Automatic * All Wheel Drive * V6 * Low Reserve * Full Power on 2040-cars

Brockton, Massachusetts, United States

Vehicle Title:Clear

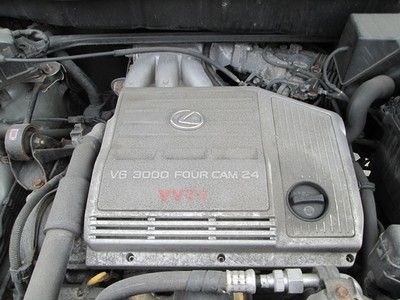

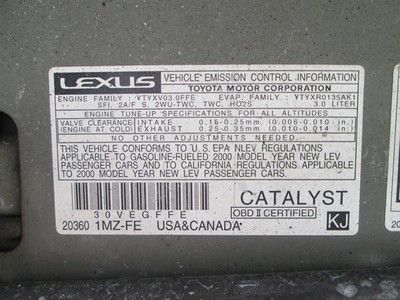

Engine:3.0L 2995CC V6 GAS DOHC Naturally Aspirated

For Sale By:Dealer

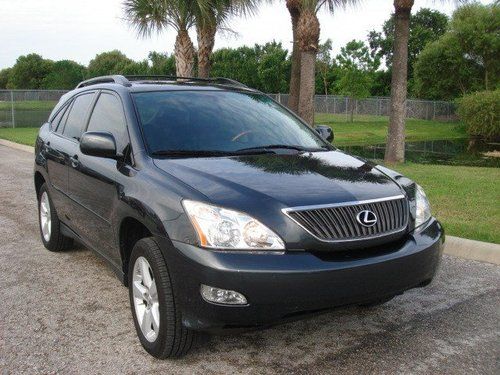

Body Type:Sport Utility

Fuel Type:GAS

Make: Lexus

Warranty: Vehicle does NOT have an existing warranty

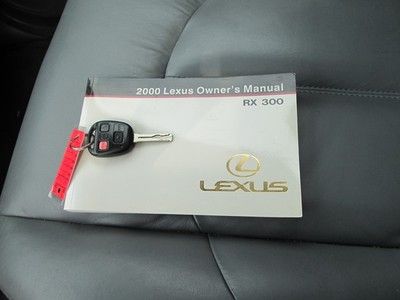

Model: RX300

Trim: Base Sport Utility 4-Door

Options: Cassette Player

Power Options: Power Locks

Drive Type: AWD

Mileage: 134,502

Sub Model: SUV 4WD

Number of Cylinders: 6

Exterior Color: Gold

Interior Color: Tan

Lexus RX for Sale

Hybrid navigation backup camera trunk closure heated seats sunroof hids

Hybrid navigation backup camera trunk closure heated seats sunroof hids 2000 lexus rx300 higway miles, no accidents, no rust, no paintwork, no surprises(US $4,999.00)

2000 lexus rx300 higway miles, no accidents, no rust, no paintwork, no surprises(US $4,999.00) 04 import sunroof leather low miles one owner suv black inspected warranty

04 import sunroof leather low miles one owner suv black inspected warranty 00 awd 4wd import sunroof leather silver suv inspected warranty - we finance

00 awd 4wd import sunroof leather silver suv inspected warranty - we finance 04 luxury suv leather chrome wheels extra clean

04 luxury suv leather chrome wheels extra clean 2007 lexus rx 350(US $23,990.00)

2007 lexus rx 350(US $23,990.00)

Auto Services in Massachusetts

Tremont Auto Body ★★★★★

Toy Town Auto Salvage ★★★★★

Town Fair Tire ★★★★★

Teta`s Automotive ★★★★★

T N T Repairs ★★★★★

Salem Auto Body Company ★★★★★

Auto blog

Toyota profits up 23% on high US sales, despite mounting legal costs

Tue, 05 Feb 2013Toyota earned $9.3 billion in net income in the financial year that ends next month. The number beats earlier forecasts and marks a five-year high for the automaker, with both operating income and revenue up by 9.5 percent and 2.5 percent, respectively. Toyota saw quarterly profit enjoy a year-on-year jump of 23.4 percent, with the manufacturer earning more than $1 billion between October and December 2012. The good news comes in spite of the fact that the Japanese automaker actually endured an operating loss in North America, due in part to legal fees.

Toyota is set to pay more than $1 billion to owners who claim their vehicles decreased in value as a result of the company's recent spate of recalls. Even so, all three of the automaker's brands enjoyed a 13.5 percent sales increase in the US in the last quarter, beating the industry average. Toyota faltered in Europe, however, where it earned $99 million in operating profit last year, compared to $111 million in 2011. You can take a closer look at the company's full press release below for more information.

Toyota settles first wrongful death suit related to unintended acceleration

Mon, 21 Jan 2013Toyota's sales seem to have rebounded from the unintended acceleration issues from 2009 and 2010, but the automaker is far from done dealing with this situation. Following a settlement worth up to $1.4 billion for economic loss to affected vehicle owners, Toyota has settled rather than going to trial in a wrongful death lawsuit stemming from an accident in Utah in 2010 that left two passengers dead. This isn't the first case in which Toyota has settled, but it was the first among a consolidated group of cases being held in Santa Ana, CA.

According to The Detroit News, this case was scheduled to take place next month, and it was for a November 2010 incident in which Paul Van Alfen and Charlene James Lloyd were killed in a Camry when, based on findings by the Utah Highway Patrol, the accelerator got stuck causing the car to speed out of control and hit a wall; the terms of the settlement were not announced.

The article says that while Toyota will settle on some cases, it doesn't plan on settling on all of them as it still wants to be able to "defend [its] product at trial." This will probably be the case in suits claiming that software for the drive-by-wire accelerator was the cause of an accident in a Toyota or Lexus vehicle. The question of whether or not the electronic accelerator played any role in this problem has been a hot-button topic since the beginning. Toyota has issued recalls in the past to attempt to prevent unintended acceleration caused by trapped floor mats and faulty accelerator pedals, but it also says driver error was to blame in some instances.

The next steps automakers could take after sales drop again in April

Tue, May 2 2017DETROIT (Reuters) - Major automakers on Tuesday posted declines in U.S. new vehicle sales for April in a sign the long boom cycle that lifted the American auto industry to record sales last year is losing steam, sending carmaker stocks down. The drop in sales versus April 2016 came on the heels of a disappointing March, which automakers had shrugged off as just a bad month. But two straight weak months has heightened Wall Street worries the cyclical industry is on a downward swing after a nearly uninterrupted boom since the Great Recession's end in 2010. Auto sales were a drag on U.S. first-quarter gross domestic product, with the economy growing at an annual rate of just 0.7 percent according to an advance estimate published by the Commerce Department last Friday. Excluding the auto sector the GDP growth rate would have been 1.2 percent. Industry consultant Autodata put the industry's seasonally adjusted annualized rate of sales at 16.88 million units for April, below the average of 17.2 million units predicted by analysts polled by Reuters. General Motors Co shares fell 2.9 percent while Ford Motor Co slid 4.3 percent and Fiat Chrysler Automobiles NV's U.S.-traded shares tumbled 4.2 percent. The U.S. auto industry faces multiple challenges. Sales are slipping and vehicle inventory levels have risen even as carmakers have hiked discounts to lure customers. A flood of used vehicles from the boom cycle are increasingly competing with new cars. The question for automakers: How much and for how long to curtail production this summer, which will result in worker layoffs? To bring down stocks of unsold vehicles, the Detroit automakers need to cut production, and offer more discounts without creating "an incentives war," said Mark Wakefield, head of the North American automotive practice for AlixPartners in Southfield, Michigan. "We see multiple weeks (of production) being taken out on the car side," he said, "and some softness on the truck side." Rival automakers will be watching each other to see if one is cutting prices to gain market share from another, he said, instead of just clearing inventory. INVESTORS DIGEST BAD NEWS Just last week GM reported a record first-quarter profit, but that had almost zero impact on the automaker's stock. The iconic carmaker, whose own interest was once conflated with that of America's, has slipped behind luxury carmaker Tesla Inc in terms of valuation.