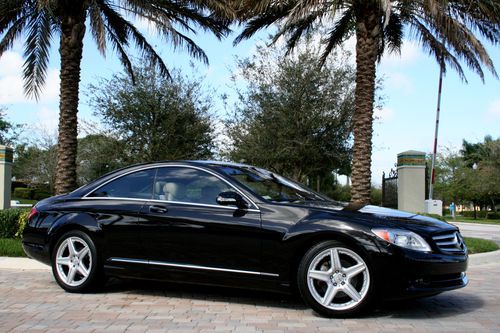

2007 Mercedes Benz Cl600 V12 Fully Loaded Only 17k Miles on 2040-cars

Houston, Texas, United States

For Sale By:Dealer

Engine:5.5L 5513CC 336Cu. In. V12 GAS SOHC Turbocharged

Body Type:Coupe

Transmission:Automatic

Fuel Type:GAS

Warranty: Vehicle does NOT have an existing warranty

Make: Mercedes-Benz

Model: CL600

Trim: Base Coupe 2-Door

Disability Equipped: No

Doors: 2

Drive Type: RWD

Drive Train: Rear Wheel Drive

Mileage: 17,915

Number of Doors: 2

Exterior Color: Silver

Interior Color: Black

Number of Cylinders: 12

Cab Type (For Trucks Only): Other

Mercedes-Benz CL-Class for Sale

2010 mercedes cl65 amg, $211k msrp, v12 bi-turbo, black/blk, 1-owner, pristine!!(US $105,888.00)

2010 mercedes cl65 amg, $211k msrp, v12 bi-turbo, black/blk, 1-owner, pristine!!(US $105,888.00) 2011 mercedes cl63 amg bi-turbo, $157k msrp, black/black, 15k miles, pristine!(US $106,888.00)

2011 mercedes cl63 amg bi-turbo, $157k msrp, black/black, 15k miles, pristine!(US $106,888.00) 2010 mercedes-benz cl550 4matic automatic 2-door coupe(US $69,950.00)

2010 mercedes-benz cl550 4matic automatic 2-door coupe(US $69,950.00) 2009 mercedes cl63 amg~distronic~premium ii pack~park guidance~like 2010(US $63,407.00)

2009 mercedes cl63 amg~distronic~premium ii pack~park guidance~like 2010(US $63,407.00) Amg performance pkg., p2 pkg., k40 radar, night view assist, sunroof(US $56,999.00)

Amg performance pkg., p2 pkg., k40 radar, night view assist, sunroof(US $56,999.00) 2007 mercedes cl550 launch edition*designo mocha black*night vision*ac/htd seats(US $46,900.00)

2007 mercedes cl550 launch edition*designo mocha black*night vision*ac/htd seats(US $46,900.00)

Auto Services in Texas

Z Rated Automotive Sales & Service ★★★★★

Xtreme Tinting & Alarms ★★★★★

Wayne`s World of Cars ★★★★★

Vaughan`s Auto Glass ★★★★★

Vandergriff Honda ★★★★★

Trade Lane Motors ★★★★★

Auto blog

Popular Science magazine's Best Of What's New 2012 all ate up with cars

Tue, 20 Nov 2012Popular Science has named the winners in its Best of What's New awards, the victors coming in the categories of aerospace, automotive, engineering, entertainment, gadgets, green, hardware, health, home, recreation, security and software. The automotive category did not go wanting for lauded advancements:

Tesla Model S: the Grand Award winner for being "the standard by which all future electric vehicles will be measured."

BMW 328i: it's 2.0-liter turbocharged four-cylinder gets called out for being more powerful and frugal than the six-cylinder it replaces.

Next Mercedes-Benz C-Class to get diesel, hybrid versions

Tue, 16 Apr 2013Mercedes-Benz is planning a more aggressive product strategy for its next-generation C-Class range. "We were fighting the 3 Series with two arms tied behind our back, and now we will change that," Steve Cannon, the automaker's US CEO, told Automotive News in a recent interview.

In addition to offering more body styles of the new C-Class, AN reports that the revamped Mercedes will also be offered here with hybrid and diesel powertrains. Currently, the C-Class comes in coupe and sedan variants, with only gasoline engines. The BMW 3 Series, however, is available as a sedan, coupe, convertible and wagon, and offers buyers the choice of gasoline, diesel (the upcoming 328d) or hybrid power.

Mercedes-Benz will show the next-generation C-Class at the 2014 Detroit Auto Show, with sales of the US-built sedan following in August. Coupe, convertible and hybrid models will follow in early 2015, and while diesel and all-wheel-drive versions are planned, no specific timetable has been released regarding availability.

2021 Mercedes-Maybach GLS 600 is business class without the jet lag

Thu, Nov 21 2019Mercedes-AMG demonstrated how sporty a mammoth SUV can be by unveiling the 2021 GLS 63 S at the 2019 Los Angeles Auto Show. Across the Pacific, at the Guangzhou auto show in China, Mercedes-Maybach revealed another GLS variant that puts an unabashed focus on comfort. The 2021 GLS 600 ends years of rumors by finally taking Maybach into the SUV segment. (If you don't count the limited-edition G 650 Landaulet). It's not a standalone model developed from the ground up, and it's in no way related to the electric Vision Mercedes-Maybach Ultimate Luxury concept introduced in 2018. It's a second-generation GLS dressed up in a Hugo Boss suit. Stylists spruced up the front end with Maybach's chromed waterfall grille and mesh inserts in the lower part of the bumper. An abundance of chrome trim (including big slabs of it in on the B-pillars) and Maybach emblems on the D-pillars further set the SUV apart from its non-Maybach-badged sibling. Buyers can order a two-tone paint job at an extra cost. 6.8-foot-long running boards automatically extend from under the body about a second after one of the passengers opens a door. Designers took advantage of the cavernous interior to replace the second- and third-row seats with a pair of business class-like chairs that offer heated, ventilated, massaging and reclining functions. Maybach developed the GLS with chauffeur-driven buyers in mind, so the passengers traveling in the back benefit from their own infotainment system with wireless headphones, folding tablets, wireless device chargers, plus heated and cooled cupholders. Alternatively, buyers can order the GLS as a five-seater with a three-person rear bench. The GLS 600 receives the twin-turbocharged, 4.0-liter V8 engine that's omnipresent in the Mercedes range. It delivers 550 horsepower from 6,000 to 6,500 rpm and 538 pound-feet of torque between 2,500 and 5,000 rpm in this application, and it spins the four wheels via a nine-speed automatic transmission and 4Matic all-wheel drive. Mercedes pegs its zero-to-60-mph time at 4.8 seconds. The standard 48-volt mild hybrid system briefly gives the GLS 600 an additional 21 horsepower and 184 pound-feet of torque. It also sends the kinetic energy it recuperates to the battery pack while braking or coasting, and powers a technology named E-Active Body Control which scans the road ahead and adjusts the suspension as needed if it detects a pothole, a bump or another obstacle.