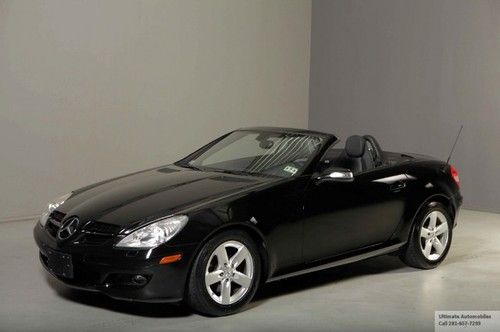

2009 Mercedes-benz Slk300 Base Convertible 2-door 3.0l on 2040-cars

Oklahoma City, Oklahoma, United States

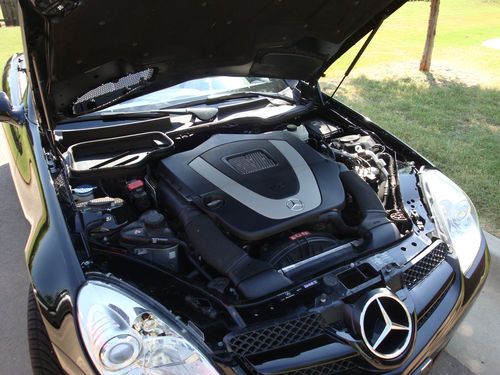

Transmission:6 Speed Automatic with Manual Option

Vehicle Title:Clear

Body Type:Convertible

Fuel Type:GAS

For Sale By:Private Seller

Mileage: 44,000

Make: Mercedes-Benz

Sub Model: SLK300

Model: SLK300

Exterior Color: Black

Trim: Base Convertible 2-Door

Interior Color: Tan

Drive Type: RWD

Number of Cylinders: 6

Options: Leather Seats, CD Player, Convertible

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Number of Doors: 2

Mercedes-Benz SLK-Class for Sale

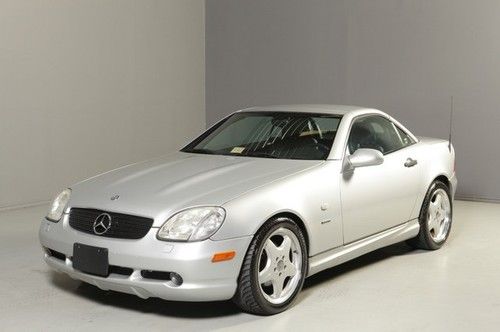

2006 mercedes benz slk 350, 9200 miles, loaded!!! very clean, garage kept

2006 mercedes benz slk 350, 9200 miles, loaded!!! very clean, garage kept $52,920 msrp premium 3 pkg navigation h/k airscarf 1-owner(US $23,900.00)

$52,920 msrp premium 3 pkg navigation h/k airscarf 1-owner(US $23,900.00) 1999 mercedes benz slk230 convertible 2.3l supercharged heated leather amg pkg(US $6,980.00)

1999 mercedes benz slk230 convertible 2.3l supercharged heated leather amg pkg(US $6,980.00) 2009 mercedes benz slk55~amg~hardtop~navi~htd lea~only 33k~conv~we finance(US $39,995.00)

2009 mercedes benz slk55~amg~hardtop~navi~htd lea~only 33k~conv~we finance(US $39,995.00) 2006 mercedes benz slk280 convertible xenons leather alloys black auto(US $15,480.00)

2006 mercedes benz slk280 convertible xenons leather alloys black auto(US $15,480.00)

Auto Services in Oklahoma

Valley Body Shop ★★★★★

Shade-Makers ★★★★★

Safelite AutoGlass ★★★★★

Precision Auto ★★★★★

Owasso Automotive Care ★★★★★

Nicoma Park Muffler ★★★★★

Auto blog

Mercedes-Maybach Pullman is the luxury car for the discerning dictator

Fri, Mar 16 2018For decades, Mercedes-Benz and Mercedes-Maybach cars have been the ride of choice for leaders across the globe, presidents, ambassadors, dictators and despots alike. The Pullman model — a long-wheelbase six-seat variant — has been particularly popular with this select clientele. This week, the German automaker announced the latest version of the car, the Mercedes-Maybach Pullman S650. Essentially, this is a stretched version of the V12-powered Maybach with two rear-facing seats just behind the front row. Mercedes is calling this vis-a-vis seating. There's also a partitioning glass between the front seats and the rear cabin. This is of course to help prevent the chauffeur from learning and spilling any state secrets or plans for plans for secret moon bases. New for this model is a front-facing camera for rear-seat passengers. This allows occupants to watch for any oncoming obstacles, barricades or road blocks. Visually, there's no mistaking the Pullman for another Maybach or really anything else on the road. The car is 21.3-feet long, 4.5-feet longer than the standard Maybach or roughly the size of two and a half Smart Fortwo placed bumper-to-bumper. The requisite 20-inch 10-hole wheels are present and the standard pinstripe Maybach grille has been updated with a slightly new design. The car only comes in S650 trim, meaning it's powered by a 630 horsepower 6.0-liter twin-turbo V12. As expected, the Mercedes-Maybach Pullman isn't cheap. Orders have started, but be prepared to shell out at least $615,000 before adding any custom touches. Related Video: Featured Gallery 2019 Mercedes-Maybach Pullman View 10 Photos Image Credit: Daimler Design/Style Maybach Mercedes-Benz Luxury Special and Limited Editions Sedan mercedes-maybach mercedes-maybach pullman

Gullwing America turns SLS AMG Roadster into stunning 1955 300 SC redux

Thu, 14 Feb 2013Gullwing America specializes in what it calls "retro styling meets modern technology." It's next demonstration of that is the convertible above, a stylized recreation of the 1955 Mercedes-Benz 300 SC (inset) supported by the structure of a 2012 SLS AMG Roadster. Commissioned by a client in Eastern Europe, the resulting car is called the 300 SLC.

The hand-formed aluminum bodywork required just a few changes to the SLS AMG Roadster, namely reworking the headlights into a stacked arrangement of LEDs and relocating the pop-up spoiler behind the cabin. The retro grille and long, straight hood evoke the past, the custom exhaust, height-adjustable suspension, 21-inch wheels up front and 22-inch wheels in back, however, stray a little further from history. The 300 SLC will come with a hardtop and be one-of-a-kind, making it even rarer than its inspiration, of which 92 were made.

If you have any more questions, they can probably be answered in the high-res photo gallery above and press release below.

Brabus takes Mercedes-Maybach even further

Sat, Jun 13 2015Hard as it may be to imagine for most, even the flagship Mercedes-Maybach S600 won't be enough for some. And those individuals can now turn to Brabus to customize their limousines even further. The latest tuning package includes an array of enhancements, starting with the engine. That's where Brabus has installed all the upgrades from the Brabus Rocket 900, boring the 6.0-liter twin-turbo V12 out to 6.3 liters, and producing a massive 887 horsepower and 1,106 pound-feet of torque. That'll propel the limo up to an Autobahn-crunching top speed quoted at 217 miles per hour, reaching 62 in just 3.7 seconds. Buyers going for the less potent Maybach S500 offered in certain markets can also opt for the Brabus B50-540 performance kit, which offers 83 extra hp and a further 88 lb-ft of torque. Brabus has also fitted a choice of 21-inch wheels, retuned suspension dropped by an inch, a full aero kit, and new radiator grille. And as sumptuous as it is already, the tuner is also offering upgrades to the interior with special leather and Alcantara upholstery, wood and carbon-fiber trim, and its full iBusiness suite. All of which promises to make the flagship Mercedes even more expensive, of course, but if there was ever an example of "if you have to ask, you can't afford it," surely the Maybach is it. BRABUS refines the new Mercedes-Maybach 662 kW / 900 HP, 1,500 Nm, top speed 350 km/h plus, high-tech forged wheels, sporty-elegant design and even more luxurious BRABUS fine leather interiors The new Mercedes-Maybach represents the absolute pinnacle of state-of-the-art automotive engineering. Nonetheless, even this luxury sedan offers room for individual refinement, which BRABUS (Brabus-Allee, D-46240 Bottrop, phone + 49 / (0) 2041 / 777-0, fax + 49 / (0) 2041 / 777 111, internet www.brabus.com) realizes with a select team of the best engineers, designers, technicians and master craftsmen. The BRABUS ROCKET 900 6.3 V12 twin-turbo increased-displacement engine provides the Mercedes-Maybach S 600 with an enormous rated power output of 662 kW / 900 HP (887 bhp) and a peak torque of 1,500 Nm (1,106 lb-ft). Top speed is in excess of 350 km/h (217 mph). To match the extreme performance of the luxury liner, the appearance of the four-seat car receives some sporty-elegant emphasis with BRABUS aerodynamic-enhancement components and BRABUS Monoblock "PLATINUM EDITION" 21-inch forged wheels. Another BRABUS domain is exclusive interior design.