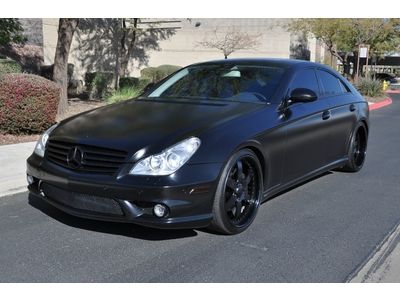

2006 Mercedes Cls500 on 2040-cars

Chicago, Illinois, United States

For Sale By:Dealer

Engine:5.0L 4966CC V8 GAS SOHC Naturally Aspirated

Body Type:Sedan

Transmission:Automatic

Fuel Type:GAS

Cab Type (For Trucks Only): Other

Make: Mercedes-Benz

Warranty: Vehicle has an existing warranty

Model: CLS500

Trim: Base Sedan 4-Door

Disability Equipped: No

Drive Type: RWD

Doors: 4

Mileage: 28,074

Drive Train: Rear Wheel Drive

Sub Model: CLS500

Number of Doors: 4

Exterior Color: Other

Interior Color: Other

Number of Cylinders: 8

Mercedes-Benz CLS-Class for Sale

2006 cls500 5.0 l v8 with premium, lighting, trim packages w heated front seats(US $31,901.00)

2006 cls500 5.0 l v8 with premium, lighting, trim packages w heated front seats(US $31,901.00) We finance!!! 2006 mercedes-benz cls500 auto roof nav air sus wood 6 cd 18 rims(US $28,998.00)

We finance!!! 2006 mercedes-benz cls500 auto roof nav air sus wood 6 cd 18 rims(US $28,998.00) 2012 cls63 amg!! performance pkg!! $127k msrp!! like new-no stories!! diam white(US $104,500.00)

2012 cls63 amg!! performance pkg!! $127k msrp!! like new-no stories!! diam white(US $104,500.00) 2009 mercedes-benz cls550 sedan premium and wood trim packages

2009 mercedes-benz cls550 sedan premium and wood trim packages 2012 mercedes-benz cls550 4matic cls-class

2012 mercedes-benz cls550 4matic cls-class You wont find anything like it, come see for yourself(US $57,750.00)

You wont find anything like it, come see for yourself(US $57,750.00)

Auto Services in Illinois

Webb Chevrolet ★★★★★

Wally`s Collision Center ★★★★★

Twin City Upholstery Ltd. ★★★★★

Tuffy Auto Service Centers ★★★★★

Towing St. Louis ★★★★★

Suburban Wheel Cover Co ★★★★★

Auto blog

Daimler rebuffs Geely offer to buy stake

Wed, Nov 29 2017HONG KONG/BEIJING - Daimler AG has turned down an offer from China's Geely to take a stake of up to 5 percent via a discounted share placement, as the German automaker has long been reluctant to see existing shareholdings diluted, sources with knowledge of the talks said. A stake of that size would be worth $4.5 billion at current market prices. Although Daimler declined the offer, it told Geely it was welcome to buy shares in the open market, the sources added. Carmakers in China have embarked on a flurry of dealmaking, as they scramble to boost production of electric and plug-in hybrid vehicles ahead of tough new quotas to be imposed by Beijing, which wants to reduce urban smog and lower the country's reliance on oil. People with knowledge of Geely's thinking said the company was keen to access Daimler's electric car battery technology and wanted to establish an electric car joint venture in Wuhan, the capital of Hubei province. Geely, which also owns Swedish car maker Volvo, is still hopeful it can secure a deal in some form over the coming weeks, they added. The two automakers met in Beijing in recent weeks at Geely's behest. There, the Chinese firm, formally known as Zhejiang Geely Holding Group, offered to take a stake of between 3 percent and 5 percent if Daimler would issue new shares at a discount, the sources said. It was not immediately clear what kind of discount for the shares Geely had in mind or whether Geely was interested in buying the shares on the open market. A spokesman for Geely declined to comment. A spokesman for Daimler said the company was "very happy with our shareholder structure at present", but added that it would welcome new investors with a long-term interest in the company. Shares in Daimler were up 1 percent in early Wednesday trade, in line with the broader market.DAIMLER ALREADY TIED TO BAIC, BYD Geely, which has a market value of some $32 billion, is the leading domestic brand in China with a 5 percent market share, according to an analysis by Nomura Securities. A stake of 5 percent would establish it as Daimler's third-largest shareholder behind the Kuwait Investment Authority and BlackRock, who hold 6.8 percent and 6 percent respectively, according to Reuters data.

2016 Mercedes-Maybach S600 First Drive

Mon, Jan 19 2015Imagine the audacity: during the salad days of the early 2000s, the company that invented the automobile – already synonymous with class-leading luxury – sought to further expand its portfolio by crashing the ultraluxury party. Going up against the likes of Rolls-Royce and Bentley, Mercedes-Benz traded its unmistakable Three-Pointed Star for a Mighty Mouse-like logo, exhuming a stately, long-dead German marque originally founded in 1909. The long-wheelbase Maybach 62 listed at an epic $360,000, while later spinoffs included curiosities like the nearly $700,000 Zeppelin, and a roofless, seven-figure limousine dubbed Laundaulet. By the time the financial bubble finally burst in 2008, the brand's fate was all but sealed, with US sales dropping into the double digits. It limped along another four years, but when the nameplate finally went kerplunk, it left behind it a trail of disappointed movers, shakers, moguls and rappers. The perfect postmodern metaphor for the brand's funeral pyre? Kanye West and Jay-Z's Otis music video, in which a perfectly fine Maybach is chopped and deconstructed, flames spewing out the tailpipes as it powerslides through an empty parking lot. Meet The (Sorta) New Boss Rising from the ashes of hubris is the 2016 Mercedes-Maybach S600, a recalibrated stab at high-end luxury with a startlingly similar, yet different, approach to its forbear. Like the last go, the new sled features a significantly longer wheelbase, which stretches 8.1 inches over the standard S600. Additional sound damping helps it claim the quietest rear cabin in all of production automobiledom, and posher trim bits include a rim of wood surrounding the reclining rear seats. Among the livery-focused special features is a rearview mirror-mounted microphone to amplify the driver's voice, an available rear fridge, and an executive seat package with folding tray tables. The super high-end hallmarks are there – a twin-turbo V12 dispatching sub-5 second 0 to 60 times, a stunning 24 speaker Burmester sound system, double-M branded silver plate champagne flutes, et al. – but the hyperinflated price tag is not. Starting at $189,350, roughly half the cost of the old flagship, the new Maybach isn't even the most expensive Mercedes-Benz you can buy. That distinction goes to the S65 AMG Coupe, which empties your coffers to the tune of $230,900.

Mercedes and VW battling Uber and Apple to spend billions on Nokia mapping division

Tue, May 12 2015Whether for autonomous driving or simply better navigation, digital mapping is closely linked with the future of motoring. The sale of a major player in that industry is spurring a showdown between automotive behemoths and tech giants, and it's a fascinating battle to watch unfold. Nokia is selling its Here mapping division, and while the company might not have the name recognition of Google, it controls about 70 percent of the auto market. The business is valued at $785 million, according to Reuters, but is likely to sell for significantly more. Case in point: Uber reportedly submitted a $3 billion bid. Apple has also been rumored to be among those interested in purchasing Here. A trio of German automotive heavyweights is mounting a challenge to Silicon Valley, though. According to Reuters speaking to two unnamed insiders, Daimler, BMW, and Audi are teaming up to submit a joint bid for an undisclosed sum. They're worried that if Here falls under the control of tech companies, then automakers might have limited availability to these vital maps in the future. Nokia bought Here for $8.1 billion in 2007, according to Reuters. The company operates a fleet of vehicles with cameras and LIDAR that drive around the world to create high-definition maps. It also generates even more information by using the GPS data from shipping and trucking companies.