1970 Mercedes-benz 280sl Roadster/hardtop, Db-396 Met, Blue, 2-owner on 2040-cars

Herndon, Virginia, United States

Mercedes-Benz SL-Class for Sale

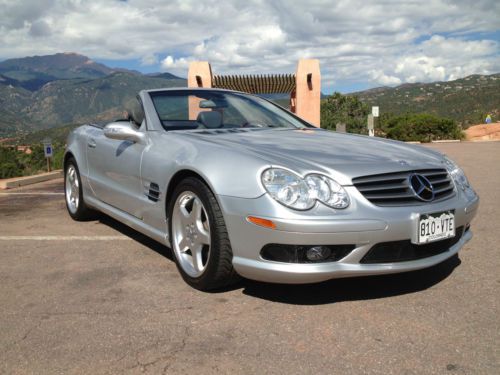

2003 mercedes-benz sl500 convertible 2-door, low miles, sport & comfort packages

2003 mercedes-benz sl500 convertible 2-door, low miles, sport & comfort packages 1978 mercedes 280sl roadster 2.8l efi 4 speed removable hardtop amg body kit

1978 mercedes 280sl roadster 2.8l efi 4 speed removable hardtop amg body kit 2003 mercedes sl55 amg roadster pano roof navi gps keyless go bose

2003 mercedes sl55 amg roadster pano roof navi gps keyless go bose 1998 mercedes sl 500 5.0l v8 convertible with hard top leather auto 80pics(US $11,495.00)

1998 mercedes sl 500 5.0l v8 convertible with hard top leather auto 80pics(US $11,495.00) 1973 mercedes benz 450slc for parts or restoration(US $1,400.00)

1973 mercedes benz 450slc for parts or restoration(US $1,400.00) 2011 mercedes-benz sl550 roadster p1 nav 19" wheels 19k texas direct auto(US $64,980.00)

2011 mercedes-benz sl550 roadster p1 nav 19" wheels 19k texas direct auto(US $64,980.00)

Auto Services in Virginia

Wiygul Automotive Clinic ★★★★★

Valle Auto Service ★★★★★

Trusted Auto Care ★★★★★

Stanton`s Towing ★★★★★

Southside Collision ★★★★★

Silas Suds Mobile Detailing ★★★★★

Auto blog

Continental Automotive recalls 5 million airbag control units

Thu, Feb 4 2016Takata isn't the only supplier having airbag problems. Rival manufacturer Continental Automotive Systems announced a recall of 5 million airbag control units fitted to vehicles from Honda, Fiat Chrysler Automotive, Mercedes-Benz, and even a certain Chrysler-based Volkswagen. This sweeping recall has actually been in progress for some time, although the exact scope is only now becoming evident. In October of 2015, Mercedes-Benz recalled 2008 and 2009 model year C- and GLK-Class vehicles because their Continental-made airbag control units could corrode. Such a condition could cause the airbags to deploy without cause or warning, or in the event of a crash, not deploy at all. You can read all about it in our post from last year. Now, Continental's recall is going wide. Alongside the already recalled C and GLK, you've already heard about the 2008 and 2009 Honda Accord airbag recall, which we reported on yesterday. Now, Fiat Chrysler is announcing the recall of the 2009 Dodge Journey, as well as the 2008 and 2009 Dodge Grand Caravan, Chrysler Town and Country, and their rebadged counterpart, the Volkswagen Routan. Yes, one manufacturer is recalling another manufacturer's vehicle. The models listed above only amount to about 580,000 vehicles out of 5 million bad airbag control units. And since Continental will notify manufacturers who will then issue their own recalls, it's extremely likely that more brands and vehicles will be ensnared. Stay tuned. Related Video: News Source: NHTSA via Automotive News - sub. req.Image Credit: Fabian Bimmer / Reuters Recalls Chrysler Dodge Fiat Honda Mercedes-Benz Safety Crossover Minivan/Van Sedan FCA

NHTSA, IIHS, and 20 automakers to make auto braking standard by 2022

Thu, Mar 17 2016The National Highway Traffic Safety Administration, the Insurance Institute for Highway Safety and virtually every automaker in the US domestic market have announced a pact to make automatic emergency braking standard by 2022. Here's the full rundown of companies involved: BMW, Fiat Chrysler Automobiles, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Subaru, Tesla, Toyota, Volkswagen, and Volvo (not to mention the brands that fall under each automaker's respective umbrella). Like we reported yesterday, AEB will be as ubiquitous in the future as traction and stability control are today. But the thing to note here is that this is not a governmental mandate. It's truly an agreement between automakers and the government, a fact that NHTSA claims will lead to widespread adoption three years sooner than a formal rule. That fact in itself should prevent up to 28,000 crashes and 12,000 injuries. The agreement will come into effect in two waves. For the majority of vehicles on the road – those with gross vehicle weights below 8,500 pounds – AEB will need to be standard equipment by September 1, 2022. Vehicles between 8,501 and 10,000 pounds will have an extra three years to offer AEB. "It's an exciting time for vehicle safety. By proactively making emergency braking systems standard equipment on their vehicles, these 20 automakers will help prevent thousands of crashes and save lives," said Secretary of Transportation Anthony Foxx said in an official statement. "It's a win for safety and a win for consumers." Read on for the official press release from NHTSA. Related Video: U.S. DOT and IIHS announce historic commitment of 20 automakers to make automatic emergency braking standard on new vehicles McLEAN, Va. – The U.S. Department of Transportation's National Highway Traffic Safety Administration and the Insurance Institute for Highway Safety announced today a historic commitment by 20 automakers representing more than 99 percent of the U.S. auto market to make automatic emergency braking a standard feature on virtually all new cars no later than NHTSA's 2022 reporting year, which begins Sept 1, 2022. Automakers making the commitment are Audi, BMW, FCA US LLC, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Maserati, Mazda, Mercedes-Benz, Mitsubishi Motors, Nissan, Porsche, Subaru, Tesla Motors Inc., Toyota, Volkswagen and Volvo Car USA.

Gordon Murray, F1-driven production and .. the Pontiac Fiero

Tue, Oct 31 2017Gordon Murray's design and engineering chops are unquestionable. But does his carmaking approach owe something to the short-lived Pontiac Fiero, a scrappy little car program that emerged from GM against serious resistance? Murray had a Formula One career that ran from 1969 to 1991, with stints at Brabham ('69 to '86) and McLaren ('87-'91), that resulted in several shelves' worth of trophies for the cars he was instrumental in designing. He moved on to McLaren Cars, the consumer side of things, where, during his tenure from 1991 to 2004, he helped design the McLaren F1 and the Mercedes-Benz SLR McLaren, two cars that took learnings from his two decades in Formula One. What do all of these cars have in common? Three things: They are light. They were built in limited numbers. And they were (and are) exceedingly expensive—when the McLaren F1 debuted in 1994, it stickered at $815,000. Murray went on to establish Gordon Murray Design in 2007. GMD has created some interesting concept vehicles, such as the diminutive T.25 city car (94.5 inches long, 51.1 inches wide and 55.1 inches high), and the OX, a lightweight truck for the developing world that packs like an IKEA shelf and is working toward realization through a worthy crowdfunding campaign established by the Global Vehicle Trust. Now he has created a vehicle manufacturing company, Gordon Murray Automotive, that will use manufacturing methods that he developed under the moniker "iStream." Unlike a unibody, there are the "iFrame," a cage-like construction made with metallic components, and the "iPanels," which are composite. The panels aren't simply a decorative skin; they actually provide structure to the vehicle. Presumably this has something of the F1 monocoque about it. Going back to the three elements, (1) this arrangement results in a vehicle that can be comparatively light; (2) Murray has indicated that his manufacturing company will be doing limited-run production; and (3) to launch Gordon Murray Automotive they are going to be building a flagship model, about which Murray said, "With our first new car, we will demonstrate a return to the design and engineering principles that have made the McLaren F1 such an icon." Which seems to imply that it will be on the pricey side. According to the company's verbiage, "iStream forges an entirely new production method that defies conventionality with its Formula One-derived construction and materials technologies." It also sounds a whole lot like ...