1998 Mitsubishi Eclipse Gst Hatchback 2-door 2.0l on 2040-cars

San Leandro, California, United States

Body Type:Hatchback

Vehicle Title:Clear

Fuel Type:GAS

Engine:2.0L 4 Cylinder Gasoline Fuel Turbocharged

Make: Mitsubishi

Model: Eclipse

Trim: GST Hatchback 2-Door

Number of Doors: 2

Drive Type: FWD

Mileage: 91,000

Exterior Color: White

Interior Color: Gray and black

Number of Cylinders: 4

Mitsubishi Eclipse for Sale

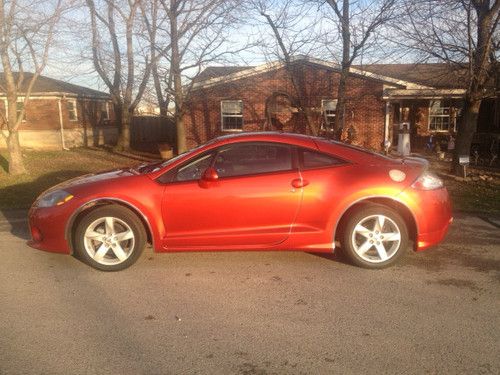

2008 mitsubishi eclipse gt orange under glow spoiler rims

2008 mitsubishi eclipse gt orange under glow spoiler rims 2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $11,500.00)

2007 mitsubishi eclipse gs coupe 2-door 2.4l(US $11,500.00) 2003 mitsubishi eclipse gs coupe 2-door 2.4l

2003 mitsubishi eclipse gs coupe 2-door 2.4l 1996 mitsubishi eclipse spyder convertible

1996 mitsubishi eclipse spyder convertible 3dr cpe rs a 2.0l power windows power door locks tilt wheel remote trunk release(US $900.00)

3dr cpe rs a 2.0l power windows power door locks tilt wheel remote trunk release(US $900.00) 1997 mitsubishi eclipse gst - built block/head, b16g, exhaust/intake/etc

1997 mitsubishi eclipse gst - built block/head, b16g, exhaust/intake/etc

Auto Services in California

Woody`s Auto Body and Paint ★★★★★

Westside Auto Repair ★★★★★

West Coast Auto Body ★★★★★

Webb`s Auto & Truck ★★★★★

VRC Auto Repair ★★★★★

Visions Automotive Glass ★★★★★

Auto blog

Mitsubishi struggling to sell doomed plant due to union workers

Sat, Oct 3 2015Mitsubishi is about to end vehicle production in the US, but the company is having serious problems finding a buyer for its Normal, IL, factory that currently assembles the Outlander Sport. A major sticking point, according to a report by The Wall Street Journal, is the plant's workforce of over 900 United Auto Workers members. The automaker has been trying to find another company to take over the site for months and has set November as the point to stop manufacturing there. The Normal, IL, factory is unique because it's the only plant in the country that's run by a Japanese automaker with a UAW-represented workforce, after starting as a joint venture with Chrysler. That makes Ford, General Motors, and FCA the preferred buyers because they could conceivably take over the union contract. However, the Blue Oval and the General likely aren't interested. According to plant officials speaking to The Wall Street Journal, FCA and some unnamed car companies are potential buyers, but there's absolutely nothing final, yet. Proponents argue that buying the location is cheaper than building a new one. Making matters harder is that the UAW and Mitsubishi are currently negotiating a new union contract, and the factory's next owner might have to take over the deal, according to the WSJ. The workers were ready to vote whether to strike recently, but that was averted when an announcement on the local's webpage said a tentative agreement was expected Sunday. Of course, the Big Three have been experiencing their own, similar issues with crafting deals, too. Related Video:

Mitsubishi previews diesel hybrid pickup concept, next-gen EV for Geneva

Wed, 13 Feb 2013Mitsubishi has a long history of tidy little pickup trucks, and the Japanese automaker is apparently looking to extend that heritage in a bolder, bigger way with the Concept GR-HEV, a "sport utility hybrid truck."

The future-think show star, slated to be unveiled at next month's Geneva Motor Show, is actually tipped to be a much larger effort - Mitsubishi says it's applying its hybrid technology to a one-ton truck for the first time. The GR-HEV is powered by a complex powertrain composed of a diesel engine and electric motors, which the company believes is better suited to the sort of heavy-duty work required in the segment. The concept also employs full-time four-wheel drive and a development of Mitsubishi's Super All-Wheel Control system (which governs things like stability and brake force control along with an active center differential) as seen on the production Lancer Evolution.

In related news, Mitsubishi has also confirmed that it will show a next-generation electric showcar at Geneva dubbed Concept CA-MiEV. With this new concept (inset photo), the company says it is looking to build on the learnings of its i citycar and take EVs out of their limited urban roles. To that end, the CA-MiEV boasts "next generation EV systems and high density batteries" that give it a range of 186 miles.

Mitsubishi e-Evolution concept EV has AI that can teach you to drive better

Thu, Oct 5 2017Following a teaser last month, Mitsubishi has revealed additional details, and a couple more images of the e-Evolution concept. The new teasers show a car with a pretty wild profile. The windshield is incredibly long and raked, and it generally has an angular, wedge-like shape. It's also an extremely cab-forward design, which is possible because it is fully electric, and there isn't an engine up front to take up lots of space. That's bad news for anyone hoping Mitsubishi might just hybridize a high-strung turbo engine. But it is still all-wheel drive, courtesy of a trio of electric motors. There's one motor up front for the front wheels, and a pair at the back for the rear wheels. These rear motors can apply different amounts of power for torque vectoring. The e-Evolution also has a unique feature in its artificial intelligence ( AI) system. Mitsubishi didn't go deep into the details of how it works, but by using many sensors, the AI can adjust how the car drives and reacts based on road conditions, traffic, and driver preferences. It can make you a better driver by silently assisting you, but it can also make you a better driver by teaching you. Apparently it can assess your driving skills and advise you on how to improve. Hopefully the e-Evolution, or whatever production model takes inspiration from it, will be fun enough to drive that you will want to improve your skills. The e-Evolution will be on display at the Tokyo Motor Show. It will only be on display for one of the press days, so if you happen to be able to get to the show then, make sure you catch it. For everyone else, stay tuned to Autoblog for more photos and info when it's fully revealed. Related Video: