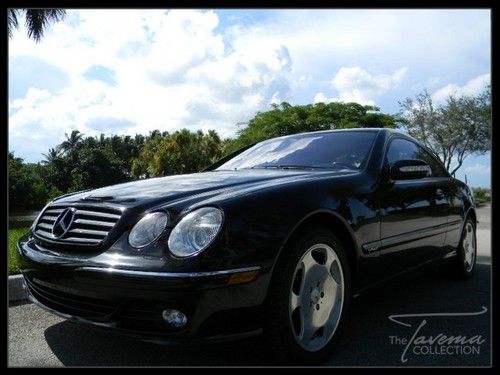

Cl63 Amg, Cert 100k Warranty, 20" Wheels, Driver Asst, P2 Pkg, Clean 1 Owner!!! on 2040-cars

Houston, Texas, United States

Transmission:Automatic

Body Type:Coupe

Vehicle Title:Clear

Fuel Type:GAS

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Seats, Power Windows

Make: Mercedes-Benz

Vehicle Inspection: Vehicle has been Inspected

Model: CL63 AMG

CapType: <NONE>

Trim: Base Coupe 2-Door

FuelType: Gasoline

Listing Type: Certified Pre-Owned

Drive Type: RWD

Certification: Manufacturer

Mileage: 8,092

Sub Model: CL63 AMG

BodyType: Coupe

Exterior Color: Black

Cylinders: Unspecified

Interior Color: Black

DriveTrain: REAR WHEEL DRIVE

Number of Doors: 2

Warranty: Warranty

Number of Cylinders: 8

Options: CD Player, Sunroof

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mercedes-Benz CL-Class for Sale

2008 mercedes-benz cl600

2008 mercedes-benz cl600 08 cl550 sport 19s premium ipod keyless go ac seats 37k miles clean one owner(US $44,995.00)

08 cl550 sport 19s premium ipod keyless go ac seats 37k miles clean one owner(US $44,995.00) Florida 02 cl 500 winter pkg navigation park assist clean carfax no reserve !!

Florida 02 cl 500 winter pkg navigation park assist clean carfax no reserve !! 10 mercedes cl550 sport 4matic awd 13k 1-own p2 distronic hk nav pdc nightvision(US $59,995.00)

10 mercedes cl550 sport 4matic awd 13k 1-own p2 distronic hk nav pdc nightvision(US $59,995.00) 05 cl600 v12 keyless go, navigation, no accidents, power trunk xenon fl(US $17,500.00)

05 cl600 v12 keyless go, navigation, no accidents, power trunk xenon fl(US $17,500.00) 1997 mercedes-benz cl600, 19" amg wheels, lorinser exhaust, dealer maintained(US $10,900.00)

1997 mercedes-benz cl600, 19" amg wheels, lorinser exhaust, dealer maintained(US $10,900.00)

Auto Services in Texas

Yang`s Auto Repair ★★★★★

Wilson Mobile Mechanic Service ★★★★★

Wichita Falls Ford ★★★★★

WHO BUYS JUNK CARS IN TEXOMALAND ★★★★★

Wash Me Down Mobile Detailing ★★★★★

Vara Chevrolet ★★★★★

Auto blog

Recharge Wrap-up: Tesla firmware update videos, Mercedes S500 Plug-In Hybrid

Tue, Sep 16 2014See the Tesla Model S with Firmware 6.0 in action in new videos from Teslarati. The large software update includes improved traffic-based navigation, a calendar function, updated power management, "Location-Based Smart Air Suspension" as well as other improvements. Drivers get more route options to save energy, and more control over how the car saves energy. The car can also remember ride height settings when driving in those same locations again. Additionally, you can start and drive the car without a key, just using the smartphone app. See how it all works in the videos below, the second of which focuses on pairing with the updated phone app. The California Public Utilities Commission (CPUC) has deemed ride-hailing app Uber's carpooling service illegal. The way the UberPool service is categorized by the CPUC, charging multiple riders separate fares for a single ride runs afoul of the law. The technical details are a bit convoluted, and what supporters could deem arbitrary, but Forbes delves into the details a bit further to try to make sense of California's intentions (even considering the possibility of other ride services, such as airport shuttle companies, fueling the fire). Lyft - which operates a similar service called LyftLine - and Sidecar have also received notices from the CPUC. Read more at Forbes. China's recent enthusiasm for electric vehicles could be largely attributed to a single person, Ma Kai. After the Politburo member was named vice premier, he encouraged maintaining and increasing EV subsidies when China sought to decrease them. He also seems ready to fight for more EV deregulation to encourage more clean vehicles. Read more about Ma Kai and what he's done for China's EV legislation at Automotive News. Mercedes-Benz begins deliveries of the S500 Plug-In Hybrid this month. The high-tech luxury PHEV features energy saving modes based on driver, route and traffic, and features a haptic accelerator that can signal when the driver should ease off to save power. It's powered by a biturbocharged V6 and 85-kW electric motor. Its 8.7-kWh battery offers about 20 miles of electric driving. The S500 plug-in starts at about $146,000. Read more in the press release below. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings. This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

2016 Mercedes-Benz C450 AMG Sport bridges the gap between C300 and C63

Mon, Jan 12 2015Mercedes-Benz is looking to its new C-Class for the second member of its new AMG Sport line, unveiling the C450 AMG 4Matic at today's 2015 Detroit Auto Show. Like the GLE450 AMG Coupe that debuted in early December, this particular C-Class bridges the gap between the standard C300 and the new Mercedes-AMG C63. Considering this, the C450 builds on the standard C400's 3.0-liter, twin-turbocharged V6, rather than getting a bespoke, high-performance engine. Output is up from 329 horsepower to 362 ponies, while torque is turned up from 354 pound-feet to 384 lb-ft. The result of these upgrades is a zippy 0-60-mile-per-hour sprint of 4.9 seconds and an electronically limited top speed of 155 mph. Those figures are identical to the Audi S4, while the BMW 335i xDrive is just a smidge quicker to 60, getting there in 4.8 seconds (the Bimmer is, however, limited to just 130 mph). Shuffling the 3.0-liter's grunt to a 4Matic all-wheel-drive system is the responsibility of Mercedes 7G-Tronic automatic gearbox that, despite not being a member of AMG's Speedshift dual-clutch family, still has its own mind for performance. Along with a quick-shifting, automatic Sport Plus mode, the C450 has a full manual shifting mode that, notably, will not automatically upshift, even when the engine is bouncing off the rev limiter. The C450 AMG hasn't only had its straight-line abilities boosted. Mercedes saw fit to include an AMG adaptive sport suspension with three-stage adjustable dampers, which have been pilfered from the C63 AMG. Paired with the aforementioned all-wheel-drive system, which can send up to two-thirds of its power to the rear axle, it's a fair to say this particular sedan should be one of the brand's more agile and entertaining. Beyond the mechanical bits, Mercedes has beefed up the exterior and interior aesthetics for its second AMG Sport model. The exterior has been touched up with new, staggered 18-inch, five-spoke wheels (or optional 19s), a more aggressive front fascia, a new rear bumper with a matte iridium diffuser, distinctive AMG badges and plenty of chrome and gloss-black elements. The cabin, meanwhile, is home to black MB Tex upholstery with red contrast stitching on the dash and doors, while AMG-specific upholstery lines the sport seats. The flat-bottomed, three-spokes steering wheel, meanwhile, is finished in Nappa leather. We'll have more on the 2016 C450 AMG Sport, including live images, coming soon from the floor of the 2015 Detroit Auto Show.

Kimi Raikkonen fastest in first Belgian Grand Prix practice

Fri, Aug 25 2017SPA-FRANCORCHAMPS, Belgium — Ferrari's Kimi Raikkonen lapped fastest in first practice for the Belgian Grand Prix on Friday but Mercedes, and title contender Lewis Hamilton, still looked every bit the team to beat. A four-time winner at Spa, and with a contract extension for 2018 announced earlier in the week, Raikkonen lapped the longest track on the calendar with a best time of 1 minute 45.502 seconds. The 37-year-old Finn's time was set on the quickest ultra-soft tires, however, while Hamilton — preparing for his 200th race start — was second-fastest and only 0.053 slower on the soft compound. Hamilton was 0.092 faster than Ferrari's world championship leader Sebastian Vettel, with the German third on the timesheets and also setting his time on the quickest but least durable tire. Vettel leads Hamilton by 14 points with nine races remaining. Red Bull's Dutch teenager Max Verstappen, Belgian-born and attracting a huge traveling support of orange-capped fans, was fourth fastest with Australian team mate Daniel Ricciardo fifth. Hamilton's teammate Valtteri Bottas, who bumped into the tire barrier after going off across the gravel and damaged his front wing, was sixth fastest. The session was halted after 15 minutes when Brazilian Felipe Massa, who missed the previous race in Hungary after feeling dizzy in practice, crashed heavily into the tire barrier at turn seven out of Les Combes. He was taken to the medical center for checks, before returning to the pitlane, with his team facing a long job rebuilding the car. The session resumed after a 10 minute stoppage. Williams said the chassis would have to be changed and the team still hoped to get the car back out on track for some of the day's second session, even if that looked like being optimistic. Fernando Alonso suffered a lack of power in his McLaren, but still ended up 13th fastest. Belgian team mate Stoffel Vandoorne, who will start his home race last on Sunday thanks to a 35 place penalty due to a power unit change, was 10th. Reporting by Alan BaldwinRelated Video: Image Credit: Reuters Motorsports Ferrari McLaren Mercedes-Benz F1 Lewis Hamilton Sebastian Vettel Kimi Raikkonen Max Verstappen Valtteri Bottas belgian grand prix