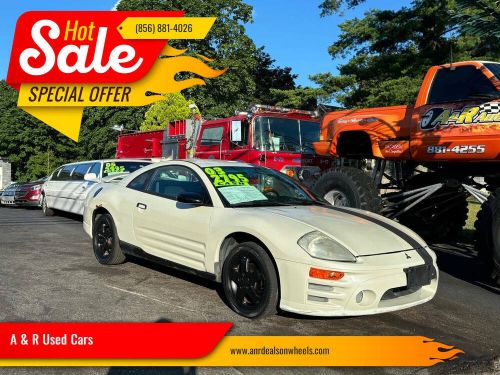

2003 Mitsubishi Eclipse Gs 2dr Hatchback on 2040-cars

Clayton, New Jersey, United States

Engine:I4 2.4L Natural Aspiration

Fuel Type:Gasoline

Body Type:Hatchback

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 4A3AC44G33E006440

Mileage: 132381

Make: Mitsubishi

Trim: GS 2dr Hatchback

Drive Type: --

Features: --

Power Options: --

Exterior Color: White

Interior Color: Black

Warranty: Unspecified

Model: Eclipse

Mitsubishi Eclipse for Sale

2007 mitsubishi eclipse spyder gs(US $4,000.00)

2007 mitsubishi eclipse spyder gs(US $4,000.00) 2011 mitsubishi eclipse 2dr spyder auto gs sport(US $12,491.00)

2011 mitsubishi eclipse 2dr spyder auto gs sport(US $12,491.00) 2009 mitsubishi eclipse gs(US $7,990.00)

2009 mitsubishi eclipse gs(US $7,990.00) 2007 mitsubishi eclipse gt(US $500.00)

2007 mitsubishi eclipse gt(US $500.00) 2008 mitsubishi eclipse gs spyder(US $7,990.00)

2008 mitsubishi eclipse gs spyder(US $7,990.00) 2003 mitsubishi eclipse gs 2dr convertible(US $7,995.00)

2003 mitsubishi eclipse gs 2dr convertible(US $7,995.00)

Auto Services in New Jersey

Woodstock Automotive Inc ★★★★★

Windrim Autobody ★★★★★

We Buy Cars NJ ★★★★★

Unique Scrap & Auto - USA ★★★★★

Turnersville Pre-Owned ★★★★★

Trilenium Auto Recyclers ★★★★★

Auto blog

Mitsubishi Evo snow frolic caught by aerial camera

Tue, 30 Apr 2013Guido Tschugg is a professional mountain biker and a Red Bull-sponsored athlete in downhill and four-cross. He's also a fan of the Mitsubishi Lancer Evolution and drifting in the snow, and with the help of filmmaker Mario Feil and drone videographers airv8, the rally car and the powder are combined to glorious effect.

We could continue talking about it, but that would delay you from enjoying the two minutes of frosty beauty in the video below.

Mitsubishi profits in North America for first time in seven years

Fri, Apr 24 2015Well, this is a change of pace. Mitsubishi has actually made some money in North America. It's the company's first operating profit in seven years, and while it might only be $4.18 million – yes, Mitsubishi made less in 2014 than some professional athletes – it's definitely a start. Sales in the US were up 19 percent between January and March, to 32,000 units, while 2014's overall sales jumped 21 percent to 117,000 units, Automotive News reports. Perhaps more impressively, the company is predicting a bountiful 2015, with sales up to 128,000 units and operating profits climbing to $58.5 million. If Mitsubishi is doing this with cars like the ancient Lancer and the awful Mirage, we should probably expect some good things when newer, more competent vehicles like the new Outlander hit dealers.

Ghosn: Nissan, Renault going for 'mini alliance' with 'reduced scope'

Tue, Jul 18 2023TOKYO — Former Nissan chairman Carlos Ghosn said on Tuesday during a news conference at the Foreign CorrespondentsÂ’ Club of Japan in Tokyo that the Japanese automaker and Renault are trying to go for less cooperation between them with a deal to overhaul their long-standing alliance. "With the latest agreement, they're trying to go for a mini alliance with a very reduced scope of cooperation," Ghosn told reporters in Tokyo via video stream. Nissan and Renault are holding discussions about a final agreement to overhaul their alliance, after announcing in January that the deal will see Renault bring down its stake in Nissan to 15% from about 43% to put them on an equal level. Earlier this year, Ghosn filed a lawsuit against Nissan and a handful of individuals seeking $588 million in lost remuneration, and a further $500 million in moral damages. “Nissan will have to pay for what they did to me and my family,” Ghosn said. “Nissan created a lot of damage Â… damage that can not be repaired.” “What IÂ’m looking for is not revenge,” Ghosn added. “I just want to make sure that all the criminals and the plotters cannot sleep quietly in their beds after what they have committed.” Material from Reuters was used in this report. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.