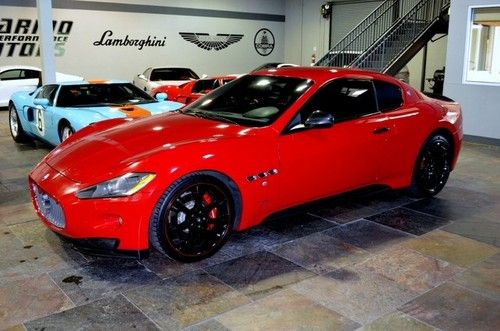

Like New 2009 Maserati Gran Turismo S - Mcc Transmission - Low Miles on 2040-cars

Atlanta, Georgia, United States

Body Type:Coupe

Vehicle Title:Clear

Engine:4.7 V8

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 8

Make: Maserati

Model: Gran Turismo

Trim: S

Options: Leather Seats, CD Player

Drive Type: RWD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag, Side Airbags

Mileage: 9,380

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: S, MCC Trans

Exterior Color: Grigio

Interior Color: Saddle

Maserati Gran Turismo for Sale

2012 maserati granturismo convertible 2dr conv granturismo(US $114,997.00)

2012 maserati granturismo convertible 2dr conv granturismo(US $114,997.00) Beautiful black maserati gran turismo in excellent condition!(US $66,000.00)

Beautiful black maserati gran turismo in excellent condition!(US $66,000.00) 2010 maserati granturismo s 4.7l 433 hp mc sportline carbon fiber pdl pw leather

2010 maserati granturismo s 4.7l 433 hp mc sportline carbon fiber pdl pw leather Oceano blue on cuoio, paddle shifter bose sound navigation bluetooth cabriolet(US $97,000.00)

Oceano blue on cuoio, paddle shifter bose sound navigation bluetooth cabriolet(US $97,000.00) New! 2013 maserati gran turismo sport, grigio granito/nero(US $135,765.00)

New! 2013 maserati gran turismo sport, grigio granito/nero(US $135,765.00) Clean, front parking sensors,red calipers, black piano high gloss interior trim(US $129,900.00)

Clean, front parking sensors,red calipers, black piano high gloss interior trim(US $129,900.00)

Auto Services in Georgia

Wheel Wizard ★★★★★

Uzuri 24-HR Plumbing ★★★★★

Used tires Atlanta ★★★★★

ultimateworks ★★★★★

Tyrone Auto Mobile Repair ★★★★★

Top Quality Car Care ★★★★★

Auto blog

Maserati GranTurismo EV reappears in spy photos

Mon, Mar 14 2022Maserati made it clear that it was working on a new electric sports car last year, and that it would be a successor to the GranTurismo sports coupe. The car has reappeared in these spy photos, and they give us a better look at the car than the official teaser images. The camouflage also appears to feature an additional name. Let's first talk about the name. In addition to the regular Maserati name, the camouflage now has another word: "Folgore." Translated from Italian, it means "lightning" or "thunderbolt." Maserati brought up this name a couple years ago when it started talking about its future electric vehicles, and it first referenced an electric version of the MC20 mid-engine sports car. So this confirms this prototype is electric, and that it will probably be known as the GranTurismo Folgore. As for the looks, the Folgore actually looks a whole lot like the internal-combustion car it will replace. That's no bad thing, though, since the old coupe is still a looker. The front fascia has the most obvious changes with a grille that's more of a simple oval shape, still bearing a large Maserati trident. The headlights are more vertical now, which helps tie it to the MC20. Looking at the rest of the car, the proportions are still very classic with a long nose and short deck, despite not needing that front-end space for an engine. The fenders are still voluptuous, and the rear lights are similarly shaped to the old car, though much slimmer. We're expecting to see the GranTurismo Folgore revealed this year, which is slightly later than Maserati initially planned. The MC20 Folgore powertrain previewed a couple years ago featured three electric motors, one at the front and two at the rear, and it would likely be carried over to the GranTurismo. Power was estimated at more than the combustion MC20's 620 horsepower. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.

2020 Maserati Quattroporte S Q4 Drivers' Notes | Lost that loving feeling

Wed, Oct 7 2020The 2020 Maserati Quattroporte is the Italian brandís flagship sedan. There¬ís only one other Maserati sedan ¬ó the Ghibli ¬ó but the Quattroporte commands the big bucks with its blend of opulent luxury and performance, all topped off by a Ferrari-sourced engine. We drove the Quattroporte S Q4 in GranLusso trim, which is the less powerful and cheaper partner of the GTS. Since it's the GranLusso, it added silk-and-leather upholstery, heated and cooled seats, a chrome front fascia insert, 20-inch wheels and glossy black brake calipers. An impressive, high-tech 3.0-liter twin-turbocharged V6 engine lurks under the S Q4¬ís hood making 424 horsepower and 428 pound-feet of torque, both respectable numbers for a boosted six-cylinder. It¬ís paired with a ZF eight-speed automatic transmission that¬íll send this big sedan from 0-60 mph in just 4.8 seconds. The all-wheel drive system is no slouch. It sends 100% of the power to the rear wheels in most driving conditions, but can quickly send as much as 50% of torque to the front wheels if it detects a loss of grip. It also has a limited-slip rear differential. At about 207 inches in length, there¬ís no disguising that the Quattroporte is a large car. It¬ís about the same size as a BMW 7 Series, Audi A8 or Mercedes-Benz S-Class sedan. When you¬íre competing with those names, the standards for excellence tend to be off the charts. Of course, Maserati comes with its own expectations and standards of performance. This car¬ís electrically-controlled adaptive dampers, Brembo brakes and unique exhaust note go a long way toward enhancing the driving experience, but read on to see what our editors think after spending a week in the driver¬ís seat. Senior Editor, Green, John Beltz Snyder: Hearing the word ¬ďMaserati¬Ē evokes something. A sense of exotica and exclusivity, notions of performance and luxury, whiffs of elitism and maybe even envy. When people see a Maserati Quattroporte in person, very little of that happens. People will eye a Bentley, give a thumbs-up to a passing Porsche, and straight-up gawk at the right Jaguar. By contrast, no one seemed to notice this Maserati, be it on the highway or when parked next to them in the parking lot. I can¬ít blame them. Its design doesn¬ít really scream, well, anything. Under normal driving, the 3.0-liter V6 under the hood doesn¬ít either. In Sport mode, though, the twin-turbocharged Ferrari-sourced engine raises its voice in a sonorous growl.

Drive like a prince: Join us for a walk through Monaco's car collection

Fri, Dec 29 2023Small, crowded, and a royal pain in the trunk lid to drive into during rush hour, Monaco sounds like an improbable location for a huge car museum. And yet, this tiny city-state has been closely linked to car culture for over a century. It hosts two major racing events every year, many of its residents would qualify for a frequent shopper card if Rolls-Royce issued one, and Prince Rainier III began assembling a collection of cars in the late 1950s. He opened his collection to the public in 1993 and the museum quickly turned into a popular tourist attraction. The collection continued to grow after his death in April 2005; it moved to a new facility located right on Hercules Port in July 2022. Monaco being Monaco, you'd expect to walk into a room full of the latest, shiniest, and most powerful supercars ever to shred a tire. That's not the case: while there is no shortage of high-horsepower machines, the first cars you see after paying ą10 (approximately $11) to get in are pre-war models. In that era, the template for the car as we know it in 2023 hadn't been created, so an eclectic assortment of expensive and dauntingly experimental machines roamed whatever roads were available to them. One is the Leyat Helica, which was built in France in 1921 with a 1.2-liter air-cooled flat-twin sourced from the world of aviation. Fittingly, the two-cylinder spun a massive, plane-like propeller. Government vehicles get a special spot in the museum. They range from a Cadillac Series 6700 with an amusing blend of period-correct French-market yellow headlights and massive fins to a 2011 Lexus LS 600h with a custom-made transparent roof panel that was built by Belgian coachbuilder Carat Duchatelet for Prince Albert II's wedding. Here's where it all gets a little weird: you've got a 1952 Austin FX3, a Ghia-bodied 1959 Fiat 500 Jolly, a 1960 BMW Isetta, and a 1971 Lotus Seven. That has to be someone's idea of a perfect four-car garage.¬† One of the most significant cars in the collection lurks in the far corner of the main hall, which is located a level below the entrance. At first glance, it's a kitted-out Renault 4CV with auxiliary lights, a racing number on the front end, and a period-correct registration number issued in the Bouches-du-Rhone department of France. It doesn't look all that different than the later, unmodified 4CV parked right next to it. Here's what's special about it: this is one of the small handful of Type 1063 models built by Renault for competition.