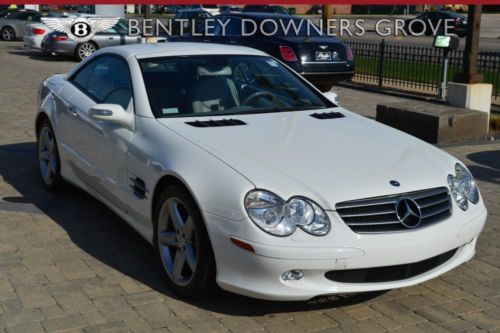

1997 Mercedes-benz Sl500 Base Convertible, 65,700 Miles on 2040-cars

Mesa, Arizona, United States

|

Commonly called "The best quality Mercedes ever made". Sold new in Paradise-Valley, Arizona for about $100k in 97 and lived all it's life, garaged, in warm, dry climate. The car looks as if it just came out of showroom with minimal imperfections. It's been driven under 3900 miles/year and garaged all during its life. This is one of approximately 451 white 1997 SL500s sold in the US (Ken Rockwell) and one of possibly 20 or 30 with low miles. Has 315HP, 345 ft.lb Torque, 155MPH(with limiter) Top-speed. For those interested, Kleeman offers a Supercharger that raises the performance of this car to about 470HP and 187mph and 12.1sec 1/4mile. The transmission is 5-speed automatic and I'm averaging up to 30mpg on straight-line freeway and 24mpg in hilly areas. Comes with 2-tops, the hard top which is on it right now and the soft-top which is lowered into the body Has 2 keys on remotes, all books and some recent records Newer Michelin tires Automatic Roll-Bar is raised when the car senses instability, or by a button. Stability control applies the brakes when it senses the car may roll at high speed. If you need specific pictures please message me CASHIERS CHECK ONLY BUYER TO ARRANGE PICKUP OR SHIPPING (Shipping to East US is about $1000 and West-US about $500), Car is located in Mesa, AZ. Per receipt of Cashiers-Check I will mail the signed, notarized, clean, lien-free, Arizona title over-night to your home address and the car-shipper will deliver the insured car to your door in 3 to 10 days depending on distance. |

Mercedes-Benz SL-Class for Sale

2007 mb model sl 55 amg stage 1, 570 hp toute ?quip? 45,000 km

2007 mb model sl 55 amg stage 1, 570 hp toute ?quip? 45,000 km 2006 mercedes-benz sl-class sl500(US $28,777.00)

2006 mercedes-benz sl-class sl500(US $28,777.00) Excellent 1987 mercedes-benz 560sl, sl class, great condition(US $10,000.00)

Excellent 1987 mercedes-benz 560sl, sl class, great condition(US $10,000.00) 1986 560sl orig calif car with 77k orig miles & all service history since new!(US $17,500.00)

1986 560sl orig calif car with 77k orig miles & all service history since new!(US $17,500.00) 1980 mercedes 450sl with hard and soft tops(US $3,125.00)

1980 mercedes 450sl with hard and soft tops(US $3,125.00) 1976 mercedes-benz 450sl clean car runs great white/blue(US $8,490.00)

1976 mercedes-benz 450sl clean car runs great white/blue(US $8,490.00)

Auto Services in Arizona

yourcarguyaz.com ★★★★★

VW & Audi Independent Service and Repair Specialist ★★★★★

USA Auto Glass Repair ★★★★★

Truck And Trailer Parts Incorporated ★★★★★

Tony`s Auto Repair ★★★★★

TintAZ.com Mobile Window Tinting ★★★★★

Auto blog

Mercedes caught testing stretched E-Class Maybach

Fri, Aug 21 2015The Mercedes-Maybach S600 won't be the only vehicle to wear the hyphenated name of two of the world's automotive luxury greats. That hulking S-Class will soon be joined by an E-Class variant, which should offer the same touch of subtle luxury as its big brother. At least, that's what we're guessing based on the latest round of spy photos, showing a stretched E-Class with some very telling camouflage. Pay attention, as our spies did, to the rear doors and C-pillar. Like the Maybach S600, the E-Class model features a larger quarter window, although unlike the S, the doors here look to be a bit larger than your usual E550 or E250. Also take note of the heavy tint on those rear windows. It's likely there to obscure whatever sumptuous hides and warm woods Maybach has fitted to the typically business-class interior. While the interior materials are likely to see sweeping changes, expect Mercedes to treat the exterior with a much gentler touch. There'll probably be some unique wheels and C-pillar-mounted Maybach badges, like what we've already seen on the S600. Check out the full round of spy photos up top, and stay tuned for more on the latest Mercedes-Maybach. Related Video:

Mercedes will still provide V8 engines to Aston Martin

Fri, Aug 20 2021News of Mercedes suspending sales of the vast majority of its V8-powered cars for the 2022 model year hit the presses about a week ago. However, what wasn’t explained then was the fate of Aston Martins with Mercedes-AMG V8 engines. Many Aston Martin products are powered by AMGÂ’s 4.0-liter twin-turbo V8 engine (the M 177 version affecting AMG products), and itÂ’s one of the motors that we reportedly wonÂ’t see in Mercedes-AMG products next year. Since AMG is struggling to fit its cars with its own engine, that brings into question Aston MartinÂ’s supply of V8s. Car and Driver got some answers from Aston, though, and the situation in the UK doesnÂ’t appear anywhere near as dire as in Germany. “Aston Martin confirms that its supply of V8 engines from Aston Martin AG is not affected," an Aston Martin spokesperson told Car and Driver. So there you have it. AstonÂ’s AMG V8-powered vehicles — Vantage, DB11 and DBX — will supposedly carry on sales without interruption. ThatÂ’s great news for Aston Martin and any uber-wealthy folks who intend to buy one. At the same time, Mercedes isn't completely out of the V8 game for 2022. In fact, it's still selling cars that directly compete with Aston Martin: AMG GT Coupe and Roadster. Those Mercedes products use the M 178 version of the AMG V8 and are reportedly unaffected by supply issues. ThereÂ’s probably even more to this story as time passes, too. Mercedes has yet to officially acknowledge the stoppage of V8s — we reached out for comment when we published our initial story, but havenÂ’t heard confirmation back yet. When we do, weÂ’ll make sure to update you on whatÂ’s going on. Related video:

Mercedes-AMG Sprinter63 S is a perfect April Fools' prank

Tue, Mar 31 2015The pranksters at Mercedes-Benz USA need to check their calendars because April Fools' Day isn't until tomorrow. Still, the folks over there deserve points for taking something that should be absolutely absurd and making it look great. Meet the Mercedes-AMG Sprinter63 S. This utilitarian van can seriously haul the mail thanks to the performance division's latest 4.0-liter, twin-turbo V8 boasting 503 horsepower under the hood. With a retuned suspension and rear diffuser, it should hold the road with aplomb while delivering packages at very high speeds. We really have to give Mercedes credit on the renderings too because they almost look realistic. However, the company misses the chance to really take things over the top by not basing the AMG Sprinter on the latest 4X4 model. When driving a performance van with over 500-horsepower putting your foot down should mean billows of tire smoke from the front and rear axles. Related Video: Introducing the all-new Mercedes-AMG Sprinter63 S. A combination of legendary performance and driving dynamics from Mercedes-AMG with the utility and capacity of a Sprinter Van. Ready to attack corners with its AMG custom-engineered sport suspension, the Sprinter63 S is powered by a 503hp handcrafted 4.0-liter biturbo V-8-which means it's also ready to haul a lot more than just cargo. It's exactly what you'd expect of our high performance division, if they were given the keys to a Sprinter van.