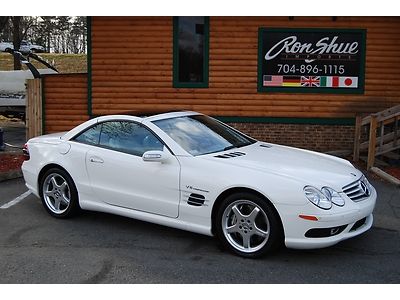

2006 Mercedes Sl55 Amg- 517 Horsepower- Factory Supercharged on 2040-cars

Cornelius, North Carolina, United States

Vehicle Title:Clear

Engine:5.5L 5439CC 335Cu. In. V8 GAS SOHC Supercharged

For Sale By:Dealer

Body Type:Convertible

Fuel Type:GAS

Make: Mercedes-Benz

Warranty: Unspecified

Model: SL55 AMG

Trim: Base Convertible 2-Door

Options: CD Player

Power Options: Power Locks

Drive Type: RWD

Mileage: 42,139

Number of Doors: 2

Sub Model: 2dr Roadster

Exterior Color: White

Number of Cylinders: 8

Interior Color: Gray

Mercedes-Benz SL-Class for Sale

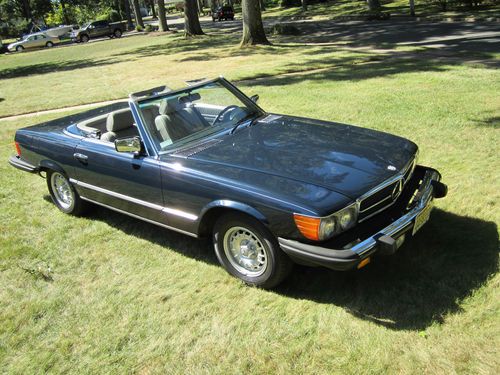

1983 mercedes-benz 380sl(US $18,500.00)

1983 mercedes-benz 380sl(US $18,500.00) 1985 380sl black on palomino, arizona car, all original factory paint, no rust!!(US $7,995.00)

1985 380sl black on palomino, arizona car, all original factory paint, no rust!!(US $7,995.00) ** extra clean ** low mileage ** mars red ** sl55 amg ** 20" wheels **

** extra clean ** low mileage ** mars red ** sl55 amg ** 20" wheels ** 2007 sl550 luxury sport convertible premium traction bose(US $38,987.00)

2007 sl550 luxury sport convertible premium traction bose(US $38,987.00) 1984 mercedes benz red convertible 500sl special edition 6,8k milleage only!(US $9,999.00)

1984 mercedes benz red convertible 500sl special edition 6,8k milleage only!(US $9,999.00) 2003 mercedes-benz sl500 convertible 2-door 5.0l(US $18,995.00)

2003 mercedes-benz sl500 convertible 2-door 5.0l(US $18,995.00)

Auto Services in North Carolina

Wood Tire & Alignment ★★★★★

Wilhelm`s ★★★★★

Wilcox Auto Sales ★★★★★

Town & Country Radiator ★★★★★

The Transmission Shop ★★★★★

The Auto Finders ★★★★★

Auto blog

Merecedes-Benz EQS, Ford Mustang Mach-E GT and Subaru Forester Wilderness | Autoblog Podcast #702

Fri, Oct 29 2021In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor James Riswick. They've been driving some exciting new EVs, like the Ford Mustang Mach-E GT and the Mercedes-Benz EQS. They also discuss driving the new Subaru Forester Wilderness, as well as the perfectly agreeable Toyota Camry XSE Hybrid. James compares four big-name off-roaders — the Ford Bronco, Jeep Wrangler, Toyota 4Runner and Land Rover Defender — based on their ability to accommodate a big load of luggage. Next they reach into the mailbag for comments on the Genesis GV70, as well as a Spend My Money question about replacing a wrecked Subaru Ascent with another three-row SUV. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #702 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown What we're driving: 2022 Ford Mustang Mach-E GT 2022 Mercedes-Benz EQS 2022 Subaru Forester Wilderness 2022 Toyota Camry XSE Hybrid Luggage testing the off-roaders: Ford Bronco vs. Jeep Wrangler vs. Land Rover Defender vs. Toyota 4Runner Mailbag: Thoughts on the Genesis GV70 Spend My Money: Three-row SUV to replace Subaru Ascent Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Mercedes-AMG GT3 racing towards Geneva debut

Fri, Feb 13 2015So far, we've only seen the fundamental road-going coupe version of the new Mercedes-AMG GT, but like the Porsche 911 it targets, you can bet there will be more derivatives to follow. And this is our first glimpse at the first of them. At the Geneva Motor Show next month, Mercedes will showcase the GT3-spec racing version of the AMG GT. The German automaker didn't tell us much more in making the announcement, but did release a pair of cropped teaser sketches showing the sports car with all manner of racing appendages, including what looks like a massive rear wing. Once ready for action, the new Mercedes-AMG GT3 will replace the previous SLS AMG GT3 that won the Nurburgring 24-hour race a couple of years back. But with every automaker and its sister company getting in on the GT3 racing action these days, it'll face some stiff competition on the track. The new Mercedes-AMG GT3 February 12, 2015 Neatly coinciding with the upcoming market launch of the road-going version of the Mercedes-AMG GT, the next stage of the vehicle's evolution is already here: the sports car and performance brand of Mercedes-Benz is presenting a new customer sport racing car that complies with FIA GT3 race regulations in the form of the new Mercedes-AMG GT3. With this, the second customer sport car to be developed by Mercedes-AMG, the Affalterbach company is seeking to build on the success of the SLS AMG GT3 and further expand the customer sport programme first started in 2010. The superb racetrack performance of the road-going GT forms the ideal basis on which to model the new Mercedes-AMG GT3, which is due to make its debut appearance at the Geneva Motor Show. Featured Gallery Mercedes-AMG GT3: teasers Geneva Motor Show Mercedes-Benz Coupe Racing Vehicles mercedes-amg 2015 Geneva Motor Show rendering mercedes-amg gt sketch mercedes-amg gt3

Mercedes-Petronas AMG W04 launched to little fanfare, lots of pressure [w/video]

Tue, 05 Feb 2013No indoor cocktail hour for the launch of the W04, the newest chassis built by the Mercedes AMG Petronas Formula One team. Instead, Nico Rosberg and Lewis Hamilton spent a morning in photo and video sessions at the track in Jerez, Spain then paused a moment to introduce the car. The team will want the W04 to demonstrate the World Championship credentials of the team personnel and one of the team drivers, instead of the mostly humble performances we've seen over the past three years.

The W04 has been fitted with a new five-element front wing, pushrod front and pull-rod rear suspension, a second-generation Coanda exhaust and an "aggressively packaged" rear end. A small vanity panel, à la Infiniti Red Bull's RB9, covers the stepped nose.

Team principal Ross Brawn has called it "a clear step forward in design and detail sophistication," but as much as we truly respect Brawn's abilities and achievements, we heard him say similar things about the updated W03 last year before almost every race weekend from about mid-season. We really hope he's right this time, and so does the team's newest driver, Lewis Hamilton. We'll do our best to ignore the parallels of the Mercedes F1 team having signed a sponsorship deal with Blackberry, another company trying to find its way back to the top and still struggling, and just point you to the video below of the W04 in action.