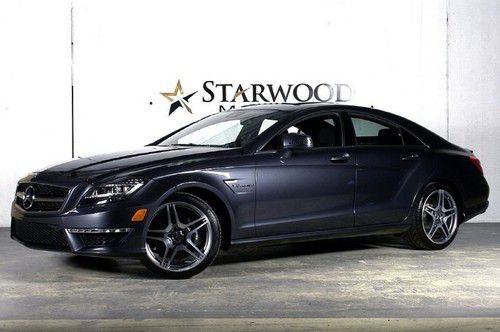

2008 Mercedes-benz Cls550 P1 Sunroof Nav Only 42k Miles Texas Direct Auto on 2040-cars

Stafford, Texas, United States

Vehicle Title:Clear

Engine:5.5L 5461CC V8 GAS DOHC Naturally Aspirated

Fuel Type:GAS

For Sale By:Dealer

Transmission:Automatic

Make: Mercedes-Benz

Warranty: Vehicle has an existing warranty

Model: CLS550

Trim: Base Sedan 4-Door

Options: Sunroof, CD Player

Safety Features: Anti-Lock Brakes, Driver Airbag, Side Airbag, Passenger Airbag

Drive Type: RWD

Power Options: Power Seats, Power Windows, Power Locks, Cruise Control

Mileage: 42,508

Sub Model: VENT LEATHER

Exterior Color: Black

Number Of Doors: 4

Interior Color: Black

CALL NOW: 281-410-6100

Number of Cylinders: 8

Inspection: Vehicle has been inspected

Seller Rating: 5 STAR *****

Mercedes-Benz CLS-Class for Sale

Barolo red**cashmere beige**1 owner san diego car(US $29,900.00)

Barolo red**cashmere beige**1 owner san diego car(US $29,900.00) 2006 mercedes-benz cls500 with amg sport package(US $20,950.00)

2006 mercedes-benz cls500 with amg sport package(US $20,950.00) P2 pack keyless go navi amg chrome whls loaded like cls500 cls55 cls63 06 07 09(US $24,950.00)

P2 pack keyless go navi amg chrome whls loaded like cls500 cls55 cls63 06 07 09(US $24,950.00) 2012 mercedes-benz cls-class cls63 amg we finance(US $94,888.00)

2012 mercedes-benz cls-class cls63 amg we finance(US $94,888.00)

Auto Services in Texas

Your Mechanic ★★★★★

Yale Auto ★★★★★

Wyatt`s Discount Muffler & Brake ★★★★★

Wright Auto Glass ★★★★★

Wise Alignments ★★★★★

Wilkerson`s Automotive & Front End Service ★★★★★

Auto blog

Man makes record-setting drive across the US in 28 hours, 50 minutes

Fri, 01 Nov 2013Records, as the say, are made to be broken. Whether that's cramming the most hot dogs down your gullet, running a faster mile, or yes, driving across the United States, odds are that there's someone out there wants to eat more, run faster or drive harder. Speaking of that last example, the record for driving from a set location on the east coast, in particular the Red Ball Garage in Manhattan to the Portofino Hotel in Redondo Beach, CA, has been one that has fascinated gearheads since a guy named Cannonball Baker made the trek from New York to LA in 53 hours, 30 minutes, in 1933.

The competition saw its glory days when Car and Driver's Brock Yates came up with the Cannonball Baker Sea-To-Shining Sea Memorial Trophy Dash (more affectionately known as the Cannonball Run), although the record was most recently set by Alex Roy and his 32-hour, seven-minute trek behind the wheel of a BMW M5 in 2006. Now, there's a new champion, who made the trip from east to west in a scarcely imaginable 28 hours and 50 minutes, behind the wheel of a 2004 Mercedes-Benz CL55 AMG. That's works out to an average speed of 98 miles per hour over the course of 2,813.7 miles.

His name is Ed Bolian, and Jalopnik has a writeup of the epic voyage that details everything from the history of the Cannonball Run to Bolian's preparation and trouble finding co-drivers, to the trip itself. It is well worth a read.

Mercedes-Maybach spied inside and out sporting the huge S-Class screen

Wed, Apr 22 2020A new Mercedes-Benz S-Class is well on its way, and that means a new Mercedes-Maybach is following right behind it. We were introduced to the new Mercedes-Maybach strategy over five years ago. At the end of 2019, Mercedes added to the small collection with the GLS 600, bringing an SUV into the Maybach fold. These spy shots mark our first good look inside and outside the next-gen Mercedes-Maybach sedan. We’ll point out the massive screen first. Photos of this huge slab of screen have largely shown it turned off. Now, we get a solid look at the display all lit up and running MercedesÂ’ next iteration of MBUX. The icons and UX look a whole lot like MercedesÂ’ current infotainment system design, just blown up to a much larger size. Mercedes is surely going to hit us with some new out-there features we didnÂ’t know we wanted and may not even use, but thatÂ’s the way it goes with excessive luxury. The gauge cluster is pretty standard for new Mercedes with a flat digital screen. An “EQ” emblem displayed in the cluster also indicates that Mercedes plans to implement its EQ Boost mild-hybrid tech with the turbocharged engine(s) offered in this new generation. The current car comes in S560 (V8) and S600 (V12) variations. We don't know what MercedesÂ’ powertrain plans are for the time being, but the GLS 600 uses 48-volt technology with its 4.0-liter twin-turbo V8 and makes 550 horsepower and 538 pound-feet of torque. Ideally, the smooth and silky V12 sticks around in the top-shelf S-Class as well. As for the design, itÂ’s exactly what one might expect from a Mercedes-Maybach. The wheelbase is stretched compared to the regular S-Class weÂ’ve spied before, and it has the signature slatted grille. Pop-out door handles appear to be carried over from the new S-Class, too. We expect the new S-Class isnÂ’t far from a reveal. ThereÂ’s a chance it still breaks cover this year, even as most automakers face delays from the coronavirus. Once itÂ’s out, the Mercedes-Maybach is likely to follow soon after. Related video:

Mercedes' CEO says Google should study car use, not car building

Sat, Feb 14 2015Google is rapidly throwing its massive weight into many facets of the auto business. Not only does the search behemoth want to take on Uber, offer car insurance quotes and run a specific version of Android on future infotainment systems, but the company is also at least toying with the idea of constructing its own completely autonomous vehicles. Such a powerful corporation entering the industry could frighten some automakers, but Daimler boss Dieter Zetsche isn't worried. The mustachioed executive doesn't believe that Google actually means to become an automaker but is instead just studying how people use cars. "Google and the likes want to get involved, I don't think in the first place to build vehicles," he told analysts, according to Reuters. Zetsche sees future collaboration with the technology giant in a quite nuanced way in that there are some things they can be partners on and other places where the two corporations might be competitors. One area where Zetsche potentially predicts an antagonistic relationship with Google regards data privacy, a concern is becoming a hot topic in the auto industry at the moment. Zetsche foresees the future of safety in Mercedes-Benz vehicles as protecting occupants not just physically but also safeguarding their personal information. "To be able to provide that, we have to keep control, and we can't do that when it is collected by Google," Zetsche said to Reuters. News Source: ReutersImage Credit: Gero Breloer / AP Photo Mercedes-Benz Technology Emerging Technologies Infotainment Autonomous Vehicles