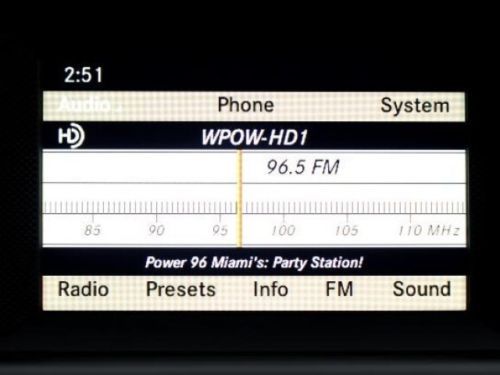

Panoramic Roof, Premium Sound, Bluetooth, Ipod/mp3 Input, Florida Fine Cars on 2040-cars

Miami, Florida, United States

Mercedes-Benz C-Class for Sale

2005 mercedes-benz c-class c230 k sport sedan sedan 4-dr, 1.8l l4 dohc 16v super(US $6,100.00)

2005 mercedes-benz c-class c230 k sport sedan sedan 4-dr, 1.8l l4 dohc 16v super(US $6,100.00) 1998 c230, black 4 door sedan(US $1,900.00)

1998 c230, black 4 door sedan(US $1,900.00) 4dr sdn c250 sport rwd c-class low miles sedan automatic gasoline 1.8l i4 dohc 1(US $33,999.00)

4dr sdn c250 sport rwd c-class low miles sedan automatic gasoline 1.8l i4 dohc 1(US $33,999.00) 2002 mercedes c32 3.2l amg v6 kompressor 350hp loaded moonroof(US $9,800.00)

2002 mercedes c32 3.2l amg v6 kompressor 350hp loaded moonroof(US $9,800.00) C250 1.8l cd nav + 4 universal media interface comandaģ single disc package

C250 1.8l cd nav + 4 universal media interface comandaģ single disc package Mercedes benz 250c two door!!! 1972 no reserve!!!

Mercedes benz 250c two door!!! 1972 no reserve!!!

Auto Services in Florida

Y & F Auto Repair Specialists ★★★★★

X-quisite Auto Refinishing ★★★★★

Wilt Engine Services ★★★★★

White Ford Company Inc ★★★★★

Wheels R US ★★★★★

Volkswagen Service By Full Throttle ★★★★★

Auto blog

5 new EVs that make driving fun

Thu, Jan 25 2024One of the things enthusiasts bellyache about the most is electrification. The noisiest complainers say that EVs will suck the fun out of driving and canít possibly be as engaging as a roaring gas engine. It¬ís undoubtedly true that the noises EVs make are not always as visceral and thrilling, but it¬ís also true that electrification has ushered in a new era of performance that gas vehicles simply cannot match. We¬íve gathered a list of EVs that don¬ít suck to drive. We all know by now about Tesla and its Plaid models, which absolutely set the quarter-mile ablaze with their amazing acceleration figures. The vehicles on this list don't come from Tesla. Nor does the list include some highly anticipated performance EVs that will soon hit the market, such as the new 2024 Porsche Macan. This selection may be a bit short on range compared to tamer models, but at the same time, it¬ís hard to ignore their specs and even harder to ignore the sensation that a full-throttle electric powertrain delivers. Let¬ís dive in to see five new EVs that make driving fun. Porsche Taycan Porsche¬ís gas-powered vehicles are among the most exciting on the road, so it¬ís not surprising to see the automaker¬ís first electric effort as a home run. The Taycan is available in a staggering number of configurations, ranging from the 375-horsepower base model to the massively powerful Turbo S models with up to 750 horsepower in temporary boost mode. Classic Porsche styling and high-end tech round out the package, making the Taycan one of the most desirable EVs today. That said, the Taycan¬ís almost $91,000 starting price puts it out of reach for a majority of car buyers, and the prices keep steadily rising along with the performance. It also trades range for performance, as the least powerful variant is the most efficient, returning 242 miles with the extended-range battery. The car can take advantage of fast charging, however, and can recover up to 80 percent of its battery capacity in just over 22 minutes. ¬† Kia EV6 GT How about a Kia that can out-accelerate many supercars, especially from a few years ago? The EV6 GT comes with two electric motors with a combined 576 horsepower and 545 pound-feet of torque. Its 0-60 mph time lands at just 3.4 seconds, and the EV offers a top speed of 161 mph, making it one serious Korean EV. At the same time, it features the standout styling of the standard model, which gives it a striking curb presence and a futuristic look that is unique among EVs.

2015 Mexican Grand Prix is a lot like old times

Mon, Nov 2 2015The last time Formula One visited Mexico, in 1992, 26 cars powered by eight engine manufacturers (counting Honda and Mugen-Honda separately) lined up on the grid; it would have been nine engine makers but the Brabham-Judd cars failed to qualify. In 1992 Lewis Hamilton was seven years old, Sebastian Vettel was five, Max Verstappen was still five years away from being born. Two of the current Sky Sports F1 commentary team, Martin Brundle and Johnny Herbert, were drivers. The starting three were Nigel Mansell on pole Ė 39 years old, this the year he'd win his only World Championship ¬Ė and Riccardo Patrese both driving Williams-Renault cars, followed by Michael Schumacher in a Benetton-Ford. Only 13 of the 26 starters would finish. The circuit is has been reworked to today's safer standards, the track surface is brand new and slippery, but the atmosphere and packed grandstands haven't changed. Nico Rosberg was another point of consistency, scoring pole position for the fourth race in a row to beat his now-World-Champion teammate Hamilton by almost two-tenths of a second. The last time Rosberg turned pole position into a victory? The Spanish Grand Prix back in May. Vettel locked up third for Ferrari, followed by the Infiniti Red Bull Racing duo of Daniil Kvyat and Daniel Ricciardo. Williams went two-up as well, Valtteri Bottas in sixth ahead of Felipe Massa in seventh. Max Verstappen turned in a great late lap to reserve eighth place, Sergio Perez did all he could in front of his home crowd to get ninth, teammate Nico Hulkenberg the caboose in the top ten. In that 1992 race the first three on the grid finished the race in the same order after Mansell dominated, and it was almost the same in 2015. If Rosberg had driven the whole season like he drove today the Driver's World Championship would still be up for grabs. He got a great start and held his line through the first corner, coming out ahead of Hamilton through the initial kinks, pulling away as soon as he got to the straight. Hamilton was never more than a few seconds behind, but every time the Brit inched closer the German found a few more tenths to keep his distance. The field got bunched up when the Safety Car came out on Lap 53 after Vettel spun and got stuck in the barriers, but Rosberg handled the restart perfectly. Both drivers made small mistakes in the last few laps while driving on the edge, but Rosberg earned a strong victory, crossing the line two seconds ahead of his teammate.

13-year-old boy swipes dad's Mercedes, drives across Europe

Wed, 16 Jan 2013After an argument with his adoptive parents that resulted in them taking away his mobile phone, an angry 13-year-old boy ran away from his home in Italy and headed straight to Poland to meet his biological sister. But instead of taking the train or hitching a ride, like most on the run, the young man (an accomplished go-kart racer and car enthusiast) grabbed the keys to his father's Mercedes-Benz and jumped behind the wheel for an impromptu road trip.

With less than 200 euros (about $270) in his wallet and a passport in his pocket, the youngster managed to put more than 500 miles between himself and his distraught parents, crossing two international borders in the process, before German police nabbed him just shy of the Polish border. According to reports, the vehicle was tracked - it wasn't his driving that alerted authorities to his location.

Reunited with his mother and father, who traveled to Germany to retrieve both their son and the vehicle, the young man apologized and acknowledged his error. As a result of his actions, social workers will increase checks on the family and we can be sure his parents are now hiding the keys.