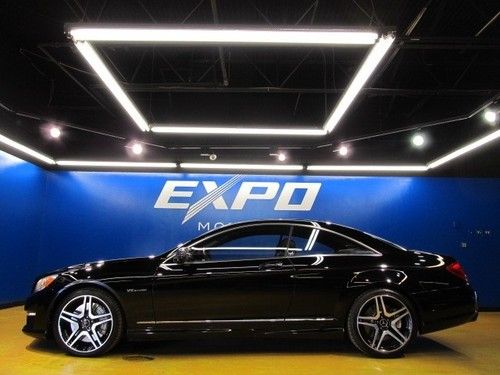

05 Cl600 V12 Keyless Go, Navigation, No Accidents, Power Trunk Xenon Fl on 2040-cars

Dania, Florida, United States

For Sale By:Dealer

Engine:5.5L 5513CC 336Cu. In. V12 GAS SOHC Turbocharged

Body Type:Coupe

Fuel Type:GAS

Transmission:Automatic

Year: 2005

Make: Mercedes-Benz

Model: CL600

Disability Equipped: No

Trim: Base Coupe 2-Door

Doors: 2

Cab Type: Other

Drive Type: RWD

Drivetrain: Rear Wheel Drive

Mileage: 91,899

Number of Doors: 2

Sub Model: CL600

Exterior Color: Black

Number of Cylinders: 12

Interior Color: Black

Mercedes-Benz CL-Class for Sale

Silver/blk-amg sport pkg-prem 2 pkg-night vision-22in modulare whls-wow!!(US $41,888.00)

Silver/blk-amg sport pkg-prem 2 pkg-night vision-22in modulare whls-wow!!(US $41,888.00) 2003 mercedes-benz cl55amg 5.5l supercharged

2003 mercedes-benz cl55amg 5.5l supercharged Mercedes benz cl63amg performance pkg prem 2 pkg amg carbon fiber pkg 172k msrp(US $109,995.00)

Mercedes benz cl63amg performance pkg prem 2 pkg amg carbon fiber pkg 172k msrp(US $109,995.00) P2 pkg, amg sport, cpo, ipod, awd, navi, rear cam, nightview, 310-925-7461(US $55,860.00)

P2 pkg, amg sport, cpo, ipod, awd, navi, rear cam, nightview, 310-925-7461(US $55,860.00) 2005 mercedes-benz 5.5l amg

2005 mercedes-benz 5.5l amg Rear view camera- 19 inch amg 5-spoke wheels- amg bodystyling-

Rear view camera- 19 inch amg 5-spoke wheels- amg bodystyling-

Auto Services in Florida

Yesterday`s Speed & Custom ★★★★★

Wills Starter Svc ★★★★★

WestPalmTires.com ★★★★★

West Coast Wheel Alignment ★★★★★

Wagen Werks ★★★★★

Villafane Auto Body ★★★★★

Auto blog

Mercedes expected to announce US HQ relocating to Atlanta today

Tue, Jan 6 2015Employees at Mercedes-Benz's US headquarters in Montvale, NJ, are set to gather today for the annual president's reception. Only this year, company chairman Dr. Dieter Zetsche is expected to fly in from headquarters to make a big announcement. That announcement, according to mounting speculation, is that MBUSA is moving to Atlanta. News of the potential move first broke around three weeks ago, suggesting that the German automaker was looking to relocate its US headquarters from New Jersey to somewhere in the South, with the Atlanta area tipped as the front-runner. Now sources are expecting that announcement to be made imminently. Although the specifics of the move have yet to be made public, Mercedes is tipped to be looking at moving into either a purpose-built facility or an existing office space in the Sandy Springs area, specifically near the intersections of Georgia 400 and Abertnathy, where UPS has its headquarters. The move is said to have hinged on a substantial incentives package worth nearly $50 million put together by the Georgia state government. The state of New Jersey is said to have offered similar incentives to keep Mercedes in the Bergen County borough of Montvale, where it employs 800 in its 141,000-square-foot office complex. One advertising company even put up billboards encouraging the company to stay, but if the reports prove accurate, it looks like their efforts may have been too little and/or too late. Mercedes wouldn't be the first automaker to move to the South, where numerous foreign carmakers have been also setting up factories. Toyota is also preparing to move its US headquarters to Texas, and though already based in Georgia, Porsche is preparing to move into a new $100 million facility, complete with on-site test track, closer to Atlanta's Hartsfield-Jackson airport that has grown into a major international hub. The move on Mercedes' part would put its US base of operations closer to its factory in Tuscaloosa, AL, and the port near Savannah, GA, from which it ships out the former's production overseas.

Win a trip to the Porsche Experience Center, including track time in a 911

Mon, Feb 28 2022Autoblog may receive a share from purchases made via links on this page. Pricing and availability is subject to change. No donation or payment necessary to enter or win this sweepstakes. See official rules on Omaze. Enter this sweepstakes today and get 150 bonus entries by signing up for the Autoblog Newsletter right here! The feeling of getting a new car is wonderful. Winning that new car, especially your dream car, feels even better, or so we would imagine. And Omaze is here with a chance to experience that feeling. Plus, between now and March 4, if you enter to win a car you'll also be entered to win a trip to the Porsche Experience Center. According to Omaze, one winner and a guest "will receive receive a one-day performance driving experience at the Porsche Experience Center in Los Angeles or Atlanta, which will include: 1.5 hours driving either a Porsche 911 GT3, a 911 Turbo S, or any vehicle available at the Porsche Driving Experience Center of equal or greater value (actual vehicle to be driven is subject to scheduling availability), on Porsche's private race track with a professional driver." Flights and accommodation will also be covered. You’re probably asking yourself, what does it take to win? First of all, according to Omaze, "no donation or payment is necessary to enter or win this sweepstakes." $10 will get you 100 entries in this sweepstakes, while $50 will get you 1,000 entries and $100 will get you 2,000 entries. The best part? Each paid entry raises money for a worthy cause. See more about these causes at Omaze. Here are our favorite vehicle giveaways weÂ’ve found online this week. Win a 1958 Porsche 356 A - Enter at Omaze Every now and then, a car comes along in a sweepstakes that makes you wonder why in the world they would be giving something so beautiful away for pennies on the dollar.

Mercedes-Maybach SUV concept: Vision Ultimate Luxury interior teased

Wed, Apr 18 2018Mercedes-Maybach posted a teaser video of what it calls "the ultimate in luxury" last week, saying that the featured, yet-to-be-named vehicle would be presented in the Beijing Motor Show. Now there's a teaser sketch giving us a wider look of the concept's interior, as well as a name. The concept also has a name by now: the Vision Mercedes-Maybach Ultimate Luxury. We guess that might have been coming, even if the name isn't exactly concise. But, the accompanying release also informs us that the concept is a combination of a high-end sedan and an SUV, confirming that it is indeed the high-riding vehicle that's been rumored for a while. The interior sketch also shows a very wide center console with stylized grab handles, which suit the SUV dimensions and aesthetic, without being as trucklike as the Maybach G650 Landaulet's interior. As well as the lavish two-tone color scheme and the touch of wood on the door panel, the concept interior shows a wide color instrument display ahead of the driver. The gear selectors are paddle shifters next to the chunky steering wheel rim, and the controls seem to have been grouped on the wheel's spokes, leaving just a few switches on the dashboard. Autocar reports that the concept will be followed by a 2019 production version, slated to debut at the Los Angeles show at the end of this year. It would be based on the Mercedes-Benz GLS, but with a more bespoke design inside out, as hinted by the concept. Basing it on the GLS would mean Mercedes would be manufacturing it at the Tuscaloosa plant in Alabama, making it the first Maybach built in the U.S. Related Video: Image Credit: Mercedes-Maybach Beijing Motor Show Maybach Mercedes-Benz SUV Concept Cars Luxury mercedes-maybach

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.068 s, 7816 u