1974 Lincoln Mark Iv, Low Miles, Beautiful Car, One Of The Best! on 2040-cars

Fort Worth, Texas, United States

Lincoln Mark Series for Sale

Auto Services in Texas

Your Mechanic ★★★★★

Yale Auto ★★★★★

Wyatt`s Discount Muffler & Brake ★★★★★

Wright Auto Glass ★★★★★

Wise Alignments ★★★★★

Wilkerson`s Automotive & Front End Service ★★★★★

Auto blog

Dodge Dart falls short of Consumer Reports Recommended, Caddy XTS and Lincoln MKS, too

Thu, 22 Nov 2012The Dodge Dart, Cadillac XTS and Lincoln MKS all failed to earn a "Recommended" rating from Consumer Reports. When it came to the compact Dart, the organization's testers thought the vehicle offered a quiet cabin, solid-feeling chassis and nimble suspension, but the new model ultimately fell short of the coveted rating due to powertrain issues. The institute's reviewers found the base 2.0-liter four-cylinder engine to be underpowered and noted "drivability issues" when the available turbocharged 1.4-liter four was paired with the optional dual-clutch transmission (some of our editors disliked it paired with the six-speed manual). CR also dinged the latter powerplant for sounding "raspy." For what it's worth, we think the forced-induction engine offers an excellent and playful exhaust note, but that's just us.

As for the XTS, CR lauded the car for its luxurious cabin, but the vehicle's experience was dulled by its finicky CUE infotainment interface. Overall, the big Cadillac scored much higher than its cross-town rival from Lincoln. While testers found the American luxury sedan to offer a quiet ride and quality fit and finish, they felt the MKS delivered a "cramped driving position, ungainly handling, uncomposed ride, and limited visibility." Ouch. At the end of the day, both cars fell short of rivals from Japan, Germany and Korea. Check out the full press release below with more details, along with CR's musings on the Chevrolet Spark and Lexus ES.

Never mind the naysayers; Lincoln is worth saving

Fri, 10 Jan 2014

In the case of Henry Leland, naming his new car brand after the first President he cast a vote for in 1864 seemed a jolly good idea, on paper.

You should always be careful about the name you choose to give your new baby. The power of association can work in many ways, not always positive.

Lincoln MKC crossover headed for Detroit

Wed, 19 Dec 2012Fresh off the launch of the stylish new MKZ sedan, the newly named Lincoln Motor Company is reportedly preparing for a lineup expansion. According to TheDetroitBureau.com, the first new product joining the Lincoln brand is a small crossover based on the Ford Escape said to be called the MKC. We saw this machine testing a few months ago, and while we were hoping the name might be reserved for a future two-door model or even the diminutive Concept C hatchback, it looks like the "C" will stand for compact crossover instead.

The report also says that this crossover will be making its debut next month at the 2013 Detroit Auto Show, so we'll have to wait until then to see what the new model looks like. Unlike the MKX, which is based off the Ford Edge, we would expect there to be a lot more differentiation between the MKC and the Escape like Ford managed to do with the newest Fusion and MKZ.

In addition to the new MKC, the article states new MKS and Navigator designs are expected to debut by 2014.

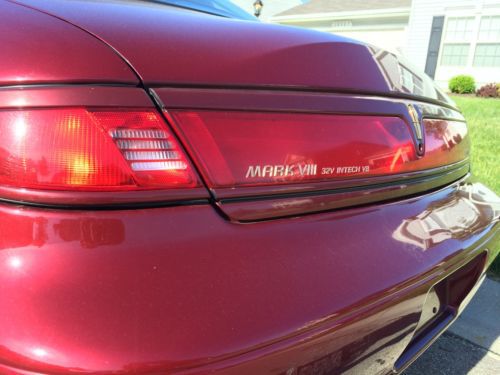

1998 lincoln mark viii lsc sedan 2-door 4.6l

1998 lincoln mark viii lsc sedan 2-door 4.6l Lincoln mark vl black/gry 1983

Lincoln mark vl black/gry 1983 1997 lincoln mark viii lsc 2-door coupe 4.6l rare black on black

1997 lincoln mark viii lsc 2-door coupe 4.6l rare black on black 1979 lincoln mark v continental

1979 lincoln mark v continental 1970 lincoln mark iii base 7.5l

1970 lincoln mark iii base 7.5l