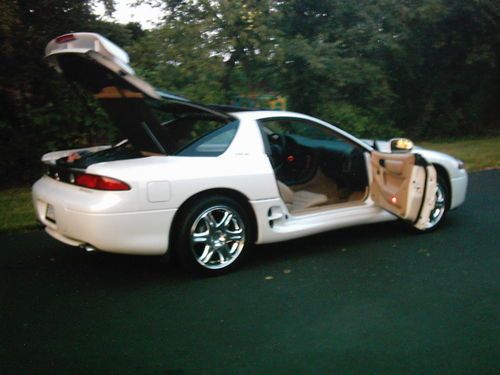

1994 Mitsubishi 3000gt Vr-4 - Stock W/ Wheels (113k Miles) on 2040-cars

Indianapolis, Indiana, United States

Body Type:Coupe

Vehicle Title:Rebuilt, Rebuildable & Reconstructed

Engine:3.0L 2972CC 181Cu. In. V6 GAS DOHC Turbocharged

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 6

Make: Mitsubishi

Model: 3000GT

Trim: VR-4 Coupe 2-Door

Options: Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Drive Type: AWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 113,000

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: VR-4

Exterior Color: Red

Interior Color: Black

Mitsubishi 3000GT for Sale

Mitsubishi 3000gt vr-4 awd twin turbo 4-wheelstearing,very rare less than 60 pro(US $25,000.00)

Mitsubishi 3000gt vr-4 awd twin turbo 4-wheelstearing,very rare less than 60 pro(US $25,000.00) 1997 mitsubishi 3000gt sl coupe 2-door 3.0l(US $4,500.00)

1997 mitsubishi 3000gt sl coupe 2-door 3.0l(US $4,500.00) 1995 mitsubishi 3000gt base coupe 2-door 3.0l(US $6,000.00)

1995 mitsubishi 3000gt base coupe 2-door 3.0l(US $6,000.00) 1999 mitsubishi 3000gt sl coupe 2-door 3.0l, 80k mi. 5sp(US $5,500.00)

1999 mitsubishi 3000gt sl coupe 2-door 3.0l, 80k mi. 5sp(US $5,500.00) 1992 mitsubishi 3000gt vr-4 coupe 2-door 3.0l

1992 mitsubishi 3000gt vr-4 coupe 2-door 3.0l 3000gt vr4 1993 rolling chassis(US $1,200.00)

3000gt vr4 1993 rolling chassis(US $1,200.00)

Auto Services in Indiana

Westfalls Auto Repair ★★★★★

Trinity Body Shop ★★★★★

Tri-County Collision Center & Towing ★★★★★

Tom O`Brien Chrysler Jeep Dodge Ram-In ★★★★★

TJ`s Auto Salvage ★★★★★

Tire Central and Service Southern Plaza ★★★★★

Auto blog

Bhutan asks Nissan, Mitsubishi for help with massive EV-only plan

Mon, Jul 7 2014Originally, the somewhat modest plan was to introduce 2,000 electric vehicles to the capital of Bhutan. Then things got bigger when Renault-Nissan CEO Carlos Ghosn paid the country a visit and the Prime Minister of Bhutan, Tshering Tobgay, said his country, "will commit to a program to achieve zero emissions as a nation by a certain target date." Now we're approaching "holy huge" territory. Last week, Tobgay visited Japan to ask Nissan and Mitsubishi for help in possibly replacing every combustion vehicle with an all-electric option. "Gasoline is expensive and unfriendly to the environment." – Bhutan's Prime Minister At the very least, Bhutan wants to make more eco-friendly vehicles available. Tobgay told AsiaNews that, "Gasoline is expensive and unfriendly to the environment. Sustainable transportation will bring citizens happiness," which is something that a country that measures its Gross National Happiness is eager to track. Switching to electric vehicles makes complete sense in Bhutan, since the mountainous Asian nation produces more renewable hydro-electricity than it can use. Ninety-five percent of the zero-emission energy is exported to India, and Bhutan uses the profits to buy fuel from India to then power its vehicles. You can probably figure out for yourself how there's a simpler way to do this. News Source: AsiaNews.it Green Mitsubishi Nissan Green Culture Electric

Mitsubishi Lancer Evo X Final Edition gets official for Japan only

Thu, Apr 16 2015It'll be the end of an era when Mitsubishi discontinues the Lancer Evolution, putting to rest a dynasty that challenged the Subauru WRX STI for decades. But before it does, the Diamond-Star automaker is sending off its most celebrated model with the Final Edition you see here. Unfortunately, it's nowhere near as cool as the concept. While the showcar pumped the output from its 2.0-liter turbo four to 473 horsepower thanks to a remapped ECU and a fresh HKS turbocharger, the production version is sticking with the stock 296 hp. It's otherwise based on the GSR model, so it's got a five-speed gearbox, but packs a long list of top-shelf equipment: BBS alloys, Bilstein shocks, Eibach springs, Brembo brakes, Recaro seats... the works. Mitsubishi will only offer 1,000 examples of the Evo X Final Edition in Japan, where buyers will be able to choose between five exterior colors and a contrasting roof in black or white. We don't know at this point whether a similar special will be offered Stateside, but if it is, we hope it'll pack at least some of the concept's power upgrades (we can dream, right?).

Mitsubishi Outlander PHEV US launch delayed over battery shortage

Mon, 30 Dec 2013Mitsubishi resumed full-scale battery production in August after a five-month shutdown due to a safety investigation. Supplier Lithium Energy Japan has been delivering 4,000 battery packs each month since September, but that's apparently still not enough to fill the overseas inventory pipeline for the Outlander PHEV and i subcompact EV while launching the Outlander PHEV here in the US. So instead of the previous tentative launch date of Fall 2014, the plug-in hybrid's Stateside on-sale date has been pushed back until 2015.

That's according to Automotive News, which also notes that Mitsubishi has sold 11,300 plug-in Outlanders this year, though that number reflects the production stoppage over the battery issues. As of April, battery supplier LEJ will be able to supply 5,000 packs per month just for the Outlander, but company president Osamu Masuko has gone on record saying that production will have to rise above that in order to make the US launch.

Every Mitsubishi dealer (and hopefully a fair number of consumers) will be looking forward to a crossover that, for the moment, doesn't really have natural rivals. The Outlander PHEV can drive 32 miles on electricity alone, has a top speed of 75 miles per hour in EV mode and offers all-wheel drive with a towing capacity of over 3,000 pounds. The model should get an impressive MPGe rating from the EPA when it finally arrives and it figures to be a bellwether for the plug-in Outlander Sport and Pajero utility vehicles that are expected to arrive after it. Hopefully 2015 will be its year.