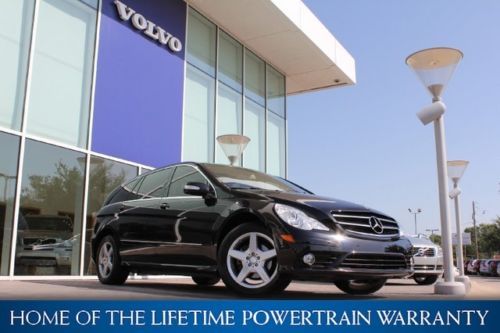

2009 Mercedes-benz R350 4matic Wagon 4-door 3.5l on 2040-cars

North Salt Lake, Utah, United States

|

||||||||||||||||||

Mercedes-Benz R-Class for Sale

06 r350 awd 1-owner only 68k miles great condition clean carfax silver/black(US $14,950.00)

06 r350 awd 1-owner only 68k miles great condition clean carfax silver/black(US $14,950.00) 2007 r500 4matic used 5l v8 24v automatic 4matic suv premium

2007 r500 4matic used 5l v8 24v automatic 4matic suv premium 2006 mercedes-benz r-class r500 4matic v8 premium repairable rebuilder easy fix!(US $9,995.00)

2006 mercedes-benz r-class r500 4matic v8 premium repairable rebuilder easy fix!(US $9,995.00) 2010 mercedes-benz p2/nav/rear cam/4matic

2010 mercedes-benz p2/nav/rear cam/4matic Must be the best around only 16k miles rear entertainment navigation like new(US $38,800.00)

Must be the best around only 16k miles rear entertainment navigation like new(US $38,800.00) 2008 mercedes-benz r350v4 4d mvp

2008 mercedes-benz r350v4 4d mvp

Auto Services in Utah

Tunex ★★★★★

The Tire Pro`s Tire Factory ★★★★★

The Mechanic Man ★★★★★

Strong Audi ★★★★★

Rocky Mountain Collision Rpr ★★★★★

Richin`s Car Service ★★★★★

Auto blog

Recharge Wrap-up: Toyota FCV Rally Car To Compete, Barra bullish on Chevy Volt

Fri, Oct 31 2014The Toyota FCV will compete in the last stage of the 2014 Japanese Rally Championship. The sport-tuned hydrogen-powered car will tackle the 177-mile Shinshiro Rally on November 1 and 2, emitting no greenhouse gases in the process. The rally course will help prove the safety of the vehicle before it goes on sale in Japan in the next several months. The Toyota FCV, rumored to be called "Mirai" in Japan, will begin sales there before April, according to Toyota, and in the summer in the US and Europe. Read more in the press release below. Carsharing is becoming more popular, and more visible, throughout the world, including the US. According to WardsAuto columnist John McElroy, 18 percent of US drivers have used some sort of carsharing service. Additionally, he says 60 percent of Americans are familiar with Zipcar and Uber. Mercedes' Harald Kroeger says promotions like free parking for carshares in Stuttgart are encouraging growth for Daimler's carsharing service, Car2go. Read more at WardsAuto. Ethanol is being help up by rail transport, according to ethanol producer Green Plains. More and more stations are carrying E15 blend gasoline, but grain producers have complained that crude oil is given higher priority by the rail lines shipping it, which rail companies deny. Union Pacific and BNSF Railway say they are stepping up service to make sure that ethanol can be shipped reliably to customers. Read more at Omaha World-Herald. General Motors "has placed a significant bet [on] the electrification of the automobile," says CEO Mary Barra. In a speech to the Detroit Economic Club this week, she spoke about the Chevrolet Volt, and its importance to GM's future. While Barra admits the Volt's success has been "not everything we wanted," it has provided experience, and shows that EVs have "an important role in the future of GM." The new Volt is more refined, stores more energy, has longer range, uses less fuel and is a big investment for Michigan. She announced that the new Volt's electric drive system will be built in Warren, and that all of its major components will be made in Michigan. "Silicon Valley doesn't have a corner on the market for innovation, creativity and drive," says Barra. "These qualities exist here – in this region – as well." See the speech's highlight video and read more in the transcript below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

L.A. Auto Show: Genesis X Convertible, Toyota Prius and more | Autoblog Podcast #756

Fri, Nov 18 2022In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. The Los Angeles Auto Show wrapped up this week, and we talk about some of the highlights from the show, and the events surrounding it, like the new Toyota Prius, Genesis X Convertible concept, new Lucid Air trims and the Lucid Gravity SUV. John talks about traveling to Sweden for the reveal of the Volvo EX90. They also talk about the cars they've been driving, including the Nissan Leaf, Nissan Kicks, Mercedes EQB and Jeep Wagoneer. They also shoot the breeze about late fall beer, courtesy of an email from a listener. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #756 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown 2022 L.A. Auto Show 2023 Toyota Prius Genesis X Convertible concept Lucid Air Pure and Touring Lucid Gravity SUV Volvo EX90 Cars we're driving Nissan Leaf Nissan Kicks Mercedes-Benz EQB 300 Jeep Wagoneer Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

Mercedes Pullman limo, C-Class Hybrid coming to Geneva

Sun, Feb 15 2015Mercedes-Benz is preparing to show the pinnacles of its engineering and luxury prowess at the 2015 Geneva Motor Show in March. Towering in physical size among these new vehicles is the long-awaited debut of the S-Class Pullman, according to Reuters. If you think the nearly $200,000 Mercedes-Maybach S600 (pictured above) is the ultimate in opulence available on Mercedes' flagship sedan, think again. The Pullman is the true top dog at a rumored 21-feet long and at a price of around $1 million for the armored version. Earlier patent photos suggest what this behemoth might look like. The driver reportedly sits in a partitioned cabin up front, and the plutocratic passengers are nestled in two facing rows of seats in the rest of the extremely long body. It's possible that Mercedes might not even build the Pullman in-house and leave the duty up to Brabus. However, there's also a rumor that the massive model might not be offered in the US. According to Reuters, the German company is also proving that it can be green by displaying the C-Class Plug-in Hybrid in Geneva. If Mercedes' display of luxury and efficiency don't strike your fancy, then the automaker is bringing some performance with its future Mercedes-AMG GT GT3 racer to the Swiss show.