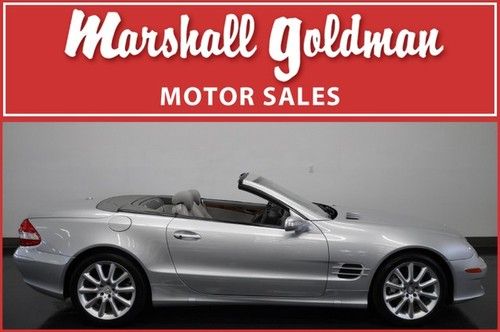

2000 Mercedes Benz Sl500 Sport Package Sl2 Package 11,852 Certified Miles Amg on 2040-cars

Lake Zurich, Illinois, United States

For Sale By:Dealer

Engine:5.0L 4973CC V8 GAS SOHC Naturally Aspirated

Body Type:Convertible

Transmission:Automatic

Fuel Type:GAS

Warranty: Vehicle does NOT have an existing warranty

Make: Mercedes-Benz

Model: SL500

Trim: Base Convertible 2-Door

Disability Equipped: No

Doors: 2

Drive Type: RWD

Drive Train: Rear Wheel Drive

Mileage: 11,852

Number of Doors: 2

Exterior Color: White

Interior Color: Gray

Number of Cylinders: 8

Mercedes-Benz SL-Class for Sale

Beautiful 2000 silver meredes sl500, hard top, garage kept, 54,000 miles mint(US $15,500.00)

Beautiful 2000 silver meredes sl500, hard top, garage kept, 54,000 miles mint(US $15,500.00) We finance 2004 mercedes-benz sl500 roadster hrdtpconv navi hids bose lthrhtdsts(US $19,000.00)

We finance 2004 mercedes-benz sl500 roadster hrdtpconv navi hids bose lthrhtdsts(US $19,000.00) 2009 mercedes-benz sl550 - black on black - low miles - factory warranty(US $51,499.00)

2009 mercedes-benz sl550 - black on black - low miles - factory warranty(US $51,499.00) 2009 mercedes benz sl550 silver arrow pano roof only 14,700 miles(US $65,900.00)

2009 mercedes benz sl550 silver arrow pano roof only 14,700 miles(US $65,900.00) 2009 mercedes benz sl63 blacak/black performance pkg, only 20,000 miles(US $75,900.00)

2009 mercedes benz sl63 blacak/black performance pkg, only 20,000 miles(US $75,900.00) 2008 mercedes benz sl550 silver/ash only 20,400 miles(US $49,900.00)

2008 mercedes benz sl550 silver/ash only 20,400 miles(US $49,900.00)

Auto Services in Illinois

USA Muffler & Brakes ★★★★★

The Auto Shop ★★★★★

Super Low Foods ★★★★★

Spirit West Motor Carriage Body Repair ★★★★★

South West Auto Repair & Mufflers ★★★★★

Sierra Auto Group ★★★★★

Auto blog

Mansory G63 AMG Sahara Edition substitutes performance for taste

Wed, Mar 4 2015We aren't sure if it's an unwritten rule or not, but it seems like European tuners are wholly incapable of building cars whose aesthetics don't offend people blessed with the gift of sight. Take Mansory, for example. The Swiss tuner has turned its hand to the Mercedes-Benz G-Class, a vehicle that on it's own is not exactly a visual stunner. Functional sure, but not exactly beautiful. But with Mansory wielding the design pen, the result is, well, yeah. It's not great. This is the Mansory G63 AMG Sahara Edition, and surprisingly, its camouflaged paint scheme is one of its least obnoxious qualities. But its grille, headlights, hood scoop, roof-mounted lights and rear spoiler just don't do this Mercedes any favors. And for some reason, the tuning firm has decided to put two different styles of 22-inch alloys. The driver's side isn't horrible, although we can't say the same about passenger-side hoops. The interior treatment is nothing compared to the cabin, though. Falcons. There are falcons in the headrests. No, we don't know why either. The avian theme isn't limited to the headrests, though, as Mansory has added wings to the seats, dash and door panels, all the while continuing on with camouflage color scheme on certain interior surfaces. Of course, if you can live with the design decisions, you'll be getting a ludicrously potent G-Wagen. Mansory has boosted the 5.5-liter, biturbocharged V8 to 828 horsepower while it's actually been limited to 737 pound-feet of torque. We aren't sure what the addition of 292 hp and 177 lb-ft of torque does to the G63's run to 60, although we're betting the Mansory version is a lot quick than the 5.3-second stock time. Check out our live gallery of the G63 AMG Sahara Edition, from the floor of the 2015 Geneva Motor Show. Related Video:

Mercedes teams with Pebble for smartwatch tech

Tue, 24 Dec 2013Most automakers have realized by now that a good infotainment system is a must-have feature for many buyers, and have, as a result, invested increasing amounts of time and money developing these technologies. But some automakers are going above and beyond in-car entertainment and navigation technology by focusing on wearable technology as well.

Nissan has emerged as one such company, developing its own alternative to Google Glass and performance-oriented smartwatch. But Mercedes-Benz is also putting itself at the forefront of wearable tech - not by developing competing products to those designed by dedicated tech companies, but by working with them. The German automaker, as we recently reported, is developing its own app for Google Glass, and is now doing the same with smartwatches as well.

Set to be unveiled at the upcoming Consumer Electronics Show in Las Vegas, Mercedes has collaborated with Pebble Technologies to develop the Digital DriveStyle app. The system will display tell its wearer where the car is, whether the doors are locked and if it needs fuel. Inside the car it'll alert the driver to potential hazards coming up on the road, while making functions like re-routing the nav system, controlling the audio system or activating Siri that much easier.

The 10 car brands most expensive to maintain over 10 years

Mon, Apr 22 2024Car maintenance has got to be one of the least fun things you can do with your free time, right behind going to the dentist and filing your taxes. However, depending on the brand you buy, your time spent at the shop could be much more than you bargained for. Consumer Reports’ new study on the most- and least-expensive-to-maintain car brands found that European car companies are most likely to break your wallet with costs nearly five times that of the automakers at the other end of the spectrum. Land Rover had the highest ten-year maintenance costs, at an average of $19,250. Porsche was second worst with $14,090 in costs. 10 car brands most expensive to maintain over 10 years: Land Rover: $19,250 Porsche: $14,090 Mercedes-Benz: $10,525 Audi: $9,890 BMW: $9,500 Volvo: $9,285 Infiniti: $8,500 Acura: $7,800 Mini: $7,625 Subaru: $7,200 The Euro brands at the “top” of this list arenÂ’t all that surprising. Land Rover has consistently landed as one of the most expensive vehicle brands to maintain for years now, though Porsche is generally viewed as being one of the more solid performance brands. That could suggest that some models donÂ’t always require more repairs, but the fixes they do need are significantly more expensive. Tesla, Buick, and Toyota were the three cheapest to maintain car brands, with 10-year maintenance costs of $4,035, $4,900, and $4,900, respectively. Consumer Reports noted that these numbers could be slightly skewed due to the fact that some automakers offer free maintenance for the first few years of ownership, and all companies cover their new vehicles for at least a few years after the purchase. Routine maintenance is a great way to avoid costly repairs over time, as itÂ’s much cheaper to catch a problem before it starts causing other issues. Check your oil, rotate your tires, and avoid driving like a wild person, and youÂ’ll likely fare much better than others, even if you own one of the scarier-to-maintain brands.