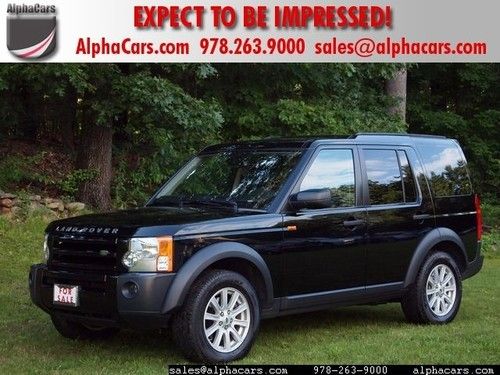

Lr3 V8-hse Luxury Pkg Navigation - Rear Entertainment -19"wheels -3rd Row Seats on 2040-cars

Hallandale, Florida, United States

Vehicle Title:Clear

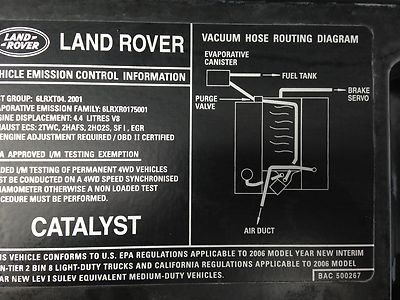

Engine:4.4L 4394CC V8 GAS DOHC Naturally Aspirated

For Sale By:Dealer

Body Type:Sport Utility

Fuel Type:GAS

Make: Land Rover

Model: LR3

Options: Sunroof

Trim: HSE Sport Utility 4-Door

Safety Features: Anti-Lock Brakes

Power Options: Power Windows

Drive Type: 4WD

Mileage: 70,700

Vehicle Inspection: Inspected (include details in your description)

Sub Model: LUXURY PKG

Exterior Color: Red

Number of Cylinders: 8

Interior Color: Black

Land Rover LR3 for Sale

7-passenger, dual screen entertainment, leather, dual sunroofs!(US $24,995.00)

7-passenger, dual screen entertainment, leather, dual sunroofs!(US $24,995.00) 2010 lr4 hse7 luxury pkg.10k miles,rear dvd,vision assist,1.49% financing(US $46,950.00)

2010 lr4 hse7 luxury pkg.10k miles,rear dvd,vision assist,1.49% financing(US $46,950.00) Leather heated seats harmon kardon bluetooth 7 passenger sat radio extra clean!(US $18,995.00)

Leather heated seats harmon kardon bluetooth 7 passenger sat radio extra clean!(US $18,995.00) 2006 land rover lr3 se sport utility 4-door 4.4l(US $13,900.00)

2006 land rover lr3 se sport utility 4-door 4.4l(US $13,900.00) Lr3 se-v8 *7 passenger* 3 sunroofs - h/k sound - black on black

Lr3 se-v8 *7 passenger* 3 sunroofs - h/k sound - black on black 2006 land rover lr3 hse sport utility 4-door 4.4l(US $22,950.00)

2006 land rover lr3 hse sport utility 4-door 4.4l(US $22,950.00)

Auto Services in Florida

Wildwood Tire Co. ★★★★★

Wholesale Performance Transmission Inc ★★★★★

Wally`s Garage ★★★★★

Universal Body Co ★★★★★

Tony On Wheels Inc ★★★★★

Tom`s Upholstery ★★★★★

Auto blog

Lexus leads J.D. Power's Vehicle Dependability Study for 2021

Thu, Feb 18 2021J.D. Power's latest Vehicle Dependability Study is out, and, not surprisingly, Lexus sits at the top for the ninth time in the last 10 years. Right behind Lexus is Porsche, followed by Kia, which is the highest-ranked mass-market brand in the study. Genesis, last year's top-ranked brand (in its first year included in the results), fell from first to eighth, though the G80 sedan did earn an award in its midsize luxury segment. The Porsche 911 was called out as the Most Dependable Model by J.D. Power for the second time in the last three years. The vehicles being studied are from the 2018 model year, which means owners have had three years to get to know their cars and trucks. It's notable that this year's study shows a marked improvement in overall vehicle dependability as tracked by J.D. Power. The overall level of problems, scored by the number of problems per 100 vehicles (PP100), declined by 10% compared to last year. "The study results validate what we have known for some time," said Dave Sargent, vice president of global automotive at J.D. Power. "Automakers are making increasingly dependable vehicles — but there are still some problem areas that need to be addressed and some warning signs on the horizon." Tesla makes its inaugural appearance on the Dependability Study, though its score of 176 PP100 isn't official. Tesla is the only automaker that has chosen not to grant J.D. Power permission to survey its owners in all 50 states. As we've pointed out in the past, the Vehicle Dependability Study includes eight major vehicle categories grouped by J.D. Power as follows: audio/communication/entertainment/navigation (ACEN); engine/transmission; exterior; interior; features/controls/displays (FCD); driving experience; heating, ventilation and air conditioning; and seats. All issues reported by owners are all tracked equally, which means a problematic phone pairing procedure dings an automaker's rating the same as a blown engine or transmission. And in fact, the ACEN category has more reported problems than any other, which means the majority of problems reported don't lead to a vehicle that leaves its owner stranded. Green Land Rover Lexus Porsche Car Buying JD Power dependability reliability

Jaguar Land Rover moves closer to building Slovakia plant

Tue, Aug 11 2015Jaguar Land Rover has announced its intention to build a new assembly plant in Slovakia. Though it has yet to make the final decision, the British automaker has signed a Letter of Intent with the Slovakian government. Its next step is to launch a feasibility study before committing. If the company does go ahead with plans, it wouldn't be the first automaker – or even the first European luxury automaker for that matter – to start producing in Slovakia. Nor would it be the first Jaguar Land Rover plant outside the UK, either. The Volkswagen Group, PSA Peugeot Citroen, and Kia all manufacture in the Central European country. VW's Bratislava plant in particular handles production of the Touareg, Audi Q7, and Porsche Cayenne. In the past few years, JLR has expanded its production capacity to new locations outside of the UK. It has a new factory in China, one under construction in Brazil, and has been manufacturing in India – home country of its parent company Tata – since 2011. It recently announced a manufacturing contract with Magna Steyr in Austria, and is investing in its facilities back home as well. Though yet to be finalized, the prospect of manufacturing in Slovakia has proven more favorable to JLR than other locations in Europe or in the United States or Mexico – all possibilities that the company says it looked into. It has yet to reveal just what it would produce there, saying only that "the plant would manufacture a range of aluminium Jaguar Land Rover vehicles," that the plant would be earmarked to come online in 2018 and eventually ramp up production to 300,000 vehicles. The prevailing wisdom would seem to indicate, however, that the site is being considered for the next-generation Land Rover Defender. Related Video: JAGUAR LAND ROVER UNVEILS NEXT STAGE OF GLOBAL EXPANSION PLANS - Letter of Intent signed for potential new plant in the Slovak Republic - Indicates the next stage of the Company's expansion plans to support a competitive global business in the future - Jaguar Land Rover's global expansion underpins long-term investment in new vehicles and technologies in the UK Coventry, UK – Jaguar Land Rover has signed a Letter of Intent with the Government of the Slovak Republic for the potential development of a new manufacturing plant in the city of Nitra in western Slovakia. With its established premium automotive industry, Slovakia is an attractive possible development opportunity.

Tesla layoffs, new safety mandates, and a bumper crop of V12s! | Autoblog Podcast #830

Fri, May 3 2024In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Associate Editor Byron Hurd for a gasoline-powered installment. They lead off by diving into the Tesla layoff news from this week before leaving electrification behind for a bit to talk about not one, but two production V12 unveilings. This isn't a drill, folks; Aston Martin and Ferrari are both committed. After that, they touch on the U.S. government announcement that it would mandate automatic emergency braking systems starting in 2029. They finish up the news segment with a chat about Fisker. Poor, poor Fisker. From there, it's on to the road tests. The Autoblog team has been testing out some EVs and both Byron and Greg had some thoughts to share, plus we get a final update from Byron on the long-term Subaru WRX and some notes from both drivers about the updated Range Rover Evoque. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast #830 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown News Axing Tesla's Supercharger department raises worries as other automakers join network Fisker tells its staff that four companies are interested in buying it Ferrari confirms the 812 Superfast's successor will keep the V12 alive Aston Martin isn't done with V12s, it redesigns the engine U.S. to require automatic emergency braking on new vehicles What we've been driving 2024 Hyundai Ioniq 6 2021 Tesla Model Y 2024 Range Rover Evoque Long-term Subaru WRX Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Government/Legal Green Podcasts Aston Martin Ferrari Hyundai Land Rover Subaru Tesla Convertible Coupe Crossover SUV Electric Performance Sedan