hand. This is for a seven day $1.00 starting bid Auction. There is no reserve on this item. Again I have a new 420A create engine for it which is not part of this auction. If you want it too it would be $1400.00 over the price of this auction. Also this action is for CASH or USPS Money Orders. Sorry no Paypal or personal check! VEHICLE MUST BE PAID FOR AND REMOVED WITHIN 72 hours of Auction end! Happy Bidding!

Mitsubishi Eclipse for Sale

1995 mitsubishi eclipse gsx awd turbo 5spd 500hp! built 2.3 liter stroker dsm(US $8,450.00)

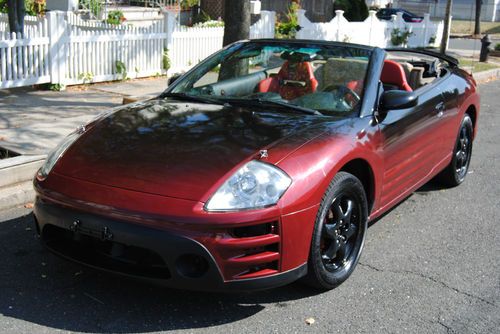

1995 mitsubishi eclipse gsx awd turbo 5spd 500hp! built 2.3 liter stroker dsm(US $8,450.00) 2009 mitsubishi eclipse convertible spyder

2009 mitsubishi eclipse convertible spyder 2002 mitsubishi eclipse spyder gs convertible 2-door 2.4l(US $4,500.00)

2002 mitsubishi eclipse spyder gs convertible 2-door 2.4l(US $4,500.00) 2006 mitsubishi eclipse gt hatchback 2-door 3.8l manual

2006 mitsubishi eclipse gt hatchback 2-door 3.8l manual 2007 mitsubishi eclipse gs coupe 2dr.(US $10,500.00)

2007 mitsubishi eclipse gs coupe 2dr.(US $10,500.00) Mitsubishi eclipse no reserve stick rear spoiler wing

Mitsubishi eclipse no reserve stick rear spoiler wing

Auto Services in Pennsylvania

Yorkshire Garage & Auto Sales ★★★★★

Willis Honda ★★★★★

Used Car World West Liberty ★★★★★

Usa Gas ★★★★★

Trone Service Station ★★★★★

Tri State Preowned ★★★★★

Auto blog

Ghosn: Restoring Mitsubishi's reputation is biggest challenge

Thu, May 12 2016After news that Mitsubishi falsified its fuel economy data on every vehicle it has sold in Japan since 1991, and the tumble in the company's value that followed, the troubled carmaker has an unlikely savior. Nissan has confirmed it will purchase over one third of Mitsubishi's stock, or 34 percent. The stake is valued at $2.2 billion. Ghosn says making Mitsubishi a part of the Renault-Nissan alliance will save billions in development costs. But the merger certainly isn't without challenges. "The biggest challenge is to support Mitsubishi changing itself and growing and being profitable and restoring its reputation," said Ghosn. Nissan is a natural partner for Mitsubishi, and since the fuel economy scandal escalated from discrepancies in the data regarding Mitsubishi-manufactured, Nissan-badged Japan-market vehicles, it makes sense for the company to sweep in and save the day. Nissan itself is partially owned by Renault, and Nissan has a 15-percent stake in the French automaker. Mitsubishi's chairman, Osamu Masuko says that the merger was inevitable, that it "would have happened one day" anyway, according to the New York Times. Carlos Ghosn, chairman of both Nissan and Renault, is confident they will be able to turn Mitsubishi's fortunes around. "We have the track record to make it work", Ghosn said, referring to the Renault-funded rescue of Nissan in the early 2000s. Related Video:

Mitsubishi developing new standalone hybrid Evo successor

Mon, 16 Dec 2013Mention the name Mitsubishi to different people and you'll likely get two startling different images. Environmentalists will focus on the company's strides in developing EVs, while performance enthusiasts will point you toward the Lancer Evolution. The prevailing wisdom was that Mitsubishi would cancel the latter to concentrate on the former, but the latest intel suggests that the two will be reconciled with a new Evo around the corner.

Although Mitsubishi is reportedly working to streamline its lineup from 23 models on 12 different platforms to 13 models on 7 by 2016, the next Evo will stand as an exception. Like Subaru did with the formerly Impreza-based WRX (or for that matter Nissan with the formerly Skyline-based GT-R), the new Evo won't have anything to do with the next Lancer, which itself will be based on a Renault-Nissan platform.

On that unique platform, Mitsubishi is likely to install a small direct-injection turbo engine (potentially a diesel) that could be based on the 1.1-liter, three-cylinder turbo engine in the XR-PHEV concept we saw in Tokyo, supplemented by small electric motors with lightweight batteries and driving all four wheels through an enhanced version of the company's Super All-Wheel Control system. As to whether the Evo name will carry over, that remains to be seen, but if these reports prove accurate, its spirit could very much live on.

Mitsubishi hopes to raise $2.5B with stock sale

Wed, 22 Jan 2014Mitsubishi, which dates all the way back to 1870, is one of the oldest business collectives in Japan. Today, the various businesses that share the Mitsubishi name are largely independent of each other. The automotive unit, however, has fallen on hard times over the past few years.

Back in 2004 and 2005, Mitsubishi Motors sold billions of preferred shares to sister companies like Mitsubishi UFJ Financial Group, Mitsubishi Heavy Industries and Mitsubishi Corp. Now the automaker is preparing to buy back those shares, only to raise the capital, it's selling $2.5 billion worth of shares, simultaneously paying stock dividends for the first time in over 16 years.

The stock issue will reportedly include as many as 241 million shares at a value of $10.73 each. The move is part of a long-term reorganization being implemented by the automaker's president Osamu Masuko, and is expected to help the company double its net income and eliminate all outstanding preferred shares by the end of the fiscal year closing in March.