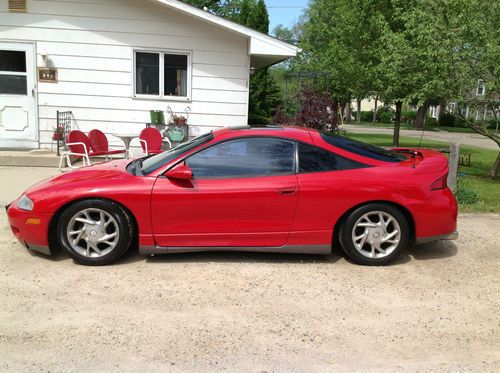

2003 Mitsubishi Eclipse Spyder Gs Convertible 2-door 2.4l on 2040-cars

Staten Island, New York, United States

Engine:2.4L 2351CC l4 GAS SOHC Naturally Aspirated

Vehicle Title:Clear

Body Type:Convertible

Fuel Type:GAS

For Sale By:Private Seller

Mileage: 116,390

Make: Mitsubishi

Exterior Color: Silver

Model: Eclipse

Interior Color: Gray

Trim: Spyder GS Convertible 2-Door

Drive Type: FWD

Options: Convertible

Number of Cylinders: 4

Safety Features: Driver Airbag, Passenger Airbag

Power Options: Air Conditioning, Cruise Control

Number of Doors: 2

This is a perfect summer car has never seen a winter,and garage kept,treat yourself to a convertible and excellent gas mileage 34 mpg one owner car.It is a five speed and you can drive it home or drive it south if you would like to take a cruise to the shore in your new convertible.

Mitsubishi Eclipse for Sale

2003 mitsubishi eclipse coupe 2-door 2.4 l sohc(US $4,500.00)

2003 mitsubishi eclipse coupe 2-door 2.4 l sohc(US $4,500.00) 1995 mitsubishi eclipse gst hatchback 2-door 2.0l(US $2,900.00)

1995 mitsubishi eclipse gst hatchback 2-door 2.0l(US $2,900.00) 2007 mitsubishi eclipse 3dr cpe gs

2007 mitsubishi eclipse 3dr cpe gs Body shop special needs work no reserve

Body shop special needs work no reserve 2009 mitsubishi eclipse gs convertible, 5 speed manual trans, power top, htd sea(US $11,900.00)

2009 mitsubishi eclipse gs convertible, 5 speed manual trans, power top, htd sea(US $11,900.00) 2004 mitsubishi eclipse gs coupe 2-door 2.4l

2004 mitsubishi eclipse gs coupe 2-door 2.4l

Auto Services in New York

X-Treme Auto Glass ★★★★★

Wheelright Auto Sale ★★★★★

Wheatley Hills Auto Service ★★★★★

Village Automotive Center ★★★★★

Tim Voorhees Auto Repair ★★★★★

Ted`s Body Shop ★★★★★

Auto blog

What we're driving this winter and why you need snow tires | Autoblog Podcast #496

Thu, Dec 15 2016On this episode, Mike Austin and David Gluckman talk about what they've been driving lately and answer some Spend My Money requests from listeners looking for advice on everything from sports cars to seven-seat SUVs. Plus we talk winter tires with an expert from Michelin's testing team. The rundown is below. Remember, if you have a car-related question you'd like us to answer or you want buying advice of your very own, send a message or a voice memo to podcast at autoblog dot com. (If you record audio of a question with your phone and get it to us, you could hear your very own voice on the podcast. Neat, right?) And please send trivia questions! You'll get the honor of stumping your fellow listeners, and we'll thank you too. Autoblog Podcast #496 Topics and stories we mention 2017 Subaru BRZ 2017 Mitsubishi Outlander GT 2018 Lexus LC 500 Used cars! Rundown Intro - 00:00 What we're driving - 04:26 Michelin winter tire interview - 25:14 Spend My Money - 44:33 Total Duration: 1:18:57 Get The Podcast iTunes – Subscribe to the Autoblog Podcast in iTunes RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Feedback Email – Podcast at Autoblog dot com Review the show on iTunes Podcasts Lexus Mitsubishi Subaru SUV snow tires

Mitsubishi Fuso targets female truckers with pink polka dot Canter

Fri, 22 Nov 2013We take it for granted that women can enter just about any career they want now. But there are still countless occupations where females are underrepresented. You don't see too many women truckers, for example - particularly in a country that's still as deeply traditional as Japan. But Mitsubishi Fuso is showing just how forward thinking - and simultaneously, how traditional (pink polka dots are a bit 'on the nose') it can be with this hybrid pink truck.

Now for those unfamiliar, the Mitsubishi Fuso Truck and Bus Corporation has nothing to do with Mitsubishi the car company these days. Instead, it's owned by Daimler, which we know best as the parent company of Mercedes-Benz. Yet Daimler also owns a number of truck and bus manufacturers - among them Freightliner, Thomas Built and Mitsubishi Fuso. One of latter's most popular products is the Canter, the model seen here coated in the shade of Pepto pink at the Tokyo Motor Show.

The point? To make truck driving more attractive to women, of course! We're not sure it'll catch on, but apart from the color scheme - which extends, incidentally, from the cab to the box and inside the cabin - this particular Canter (which Fuso has dubbed Canna) features a hybrid powertrain that produces 130 horsepower and 221 pound-feet of torque, paired to a 7.5Ah lithium-ion battery good for 270 volts. The whole package weighs 6,250 pounds and can carry three Japanese school girls dressed up as Sailor Moon in the front and plenty of Hello Kitty merchandise in the back.

Renault to propose joint holding company with Nissan, Nikkei reports

Fri, Apr 26 2019TOKYO — Renault SA will propose to Nissan Motor Co a plan to create a joint holding company that would give both firms equal footing as the French automaker seeks further integration with its Japanese partner, the Nikkei newspaper reported on Friday. Under the proposal, both firms would nominate a nearly equal number of directors to the new company in which ordinary shares in both Nissan and Renault would be transferred on a balanced basis, the newspaper said, without citing sources. This would effectively dilute the stake held by the French government in Renault to around 7-8 percent, from its current 15 percent, it added. The new company would be headquartered in a third country, such as Singapore. Renault plans to make the proposal to Nissan soon, the Nikkei said, having modified an earlier merger idea that Nissan rejected on April 12. Nissan declined to comment on the issue. The Financial Times newspaper reported that both Nissan and the Japanese government have refused to engage in merger talks with Renault. The report of the proposal comes as the outlook for the alliance — one of the world's top automaking partnerships — has clouded since the arrest in November of its main architect, Carlos Ghosn, for suspected financial misconduct. It also comes as Nissan's financial performance struggles following years of focusing on volume sales over building its brand, particularly in the United States, its biggest market. Nissan slashes its forecast This week, the Japanese automaker slashed its profit forecast for the year just ended to its lowest in nearly a decade, citing weakness in its U.S. operations. Renault for years has been vying for a closer merger with Nissan, which it rescued from the brink of bankruptcy two decades ago. Ghosn had been working to achieve a deeper integration before his arrest on financial misconduct charges in November last year. While the automakers have been consolidating many of their operations over the past decade, including procurement and production, many executives at Nissan have opposed an all-out merger with Renault. Instead, Nissan has argued for a more equal footing with Renault, which holds a 43 percent stake in its bigger partner. Nissan holds a 15 percent stake in Renault. It was unclear whether Renault would hold the casting vote in major decisions at the new company, as it did in Renault-Nissan B.V., a strategic management company jointly held by both companies that oversaw operations for the partnership.