Cls63 Amg Turbocharge V8 5.5l One Owner*low Miles*clean Carfax on 2040-cars

New Iberia, Louisiana, United States

|

Original owner. Will have car shipped to any buyer in the US. Will require deposit to secure car purchase.

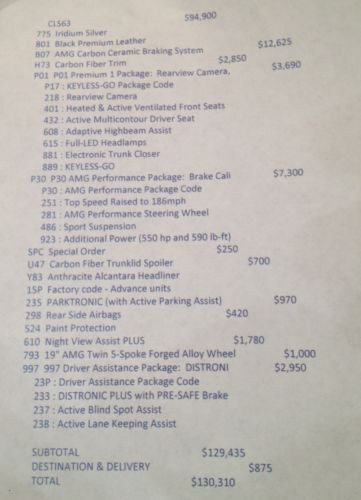

Beside options listed, car comes loaded from factory 0-60 in under 4 seconds 550 hp/590 lb-ft torque 186 top speed 16/21 mpg EPA city/hwy driving 7 speed 19'' AMG Twin 5-spoke Forged Alloy Wheels |

Mercedes-Benz CLS-Class for Sale

2013 mercedes-benz cls-class cls550(US $65,000.00)

2013 mercedes-benz cls-class cls550(US $65,000.00) 4dr coupe cls550 rwd 4.6l bi-turbo premium lane tracking parktronic nav leather

4dr coupe cls550 rwd 4.6l bi-turbo premium lane tracking parktronic nav leather

Cls63 amg, only 53k miles, 507hp, hk audio, navi, keyless go, black on black 63(US $38,973.00)

Cls63 amg, only 53k miles, 507hp, hk audio, navi, keyless go, black on black 63(US $38,973.00) Mercedes cls 63 amg white, tan interior, like new, amg series , sports car(US $88,000.00)

Mercedes cls 63 amg white, tan interior, like new, amg series , sports car(US $88,000.00) 2012 cls550 5k navigation rear camera heated & cooled seats carfax finance 56749

2012 cls550 5k navigation rear camera heated & cooled seats carfax finance 56749

Auto Services in Louisiana

TOS Of Slidell ★★★★★

Select Autosport ★★★★★

Rodolfo`s Auto Sales ★★★★★

Rock & Roll Wrecker Service ★★★★★

Riverside Used Auto Parts ★★★★★

Riverside Used Auto Parts ★★★★★

Auto blog

Mercedes-Benz G500 4x4 squares up for production

Mon, Jun 22 2015After showcasing the G500 4x42 in concept form at the Geneva Motor Show this past March, Mercedes has confirmed that it's putting the monster truck into production. The Mercedes G500 4x42 is a more extreme take on the legendary Gelandewagen. It ditches the extra set of wheels from the earlier G63 AMG 6x6, but keeps its wider track and jacked-up suspension, complete with portal axles, 22-inch wheels, 325/55-section tires, and a good foot and a half of ground clearance. It also loses the AMG-spec engine in favor of a 4.0-liter twin-turbo V8 with 422 horsepower, based on the unit in the C63 and AMG GT. The smaller engine (and smaller axle-count) makes its list price a little easier to swallow than the half-million Benz commanded for the 6x6, but it'll still be a rather large pill. Pricing in Germany is listed at ˆ226,100 – equivalent to over $250k at current exchange rates. That makes it the second most expensive version of the G-Class currently available, behind the G65 that retails for ˆ271,915 (~$309k) in Germany and $217,900 in the US. MBUSA tells Autoblog that there are currently no plans for bringing the G500 4x42 to North America. But if it were to ford the Atlantic, it would likely carry a price tag in the neighborhood of $200k for the privilege of riding higher than just about any other commercially available passenger vehicle on the road. Alle Neuheiten der legendaren G-Klasse ab sofort bestellbar: Der Mercedes-Benz G 500 4x42 geht in Serie Stuttgart, Jun 19, 2015 Stuttgart - Outstanding response to the "Extreme-G": the G 500 4x42 show car proved hugely popular with many customers and is set to enter series production. In the superlative-studded history of the G-Class, the G 500 4x42 is the new highlight in the model range. The technical package consists of the all-wheel drive powertrain including portal axles and the new 4-litre V8 engine with twin turbocharging and an output of 310 kW (422 hp). All the other G-Class models have further improved interiors and powertrains, and meet the highest emissions standard Euro 6. The G 350 d, G 500, AMG G 63, AMG G 65 and G 500 4x42 can be ordered with immediate effect. A new addition to the extreme G-Class model family: the AMG G 63 6x6 is gaining a sibling in the form of the G 500 4x42.

Mercedes A-Class next up for facelift

Sun, Jan 11 2015This is the coming Mercedes-Benz A-Class, and in case the paucity of camouflage didn't make it clear, it won't look much different the one that's been on sale for all of two years. Caught in Sweden braving the temperatures, its exterior updates aren't expected to go much further than a reworked face that brings it in line with the recently updated B-Class, including a new grille, headlights and taillights, and bumpers. The cabin is where most of the work is being done, to give it a better punch against the BMW 1 Series. A tweaked dash cluster, better fabrics and materials, the eight-inch tablet-style nav/multimedia screen, and ambient lighting should join the party. The updated range of B-Class engines should also make the jump into the A. A photo caught at a dealer meeting in Barcelona last year makes us pretty sure it will be introduced at the Frankfurt Motor Show in September this year. Until then, there are spy shots to peruse.

Autoblog Podcast #410

Tue, Dec 16 2014Episode #410 of the Autoblog Podcast is here, and this week, Dan Roth, Chris Paukert, and Greg Migliore talk about the Mercedes-Benz GLE, the next generation Audi Q7, and Ford's promise of 12 new performance models by 2020. We start with what's in the garage and finish up with some of your questions, and for those of you who hung with us live on our UStream channel, thanks for taking the time. Check out the rundown with times for topics, and you can follow along down below with our Q&A. Thanks for listening! Autoblog Podcast #410: The video meant to be presented here is no longer available. Sorry for the inconvenience. Topics: Mercedes-Benz GLE 2016 Audi Q7 New Performance Ford/End of MyFordTouch In The Autoblog Garage: 2015 Toyota Camry XLS 2015 Ford F-150 2015 Volkswagen GTI Hosts: Dan Roth, Chris Paukert, Greg Migliore Runtime: 01:28:00 Rundown: Intro and Garage - 00:00 Tacoma - 24:17 Barn Find - 38:27 DB10 - 49:23 Q&A - 01:00:00 Get the podcast: [UStream] Listen live on Mondays at 10 PM Eastern at UStream [iTunes] Subscribe to the Autoblog Podcast in iTunes [RSS] Add the Autoblog Podcast feed to your RSS aggregator [MP3] Download the MP3 directly Feedback: Email: Podcast at Autoblog dot com Review the show in iTunes Podcasts Detroit Auto Show Audi Ford Mercedes-Benz ford performance