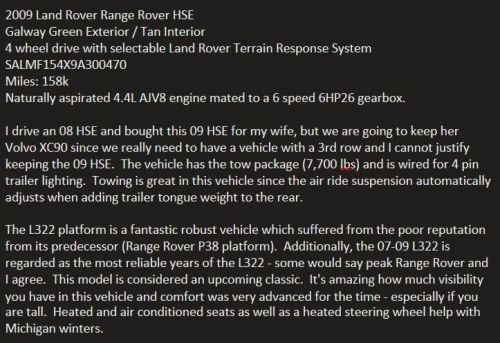

2009 Land Rover Range Rover Hse Trim Level on 2040-cars

Fuel Type:Gasoline

For Sale By:Private Seller

Engine:Naturally Aspirated 4.4L AJ-V8

Body Type:SUV

Vehicle Title:Clean

VIN (Vehicle Identification Number): SALMF154X9A300470

Mileage: 158000

Model: Range Rover

Make: Land Rover

Interior Color: Tan

Previously Registered Overseas: No

Number of Seats: 5

Drive Side: Left-Hand Drive

Horse Power: More Than 185 kW (247.9 hp)

Engine Size: 4.4 L

Exterior Color: Galway Green

Car Type: Modern Cars

Number of Doors: 5

Features: AM/FM Stereo, Air Conditioning, Alarm, Alloy Wheels, Automatic Wiper, Climate Control, Cruise Control, Electric Mirrors, Electrochromic Interior Mirror, Electronic Stability Control, Folding Mirrors, Leather Interior, Leather Seats, Metallic Paint, Navigation System, Parking Assistance, Parking Sensors, Power Locks, Power Seats, Power Steering, Power Windows, Seat Heating, Split Bench Seat, Sunroof, Tilt Steering Wheel, Tinted Rear Windows, Top Sound System, Tow Bar, Trailer Hitch, Xenon Headlights

Trim: HSE Trim Level

Number of Cylinders: 8

Drive Type: 4WD

Safety Features: Anti-Lock Brakes, Back Seat Safety Belts, Driver Airbag, Electronic Stability Program (ESP), Fog Lights, Immobiliser, Passenger Airbag, Safety Belt Pretensioners, Side Airbags, Traction Control

Date of 1st Registration: 20090101

Land Rover Range Rover for Sale

2019 land rover range rover 3.0l v6 supercharged hse(US $33,788.00)

2019 land rover range rover 3.0l v6 supercharged hse(US $33,788.00) 2014 land rover range rover pure plus(US $2,500.00)

2014 land rover range rover pure plus(US $2,500.00) 2019 land rover range rover s(US $34,500.00)

2019 land rover range rover s(US $34,500.00) 2003 land rover range rover hse low 76k miles 1owner discover clean carfax(US $12,999.00)

2003 land rover range rover hse low 76k miles 1owner discover clean carfax(US $12,999.00) 2018 land rover range rover sv autobiography dynamic(US $80,990.00)

2018 land rover range rover sv autobiography dynamic(US $80,990.00) 2016 land rover range rover only 56k miles! one-owner. video in description(US $33,900.00)

2016 land rover range rover only 56k miles! one-owner. video in description(US $33,900.00)

Auto blog

Jaguar Land Rover hands Tata the biggest loss in Indian corporate history

Fri, Feb 8 2019BENGALURU/NEW DELHI — Jaguar Land Rover's owner Tata Motors Ltd stunned markets by posting the biggest-ever quarterly loss in Indian corporate history of about $4 billion on slumping China sales, sending its shares crashing as much as 30 percent. Tata Motors also warned that the Jaguar Land Rover (JLR) unit, which brings in most of its revenue, would swing to an operating loss for the year versus an earlier projection it would break even, given weak sales at the luxury British carmaker. JLR's China retail sales were cut almost in half in the December quarter as overall demand in the world's biggest auto market contracted last year for the first time since the 1990s. The firm has also been buffeted by Brexit woes and weaker business for diesel cars that account for bulk of its sales in Europe. Tata Motors turned in a third-quarter loss of 269.93 billion rupees ($3.8 billion) on Thursday, more than half its current market capitalization of $6.1 billion, mostly due to a massive impairment at JLR. Analysts were expecting a profit. "We are now taking clear and decisive actions in JLR to step up its competitiveness, reduce costs and improve cash flows and make the business fit for the future," Chief Financial Officer PB Balaji told reporters on a conference call on Thursday. JLR has taken steps to address the slide in China sales by changing its strategy to focus on profits for dealers instead of sales and incentivising retail sales over wholesale, he said. "We are encouraged by continued demand for the refreshed Range Rover and Range Rover Sport," JLR Chief Commercial Officer Felix Brautigam said in a statement. "With deliveries of the new Evoque due to start later this quarter, we look forward to building momentum." But analysts expect JLR to struggle to generate profit with China's economy projected to slow further this year after growth eased to its weakest pace in almost three decades in 2018. JLR's overall retail sales in January plunged 11 percent. The dour numbers prompted Tata investors to make a beeline for the exits as markets opened on Friday, with shares of the company skidding to their lowest in nine years at one point. The stock was down about 20 percent by 0720 GMT near 150 rupees, on track for its sharpest drop since 2003. At least four brokerages cut their price target for Tata Motors shares after its quarterly loss. Analysts at Jefferies pegged the stock at 250 rupees, versus an earlier target of 300 rupees, citing weak performance at JLR.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.

NHTSA, IIHS, and 20 automakers to make auto braking standard by 2022

Thu, Mar 17 2016The National Highway Traffic Safety Administration, the Insurance Institute for Highway Safety and virtually every automaker in the US domestic market have announced a pact to make automatic emergency braking standard by 2022. Here's the full rundown of companies involved: BMW, Fiat Chrysler Automobiles, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Subaru, Tesla, Toyota, Volkswagen, and Volvo (not to mention the brands that fall under each automaker's respective umbrella). Like we reported yesterday, AEB will be as ubiquitous in the future as traction and stability control are today. But the thing to note here is that this is not a governmental mandate. It's truly an agreement between automakers and the government, a fact that NHTSA claims will lead to widespread adoption three years sooner than a formal rule. That fact in itself should prevent up to 28,000 crashes and 12,000 injuries. The agreement will come into effect in two waves. For the majority of vehicles on the road – those with gross vehicle weights below 8,500 pounds – AEB will need to be standard equipment by September 1, 2022. Vehicles between 8,501 and 10,000 pounds will have an extra three years to offer AEB. "It's an exciting time for vehicle safety. By proactively making emergency braking systems standard equipment on their vehicles, these 20 automakers will help prevent thousands of crashes and save lives," said Secretary of Transportation Anthony Foxx said in an official statement. "It's a win for safety and a win for consumers." Read on for the official press release from NHTSA. Related Video: U.S. DOT and IIHS announce historic commitment of 20 automakers to make automatic emergency braking standard on new vehicles McLEAN, Va. – The U.S. Department of Transportation's National Highway Traffic Safety Administration and the Insurance Institute for Highway Safety announced today a historic commitment by 20 automakers representing more than 99 percent of the U.S. auto market to make automatic emergency braking a standard feature on virtually all new cars no later than NHTSA's 2022 reporting year, which begins Sept 1, 2022. Automakers making the commitment are Audi, BMW, FCA US LLC, Ford, General Motors, Honda, Hyundai, Jaguar Land Rover, Kia, Maserati, Mazda, Mercedes-Benz, Mitsubishi Motors, Nissan, Porsche, Subaru, Tesla Motors Inc., Toyota, Volkswagen and Volvo Car USA.