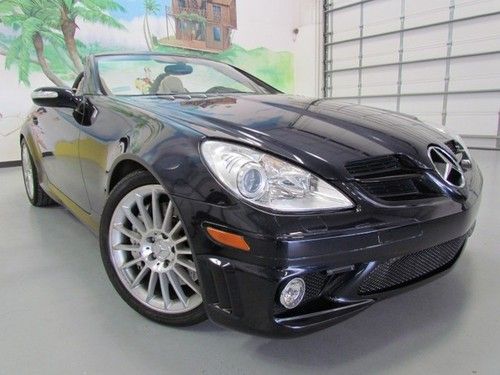

Custom Wheels Convertible Retractable Hard Top Factory Warranty Off Lease Only on 2040-cars

Lake Worth, Florida, United States

For Sale By:Dealer

Engine:3.0L 2996CC V6 GAS DOHC Naturally Aspirated

Body Type:Convertible

Transmission:Manual

Fuel Type:GAS

Cab Type (For Trucks Only): Other

Make: Mercedes-Benz

Warranty: Vehicle does NOT have an existing warranty

Model: SLK300

Trim: Base Convertible 2-Door

Disability Equipped: No

Drive Type: RWD

Doors: 2

Mileage: 39,164

Drive Train: Rear Wheel Drive

Sub Model: 3.0L Convert

Number of Doors: 2

Exterior Color: Silver

Interior Color: Gray

Number of Cylinders: 6

Mercedes-Benz SLK-Class for Sale

Clean carfax one owner 19k miles!! navigation,heated seats,hardtop,harman/kardon(US $41,995.00)

Clean carfax one owner 19k miles!! navigation,heated seats,hardtop,harman/kardon(US $41,995.00) 2001 mercedes benz slk320 convertible... car fax certified... only 50k miles(US $11,477.00)

2001 mercedes benz slk320 convertible... car fax certified... only 50k miles(US $11,477.00) 1999 mercedes benz slk230 kompressor convertible amg sport(US $6,950.00)

1999 mercedes benz slk230 kompressor convertible amg sport(US $6,950.00) 2001 mercedes-benz slk230 kompressor convertible 2-door 2.3l(US $7,900.00)

2001 mercedes-benz slk230 kompressor convertible 2-door 2.3l(US $7,900.00) Slk-230(US $13,000.00)

Slk-230(US $13,000.00) 2008 mercedes benz slk-55,rare to find,every option possible !!(US $29,850.00)

2008 mercedes benz slk-55,rare to find,every option possible !!(US $29,850.00)

Auto Services in Florida

Zych Certified Auto Repair ★★★★★

Xtreme Automotive Repairs Inc ★★★★★

World Auto Spot Inc ★★★★★

Winter Haven Honda ★★★★★

Wing Motors Inc ★★★★★

Walton`s Auto Repair Inc ★★★★★

Auto blog

Weekly Recap: Mercedes continues the pseudo-coupe craze with AMG-tuned CUV

Sat, Dec 13 2014But as BMW's X6 has demonstrated, sport sells in in the crossover segment, and Mercedes is giving the people what they want. BMW proved there is a market for crossover utility vehicles designed to look like coupes – as much as a vehicle with four doors and noticeable ground clearance can look like a coupe, anyway. Now comes the reply from Mercedes-Benz: the GLE Coupe. The rakish crossover is a harbinger of things to come from Mercedes, as it begins the company's transition to a new nomenclature and marks the debut of the AMG Sport line. It also continues the recent coupe craze. Designers from many automakers, like Nissan and Volkswagen, have increasingly turned to swoopy, dramatic styling to make utility vehicles and sedans seem more desirable. By revealing the GLE 450 AMG Sport model first, Mercedes is clearly hoping to cast the GLE Coupe as a sportier, lifestyle-oriented alternative in its lineup of beefy crossovers and SUVs. Mercedes used the word "sport," or a variation of it, 53 times in its press release, so uh yeah, it's sporty. It's not an empty promise: Benz means business with the AMG Sport line. This GLE Coupe gets a 3.0-liter biturbo V6 rated at 362 horsepower and 384 pound-feet of torque paired with Mercedes' new nine-speed automatic transmission, and it runs with 4Matic all-wheel drive. Specs on the other GLE Coupe models were not disclosed. But as BMW's X6 has demonstrated, sport sells in in the crossover segment, and Mercedes is giving the people what they want. After all, more than 260,000 people have bought X6s since 2008, and Mercedes wants a piece of that. From certain angles, the GLE Coupe even looks vaguely like an X6. "This is really a vehicle that is all about status," said Dave Sullivan, product analysis manager for research firm AutoPacific. "You can buy a SUV that doesn't have the inherent qualities of a SUV, such as cargo hauling. People will likely be drawn to the looks. Coupes are all the rage." BMW, however, isn't running from the fight, and the updated 2015 X6 is arriving in showrooms this month. It also added a smaller sibling, the X4, to its coupe-crossover stable in July. The GLE Coupe arrives next year, though Mercedes hasn't specified exactly when it will hit showrooms from the factory in Alabama, or specified details on the rest of the non-AMG Sport models. In 2008, it was surprising the X6 was a hit. In 2015, it will be even more surprising if the GLE Coupe isn't.

Weekly Recap: Autonomous driving goes commercial in Nevada

Sat, May 9 2015Nevada granted Daimler Trucks North America the first license to run an autonomous commercial vehicle on public roads in the United States Tuesday, marking another milestone in the technology's rapid advancement. Gov. Brian Sandoval and Daimler truck chief Wolfgang Bernhard promptly used the license to lap Highway 15 near Las Vegas in a newly revealed Freightliner Inspiration Truck. It was a clear signal that autonomous driving is big-rig reality, though it's still a long way from widespread use. Nevada certified two of Daimler's Freightliner Inspiration Trucks, which use the company's Highway Pilot system with a stereo camera, radar, and lane-keeping collision-prevention features to regulate the brakes and steering. The radar component has a long-range sensor that can cover 820 feet at an 18-degree angle and a shorter-range unit that stretches 230 feet at a 130-degree angle. The Inspiration trucks are based on the existing Freightliner Cascadia Evolution model used on US roads. In addition to the autonomous technologies, it also has futuristic design cues, including blue lighting in the front and a new hood and grille. While there are only two Freightliner Inspiration trucks in existence, Daimler expects to bring the Highway Pilot system into mass-produced big rigs by 2025, in time to capitalize on the market's predicted growth. The German truckmaker predicts the global hauling market will triple by 2050, and the United States will be a key part of that growth. Trucks carry 69.1 percent the nation's domestic freight tonnage and hauled 9.7 billion tons of freight in 2013, according to the American Trucking Association. Daimler expects autonomous driving to augment this growth, and perhaps evolve the role of the truck driver. Still, the company points out autonomous tech is not meant to replace drivers, but to assist them and relieve fatigue and monotony on long hauls. The driver has to stay in control for passing, in city traffic, and when hooking up the trailer. The company said autonomous driving also offers the potential for improved fuel economy – tests showed a five-percent gain – and lower maintenance costs. Daimler also said the technology could reduce congestion on the road. Much of this is attributable to the constant flow of traffic, which is aided by autonomous driving. While the benefits are becoming increasingly apparent, autonomous technology is still met with skepticism.

Next Mercedes-Benz GLK to get AMG variant? Not likely...

Fri, 15 Mar 2013If you think Mercedes-Benz will slap an AMG badge on anything with wheels, think again. Word has it the German manufacturer will not offer buyers a performance version of the GLK, with Tobias Moers, director of AMG vehicle development, saying that he doesn't see a market for the car. That's not to say the picture won't change in the near future, however. According to CarAdvice.com, AMG is keeping a close eye on the arrival of the Porsche Macan.

"Maybe there will be a change in the market when the Porsche [Macan] comes up," Moers said, "but right now, no."

The real hitch in the giddy-up seems to be cost. Moers says developing the machine into something worthy of an AMG would represent "a huge investment." We can't exactly argue with that. Fortunately, AMG buyers have plenty of Mercedes-Benz models to choose from.