2003 Mercedes Benz S500 4matic on 2040-cars

Erie, Pennsylvania, United States

Vehicle Title:Salvage

Used

Year: 2003

Drive Type: All Wheel

Make: Mercedes-Benz

Mileage: 163,000

Model: 500-Series

Exterior Color: Silver

Trim: 4D S5M

Interior Color: leather

|

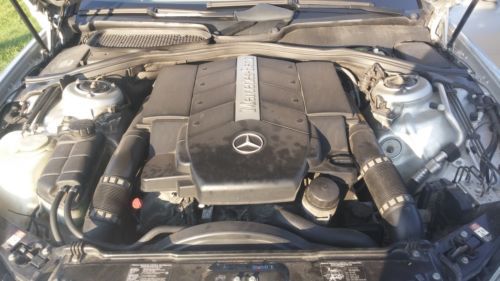

2003 Mercedes Benz s500 . Beautiful car! Navigation system and all the bells and whistles that the Mercedes offers. Also, 22 inch Rosay rims! Body and inside are in good condition and runs great! Smoke-free environment. All sells are made through PayPal and are final.

|

Mercedes-Benz 500-Series for Sale

1986 mercedes-benz 560sec base coupe 2-door 5.6l(US $6,000.00)

1986 mercedes-benz 560sec base coupe 2-door 5.6l(US $6,000.00) 1990 mercedes-benz 560sec base coupe 2-door 5.6l- 1-owner ca car w/ 66k miles

1990 mercedes-benz 560sec base coupe 2-door 5.6l- 1-owner ca car w/ 66k miles 1990 mercedes-benz 560sec base coupe 2-door 5.6l

1990 mercedes-benz 560sec base coupe 2-door 5.6l 2003 mercedes 500 sl

2003 mercedes 500 sl 1988 mercedes benz 560sl 31k miles signal red/black leather museum quality car

1988 mercedes benz 560sl 31k miles signal red/black leather museum quality car 1988 mercedes benz 560 sl 21k miles rare blue green/creme exceptional car !!!

1988 mercedes benz 560 sl 21k miles rare blue green/creme exceptional car !!!

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

Van Gorden`s Tire & Lube ★★★★★

Valley Seat Cover Center ★★★★★

Tony`s Transmission ★★★★★

Tire Ranch Auto Service Center ★★★★★

Thomas Automotive ★★★★★

Auto blog

Mercedes-AMG GT3 racing towards Geneva debut

Fri, Feb 13 2015So far, we've only seen the fundamental road-going coupe version of the new Mercedes-AMG GT, but like the Porsche 911 it targets, you can bet there will be more derivatives to follow. And this is our first glimpse at the first of them. At the Geneva Motor Show next month, Mercedes will showcase the GT3-spec racing version of the AMG GT. The German automaker didn't tell us much more in making the announcement, but did release a pair of cropped teaser sketches showing the sports car with all manner of racing appendages, including what looks like a massive rear wing. Once ready for action, the new Mercedes-AMG GT3 will replace the previous SLS AMG GT3 that won the Nurburgring 24-hour race a couple of years back. But with every automaker and its sister company getting in on the GT3 racing action these days, it'll face some stiff competition on the track. The new Mercedes-AMG GT3 February 12, 2015 Neatly coinciding with the upcoming market launch of the road-going version of the Mercedes-AMG GT, the next stage of the vehicle's evolution is already here: the sports car and performance brand of Mercedes-Benz is presenting a new customer sport racing car that complies with FIA GT3 race regulations in the form of the new Mercedes-AMG GT3. With this, the second customer sport car to be developed by Mercedes-AMG, the Affalterbach company is seeking to build on the success of the SLS AMG GT3 and further expand the customer sport programme first started in 2010. The superb racetrack performance of the road-going GT forms the ideal basis on which to model the new Mercedes-AMG GT3, which is due to make its debut appearance at the Geneva Motor Show. Featured Gallery Mercedes-AMG GT3: teasers Geneva Motor Show Mercedes-Benz Coupe Racing Vehicles mercedes-amg 2015 Geneva Motor Show rendering mercedes-amg gt sketch mercedes-amg gt3

Weekly Recap for 8.12.16 | Autoblog Minute

Sat, Aug 13 2016A recap of the week in automotive news, including a look at a two-door Maybach coupe, FCA's Ram heavy-duty truck recall, and spy shots of POTUS' new car. Maybach Mercedes-Benz Autoblog Minute Videos Original Video autos limo maybach coupe

Mercedes, Nissan and VW slammed by China's CCTV

Tue, Mar 17 2015Several automakers in China, including joint ventures with Nissan, Volkswagen and Mercedes-Benz, are in hot water because their dealers are allegedly overcharging customers for repairs. China Central Television, the country's state broadcaster, leveled the claims during its annual Consumer Day expose. CCTV runs these reports each year on March 15 and often takes aim at foreign companies operating within China. This year the focus fell on automakers, according to the Financial Times, and no domestic car companies were targeted. The network also accused dealers of overselling parts, and it took aim at Jaguar Land Rover specifically for problems surrounding transmission repairs, according to Reuters. The yearly stories are often criticized for focusing on outside businesses. "It panders to a certain type of nationalism as it tends to target foreign companies and rarely touches large state groups or monopolies," Qiao Mu, a journalism professor at Beijing Foreign Studies University, said to the Financial Times. Foreign automakers seem to face tighter scrutiny when doing business in China than their domestic counterparts, in general. The government there investigated several luxury brands, including Audi and BMW, last year for how they supplied spare parts and whether the components were overpriced. Some incurred fines, and Lexus decided to lower its prices. Volkswagen also experienced protests when owners felt the company wasn't handling a recall properly. The CCTV report also comes as many auto dealers in China are feeling a pinch due to high mandated sales targets from automakers. The situation was so dire in early 2015 several brands cut back sales targets and in some cases even paid the sellers to offset poor profits. News Source: Financial Times - sub. req., ReutersImage Credit: Andy Wong / AP Photo Government/Legal Mercedes-Benz Nissan Volkswagen Car Dealers Auto Repair Maintenance jaguar land rover

2040Cars.com © 2012-2025. All Rights Reserved.

Designated trademarks and brands are the property of their respective owners.

Use of this Web site constitutes acceptance of the 2040Cars User Agreement and Privacy Policy.

0.655 s, 7891 u