2003 Mitsubishi Eclipse Gt on 2040-cars

Easton, Pennsylvania, United States

|

The good: Seats and door cards have no cracks or defects, dash has 2 cracks on passengers side. All lights work, brakes and suspension are good, bushings are good, steering and tires good. 5 speed manual trans, shifts fine. Rust free rolling chassis. New radiator and battery. The bad: Pullable dent in front of the drivers side tail light, minor dents and scratches, headlight covers faded, amplifier under passengers seat is blown. The ugly: Motor has a rod knock or piston slap issue, clutch is shattered, needs new clutch hydraulic. For local pickup only. Within 1hr of New York City and Philadelphia. Any questions, don't hesitate to ask. |

Mitsubishi Eclipse for Sale

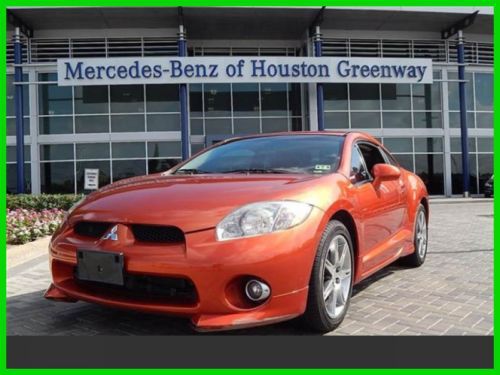

2006 mitsubishi eclipse gt coupe 2-door 3.8l(US $10,000.00)

2006 mitsubishi eclipse gt coupe 2-door 3.8l(US $10,000.00) 2003 mitsubishi eclipse convertible(US $5,800.00)

2003 mitsubishi eclipse convertible(US $5,800.00) 1999 mitsubishi eclipse

1999 mitsubishi eclipse 2012 mitsubishi eclipse spyder gs sport *low miles* clean car(US $18,450.00)

2012 mitsubishi eclipse spyder gs sport *low miles* clean car(US $18,450.00) 2006 gt used 3.8l v6 24v automatic front wheel drive coupe premium

2006 gt used 3.8l v6 24v automatic front wheel drive coupe premium 06 black mitsubishi eclipse gt(US $5,500.00)

06 black mitsubishi eclipse gt(US $5,500.00)

Auto Services in Pennsylvania

West Penn Collision ★★★★★

Wallace Towing & Repair ★★★★★

Truck Accessories by TruckAmmo ★★★★★

Town Service Center ★★★★★

Tom`s Automotive Repair ★★★★★

Stottsville Automotive ★★★★★

Auto blog

Nissan To Buy Mitsubishi For $2.2B | Autoblog Minute

Fri, May 13 2016Nissan confirmed this week that it would take a controlling interest in troubled Japanese automaker Mitsubishi. Nissan will buy 34% of Mitsubishi for $2.2B. Mitsubishi Nissan Autoblog Minute Videos Original Video

Mitsubishi ready to pull Evo's plug

Mon, 31 Mar 2014We have all manner of unofficial metrics in the auto industry. No doubt you've heard some of them, like the butt dyno. Another popular measure is the smiles-per-dollar index - how entertaining is a car versus its price. Cars like the Mazda MX-5 Miata, Scion FR-S and Mini Cooper S, for example, score quite highly, while vehicles like the BMW M5 or Audi RS7 are great to drive, but score lower because of their much higher price tags. For a long time, the king of the smiles-per-dollar index was arguably the Mitsubishi Lancer Evolution X, which blended hair-raising thrills for the price of a well-equipped Ford Fusion Titanium.

Now, it looks like the Evo will need to hand over its title, as this generation of the rally-derived rocket is likely to be Mitsubishi's last - at least for a while. There's been no mention of just when production of the current car will end, so if you're in the market, we'd suggest trying to find a dealer with inventory ASAP. The news comes from the automaker's Japanese mothership, which says the brand will instead focus on utility vehicles and EVs. While there are no direct plans for a successor, an Evo XI as it were, the door remains open for a different kind of beast, according to Mitsubishi.

"Mitsubishi Motors does not have any plans to design a successor with the current concept, as a high-performance four-wheel drive gasoline-powered sedan," said Namie Koketsu, a spokesperson for Mitsubishi, according to Automotive News. "Mitsubishi Motors will explore the possibilities of high-performance models that incorporate electric vehicle technology."

Nissan CEO Makoto Uchida rules out closer capital ties with Renault

Mon, Dec 2 2019YOKOHAMA — Nissan is committed to its automaking alliance with Renault but will not look to deepen its capital ties with the French automaker any time soon, its new CEO said on Monday. On his first day in the new position, chief executive Makoto Uchida also pledged to repair profitability at Japan's No. 2 automaker and said setting realistic targets would be key toward that goal, as it tries to make a clean break from the leadership of former chairman Carlos Ghosn. "Closer capital ties with Renault are not a focus in the short term," he told reporters. Uchida became CEO of Nissan on Dec. 1, as the car maker tries to recover from a profit slump and draw a line under a year of turmoil after the Ghosn scandal. The ousted chairman is fighting financial misconduct charges in Japan. One of the new CEO's big tasks is to salvage ties with Renault, which have deteriorated since Ghosn's ouster as chairman of both companies. Renault holds a 43.4% stake in Nissan after it saved the Japanese automaker from financial ruin two decades ago, and has pushed for the two companies to merge. In rejecting a notion of a merger with Renault, Uchida, 53, echoes his predecessor Hiroto Saikawa, who stepped down in September. He added that the alliance must re-think how it can serve all of its three members, which also includes Mitsubishi Motors. "The alliance has to benefit each of its partners in terms of revenue and profit," he said. "We need to re-evaluate what has worked and what hasn't worked in the alliance in the past few years." The CEO called for Nissan to set "challenging but achievable" targets, adding that this and the launch of more new car models and vehicle technologies would be key to its financial recovery. Nissan is bracing for its lowest annual profit in 11 years and has slashed its dividend by 65%. Its struggles come at a time when car companies desperately need scale to keep up with sweeping technological changes like electric vehicles and ride-hailing. "Somewhere along the way we created a culture of setting targets which could not be achieved," Uchida said, adding that this had resulted in a focus on short-term results. "Years of this had led Nissan to its current "difficult situation," he said, using heavy vehicle discounting in the U.S. market as an example of how aggressive sales targets to grow market share had deteriorated the company's brand.