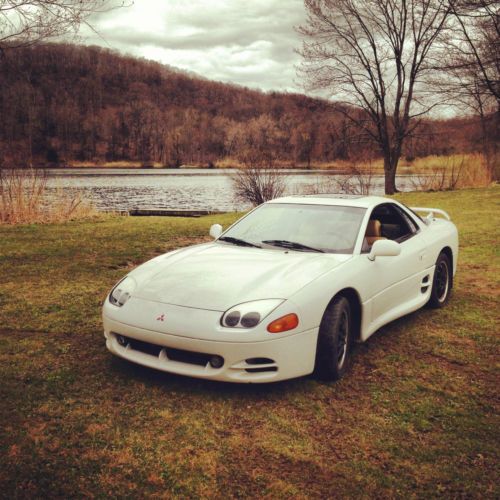

3000 Gt Vr4 Twinturbo Like The Veh Featured In 2 Fast 2 Furious on 2040-cars

Oviedo, Florida, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:3.0L 2972CC 181Cu. In. V6 GAS DOHC Turbocharged

Fuel Type:Gasoline

For Sale By:Private Seller

Year: 1993

Make: Mitsubishi

Model: 3000GT

Trim: VR-4 Coupe 2-Door

Options: 4-Wheel Drive, Leather Seats, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag

Drive Type: AWD

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Mileage: 85,000

Sub Model: GT 3000

Exterior Color: Black

Disability Equipped: No

Interior Color: Tan

Warranty: Vehicle does NOT have an existing warranty

Number of Cylinders: 6

|

1993 Mitsubishi 3000 GT VR4 TwinTurbo like the vehicle featured in 2 Fast 2 Furious

|

Mitsubishi 3000GT for Sale

1996 3000gt great condition, low miles, non smoker, dealer maintained(US $6,500.00)

1996 3000gt great condition, low miles, non smoker, dealer maintained(US $6,500.00) Mitsubishi 3000gt(US $6,000.00)

Mitsubishi 3000gt(US $6,000.00) 1995 mitsubishi 3000gt sl coupe 2-door 3.0l(US $3,000.00)

1995 mitsubishi 3000gt sl coupe 2-door 3.0l(US $3,000.00) 1994 mitsubishi 3000gt vr4 twin turbo v6 awd 6 speed manual 3000 gt low reserve

1994 mitsubishi 3000gt vr4 twin turbo v6 awd 6 speed manual 3000 gt low reserve 1991 mitsubishi 3000gt vr4 5speed manual 4x4 awd 4wd bi turbo twin turbo carfax!(US $11,950.00)

1991 mitsubishi 3000gt vr4 5speed manual 4x4 awd 4wd bi turbo twin turbo carfax!(US $11,950.00) Vr-4 manual coupe 3.0l 8 speakers am/fm radio cassette air conditioning spoiler

Vr-4 manual coupe 3.0l 8 speakers am/fm radio cassette air conditioning spoiler

Auto Services in Florida

Yokley`s Acdelco Car Care Ctr ★★★★★

Wing Motors Inc ★★★★★

Whitt Rentals ★★★★★

Weston Towing Co ★★★★★

VIP Car Wash ★★★★★

Vargas Tire Super Center ★★★★★

Auto blog

2014 Mitsubishi Mirage arrives in US this fall

Thu, 28 Mar 2013Mitsubishi dealers have been painfully starved of fresh product for ages now, with their most recent new model, the bubble-shaped i electric car, already requiring a serious sales jumpstart. We've known for a while that help is on the way in the form of an all-new Outlander crossover, but we've basically only had loose confirmations to go on that the Japanese automaker would eventually reintroduce its Mirage subcompact to the American market. Today, those rumors have turned to reality, as Mitsubishi has confirmed that the five-door economy car will hit US dealerships this fall.

Every subcompact player needs a trump suit, from Ford's tech-rich Fiesta to Honda's impossibly space-efficient Fit, and the Mirage's calling card figures to be its fuel economy. Mitsubishi says it expects its 2014 Mirage to achieve 37 miles per gallon in the city and 44 on the highway (combined rating of 40 mpg) when equipped with a continuously variable transmission. Those figures are good enough, Mitsu says, to earn it the title of the most fuel-efficient gasoline vehicle sold in America that isn't a hybrid.

Of course, Mitsubishi isn't outlining any additional specs at the moment - not even engine configuration. We're expecting the company's 1.2-liter three-cylinder, which in European spec delivers a modest 79 horsepower and 78 pound-feet of torque. The Continent's Mirage weighs under 1,900 pounds, but the normally aspirated triple still makes for leisurely acceleration of 11.7 seconds to 62 miles per hour. It will be interesting to see if Mitsubishi makes some powertrain alterations to better suit American expectations.

Mitsubishi looks to crossovers and EVs for US success

Fri, Jan 8 2016Say what you will about Mitsubishi, but the Japanese automaker is slowly seeing a resurgence here in the United States. December 2015 marked the company's twenty-second consecutive month of year-over-year sales increases, and looking at last year as a whole, Mitsubishi's sales were up 23 percent over 2014. Ken Konieczka, Mitsubishi's vice president of sales operations, says that in order to stay successful, the company will bet big on crossovers and electric vehicles in the coming years. And that means a relatively aggressive product plan here in the US. First up, a brand-new CUV will launch in early 2018, previewed by the eX Concept that debuted at last year's Tokyo Motor Show (pictured). Konieczka says Mitsubishi is making room for this new crossover in its lineup – the Outlander will slowly get bigger, and the Outlander Sport will get smaller. The production version of the eX will slot between those two. Speaking of the Outlander siblings, both will be replaced in the next five years. A new, larger Outlander will arrive in 2019, and the smaller Outlander Sport will arrive in 2020. To fulfill the electric side of the business, Konieczka confirms the next Outlander Sport will sprout an EV variant, and the Outlander plug-in hybrid will launch in the United States later in 2016, as a 2017 model. As for the rest of the company's portfolio, Mitsubishi will offer the updated Mirage hatchback and new G4 sedan later this year. The future for the Lancer, however, looks grim. Konieczka says Mitsubishi still can't find an OEM partner to help create and produce a new Lancer, and our gut says the compact sedan will be phased out in the very near future. "We made a lot of mistakes," Konieczka admits, saying Mitsubishi was "spread too thin [and] had too many models" in the past. This new, more focused approach on EVs and crossovers certainly sounds promising, and will hopefully help Mitsubishi continue its slow growth here in the US market. Still, we won't know for sure until the new products actually reach showrooms. But for now, at least, things are steadily on the rise.

New Mitsubishi Outlander PHEVs coming to Frankfurt

Tue, Sep 1 2015Mitsubishi is following the unveiling of the heavily refreshed 2016 Outlander at the 2015 New York Auto Show with the European debut of the plug-in hybrid version at this year's Frankfurt Motor Show. The PHEV goes on sale there in September, and a rally-prepped PHEV Outlander is taking part in the Baja Portalegre 500 in Portugal in October. Rumors suggest that the updated plug-in model might come to the US in early 2016. Mechanically, the Outlander PHEV retains separate motors to power the front and rear wheels, but the company has some revisions for the system to make it more efficient. Emissions are cut thanks to reduced engine friction, and acceleration is reportedly quicker, too. In large part, the 2016 PHEV carries over all of the styling and mechanical updates of its non-electrified sibling. That includes the completely new front end that mixes chrome and gloss black for a more interesting look. The plug-in gets a few design cues of its own, including a different shape for the lower bumpers, less chrome down the sides, and some body-color trim. It also rides on a set of two-tone 18-inch wheels. Inside, there's a four-spoke steering wheel and brown, and black leathers are available. Previously offered on the Japanese model, European customers now get access to the Outlander PHEV's vehicle-to-home power system. The tech allows owners to plug in their CUV and provide electricity to their house from the vehicle's battery. Mitsubishi Motors Lineup at 2015 International Motor Show (IAA) Tokyo, August 31, 2015 Improved Outlander PHEV with Dynamic Shield debuts in Europe Tokyo, August 31, 2015 - Mitsubishi Motors Corporation (MMC)'s revamped 2016MY Outlander PHEV, due to go on sale in Europe in September, will make its European debut at the 66th International Motor Show (IAA)*1 Alongside the new Outlander PHEV, MMC will be exhibiting the rally version of the Outlander PHEV to compete in the Baja Portalegre 500 cross-country rally*2 and several production models in a total lineup of 15 vehicles (13 on press days, for more information please see the last page). *1: To be held at the Messe Frankfurt exhibition grounds in Frankfurt am Main, Germany from September 15 through September 27. For more information please access http://www.iaa.de/en/press-room/ (English) *2: A cross-country rally due to be held in the eastern part of Portugal from October 22nd through October 24th.

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.278 s, 7891 u