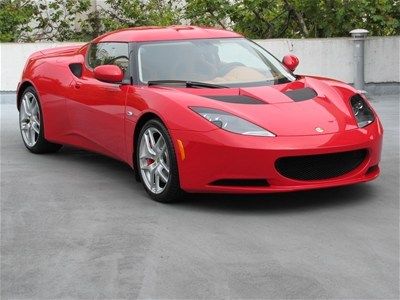

2013 Ardent Red on 2040-cars

San Francisco, California, United States

Engine:6

Vehicle Title:Clear

Interior Color: Tan

Make: Lotus

Model: Evora

Warranty: Vehicle does NOT have an existing warranty

Mileage: 0

Number of doors: 2

Exterior Color: Red

Lotus Evora for Sale

2010 lotus evora racing green / tan / technology & sport packages(US $43,900.00)

2010 lotus evora racing green / tan / technology & sport packages(US $43,900.00) 2010 lotus evora arctic silver / black / premium, technology & sport packages(US $49,000.00)

2010 lotus evora arctic silver / black / premium, technology & sport packages(US $49,000.00) 2011 lotus evora s(US $69,900.00)

2011 lotus evora s(US $69,900.00) 2011 lotus evora 2+2(US $59,900.00)

2011 lotus evora 2+2(US $59,900.00) Full factory warranty * rare ice white over black * technology package*(US $59,000.00)

Full factory warranty * rare ice white over black * technology package*(US $59,000.00) * evora 2+2 * navigation and premium sound pkg *(US $52,000.00)

* evora 2+2 * navigation and premium sound pkg *(US $52,000.00)

Auto Services in California

Yoshi Car Specialist Inc ★★★★★

WReX Performance - Subaru Service & Repair ★★★★★

Windshield Pros ★★★★★

Western Collision Works ★★★★★

West Coast Tint and Screens ★★★★★

West Coast Auto Glass ★★★★★

Auto blog

Lotus will go public via SPAC with $5.4 billion valuation

Wed, Feb 1 2023Lotus Technology, the electric-car maker owned by Chinaís Zhejiang Geely Holding Group Co., agreed to merge with a blank-check company in a transaction that values the combined entity at about $5.4 billion. L Catterton Asia Acquisition Corp. will combine with the EV making subsidiary of the British carmaking group that Geely acquired back in 2017, the two said in a statement Tuesday. The special purpose acquisition company¬ís sponsor has ties to Bernard Arnault, the world¬ís richest man. Lotus Tech has been looking to go public since at least early last year. Management may have been encouraged by another luxury auto brand¬ís recent listing: Porsche AG pulled off Europe¬ís largest initial public offering in a decade when it debuted in Frankfurt in September. A week later, Porsche overtook Volkswagen AG as Europe¬ís most valuable automaker. Rather than go the IPO route, Lotus Tech will merge with a SPAC whose sponsor combined with the private equity operations of Arnault¬ís luxury-goods powerhouse LVMH in 2016. LVMH is a passive minority investor in L Catterton, according to a spokeswoman. Arnault overtook Tesla Inc. Chief Executive Officer Elon Musk as the world¬ís richest man last month ¬ó the first time a European claimed the top spot on the Bloomberg Billionaires Index. While Group Lotus is tiny compared to Tesla, Geely has been steering it away from combustion engines and has several all-electric models planned for the coming years. Lotus Tech sees itself as a competitor to the likes of Ferrari and Aston Martin, and will get a jump on the first electric models from those brands. Lotus unveiled its all-electric Eletre sport utility vehicle last year and plans to launch a rival to Porsche¬ís popular Taycan EV in 2023. Geely and other owners are expected to retain an 89.7% shareholding in Lotus Tech after the SPAC merger. Geely¬ís billionaire owner Li Shufu also controls Swedish carmaker Volvo Car AB and owns stakes in Germany¬ís Mercedes-Benz Group AG and the UK¬ís Aston Martin Lagonda Global Holdings Plc. Deutsche Bank AG advised Lotus Tech on the deal, while Credit Suisse Group AG acted as capital markets adviser to the SPAC. Related video: Featured Gallery Lotus Eletre View 25 Photos Earnings/Financials Green Lotus Electric Luxury Performance

New 2024 Lotus Emira priced at just under six figures

Fri, Jul 14 2023Unveiled in 2021, and delayed earlier in 2023 allegedly due to certification-related issues, the 2024 Lotus Emira is finally ready to turn its wheels on American pavement. The coupe appears on the firm's online configurator, but it costs significantly more than initially announced. Buyers will have two Emira flavors to choose from. The entry-level car uses a Mercedes-AMG-sourced 2.0-liter four-cylinder engine that's turbocharged to develop 360 horsepower and 310 pound-feet of torque. It spins the rear wheels via an eight-speed automatic transmission. Next up is a supercharged, 3.5-liter V6 provided by Toyota and rated at 400 horsepower and 310 pound-feet of torque. The six-cylinder spins the rear wheels via a six-speed manual transmission, though a six-speed automatic that bumps the torque figure to 317 is a $2,150 option. Pricing for the base Emira starts at $99,900 excluding destination fee, which hasn't been published yet, while the V6-powered car carries a base price of $105,400. Note that these figures only apply to the First Edition model; Lotus hasn't detailed or priced the other available trim levels. For context, the Geely-owned British brand initially announced prices of $85,900 and $93,300 for the four-cylinder- and V6-powered models, respectively. An earlier report blames the increases on the supply chain-related constraints that have plagued most carmakers since 2020. Enthusiasts configuring an Emira have a long list of options to choose from. Lotus offers Touring and Sport chassis configurations (the latter brings a firmer suspension system), 13 paint colors, a Black Pack that bundles black exterior trim pieces, and three wheel designs. Inside, you've got several leather and Alcantara upholsteries to choose from plus a vehicle tracker, a HomeLink transceiver, and tinted windows. Lotus dealers across the nation will begin receiving the V6-powered Emira First Edition in the third quarter of 2023, while buyers waiting in line for a four-cylinder-powered model won't get their car until the first quarter of 2024. Additional trim levels should join the range later on. Related video:

UK car output falls 14% in March, may get worse with no-deal Brexit

Tue, Apr 30 2019LONDON ó British car output fell for the 10th month in a row in March, hit by a slowdown in key foreign markets, and the sector stands to suffer a lot more if the country leaves the European Union without a deal, an industry body said on Tuesday. Output tumbled by an annual 14.4 percent to 126,195 cars in March, the Society of Motor Manufacturers and Traders said. Exports, which account for nearly four out of every five cars made in Britain, were down by 13.4 percent. The SMMT said analysis it had commissioned predicted output would fall this year to 1.36 million units from 1.52 million in 2018, assuming London can secure a transition deal with the EU. If Britain has to rely instead on World Trade Organization rules for its trade with the bloc, which include import tariffs, output is forecast to fall by around 30 percent to 1.07 million units in 2021, returning to mid-1980s levels, the SMMT said. The forecasts were produced for SMMT by AutoAnalysis, a consultancy. Prime Minister Theresa May has secured a delay to the Brexit deadline until Oct. 31, giving her more time to try to break an impasse in parliament over the terms of Britain's departure from the EU. Foreign minister Jeremy Hunt traveled to Japan earlier this month to try to persuade the Japanese government and Toyota, which has a big presence in Britain, that London was determined to avoid a no-deal Brexit. "Just a few years ago, industry was on track to produce 2 million cars by 2020 ¬ó a target now impossible with Britain's reputation as stable and attractive business environment undermined," SMMT chief executive Mike Hawes said. "All parties must find a compromise urgently so we can set about repairing the damage and diverting energy and investment to the technological challenges that will define the future of the global industry." (Reporting by William Schomberg, editing by David Milliken)