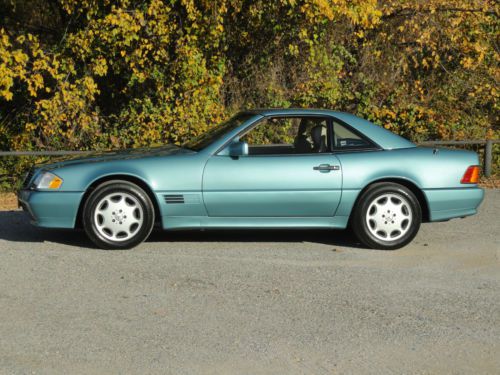

1995 Mercedes-benz Sl320 2-door Convertible on 2040-cars

Lewisville, Texas, United States

|

If you are looking for a classic Mercedes-Benz, this is the car for you. It is an immaculate one-owner car with a clean CarFax. This SL has nothing but TLC in it's history. I have driven this car about 200 miles and I absolutely love it. The motor and transmission are strong and smooth. It handles like a new Mercedes. It's a dream to drive. You cannot go down the road in this car without a big smile on your face. I've had several C-class Mercedes and a couple of SLKs and this SL-320 is definitely my favorite. Everything works on this car and everything functions like it should except for the following: The hydraulic cylinders that raise the top have leaky seals. Replacement cylinders are $55 each (there are two) from Top Hydraulics. See tophydraulicsinc on the web for information. Other than that, everything looks like it is in pristine condition. I purchased this car and I am selling it through my friends dealer's license in Texas. I only buy Mercedes and Jeep. I am very happy with this vehicle and I know that you will be very proud to own and drive it. If you have any questions, please contact me. |

Mercedes-Benz SL-Class for Sale

1987 mercedes benz 560sl(US $19,900.00)

1987 mercedes benz 560sl(US $19,900.00) Mercedes benz 500sl v8 roadster(US $6,250.00)

Mercedes benz 500sl v8 roadster(US $6,250.00) 2007 mercedes sl550 navigation sat radio bluetooth heated seats

2007 mercedes sl550 navigation sat radio bluetooth heated seats 2005 mercedes-benz sl500 convertible 2-door 5.0l 10,215 miles one owner

2005 mercedes-benz sl500 convertible 2-door 5.0l 10,215 miles one owner 1968 mercedes benz 250sl - very original, rust-free, documented california w113

1968 mercedes benz 250sl - very original, rust-free, documented california w113 1983 mercedes benz 380 sl

1983 mercedes benz 380 sl

Auto Services in Texas

Xtreme Customs Body and Paint ★★★★★

Woodard Paint & Body ★★★★★

Whitlock Auto Kare & Sale ★★★★★

Wesley Chitty Garage-Body Shop ★★★★★

Weathersbee Electric Co ★★★★★

Wayside Radiator Inc ★★★★★

Auto blog

Sunday Drive: Volvo hits a crossover home run, and people still love sports cars

Sun, Sep 24 2017Looking back at the week that just was clearly tells us at least three things. First, crossovers don't have to be boring. Second, people still love sports cars, from the attainable (Audi TT RS) to the fanciful (Mercedes-AMG GT C). And finally, the traditional German trio of premium luxury brands had better not rest on their laurels, because credible challengers are coming in from every direction. The biggest reveal of the week, at least judging by the interest of Autoblog readers, was the Volvo XC40. Not only is the little 'ute a looker, it introduces some innovative new buying/leasing schemes designed to appeal to an audience accustomed to trading in and trading up every couple of years. Think of Volvo's flat-fee lease as you would a smartphone contract, and you'll be on the right track. Genesis looks to have a hit on its hands in the form of the G70 sport sedan. We took a Korean-spec model for a spin and found a lot to like about the upstart contender. We can't wait to sample one here in the United States to see how it stacks up against the Audi A4, BMW 3 Series, and Mercedes-Benz C-Class. In other news, we're still really excited to see a production Ford Ranger Raptor. But if you just can't wait for the official reveal — it's OK, neither can we — take a look at the renderings in our post down below. As always, tune in to Autoblog next week for a front-row seat to all the happenings worth following in the automotive industry. Volvo XC40 revealed | Crossover at the crossroads of style and substance 3 ways the Volvo XC40 is a game-changer Genesis G70 First Drive | An arrow to the heart of the Germans 2018 Audi TT RS Drivers' Notes | Five pots of turbocharged honey 2018 Mercedes-AMG GT C Quick Spin | This is the AMG GT you want The Ford Ranger Raptor is real, and this is what it might look like

Autoblog Minute: Frankfurt Motor Show recap

Wed, Sep 16 2015We check in with Autoblog staffers in Germany for a recap of the biggest reveals from the 2015 Frankfurt Motor Show. Autoblog's Adam Morath reports on this edition of Autoblog Minute with commentary from senior editor, Greg Migliore. Show full video transcript text [00:00:00] As the doors of the Frankfurt Motor Show open to the world's press we venture across the Atlantic for a front row seat to all the action. I'm Adam Morath and this is your Autoblog Minute. The fall auto show season kicks off this week and Germany is set to play host. We're expecting plenty of big vehicle reveals and industry news to come out of Frankfurt. [00:00:30] [Greg Migliore Interview] [00:01:00] Be sure to check in with Autoblog for tons of great photos, video and editorial coverage on all things Frankfurt. For Autoblog, I'm Adam Morath. Autoblog Minute is a short-form video news series reporting on all things automotive. Each segment offers a quick and clear picture of what's happening in the automotive industry from the perspective of Autoblog's expert editorial staff, auto executives, and industry professionals. Frankfurt Motor Show Bentley Jaguar Mercedes-Benz SUV Concept Cars Electric Autoblog Minute Videos Original Video

Recharge Wrap-up: Mercedes gets F1 efficiency, EV charging in Vermont, VW e-Golf to use Bosch

Mon, Jul 14 2014Efficiency equals performance, especially in the case of Formula 1 racing. The Mercedes AMC Petronas team points to several key efficiency technologies it uses to get the most out of its cars. And if their utter dominance so far this season is testament to this relationship, perhaps we should pay attention. Mercedes highlights hybrid tech, turbocharging, aerodynamics, lightweight construction, tribology (both in making internal components and lubricants more slippery) and simulation as crucial to getting around the track faster than anyone else. These just happen to be some of the same things that make the cars we drive on public roads more fuel-efficient. Learn more in the press release below. It's a good read. Brammo, maker of sweet electric motorcycles, is teaming up with TEAM Industries to make drivetrains for electric vehicles. TEAM, which specializes in drivetrain technology, will also become an investor in Brammo as part of the partnership. "The electric vehicle market is a growth market," says TEAM CEO and President David Ricke, "and TEAM and Brammo will be providing a wide range of solutions for OEM manufacturers." Read more over at EV World. Vermont celebrated the installation of a new EV charging station as part of a Green Energy Corridor between Boston and Montreal. When finished, drivers will be able to make the whole trip in an EV with access to charging along the way. For $5, customers can charge their vehicle in about 30 minutes at the Red Hen Baking Company in Middlesex. There are currently only about 700 EVs on the road in Vermont. The state has a goal to get 90 percent of its energy from renewable sources by 2050, and getting more EVs on the road is crucial to that mission. Vermont hopes that expanding the charging infrastructure will convince more people to go electric. Read more at Vermont Public Radio's website. For it's new e-Golf, Volkswagen will use Bosch chargers for home installation and ChargePoint stations at its dealerships. Bosch will have various 240-volt options for the home, and will also provide installation. e-Golf customers will also get a free ChargePoint membership, and will have access to the company's network of charging stations worldwide. The 2015 e-Golf goes on sale in the US later this year. Read more in the press release below. Synergies between F1 and Road Car Development: Efficiency equals performance In Formula 1 Racing, performance is everything.