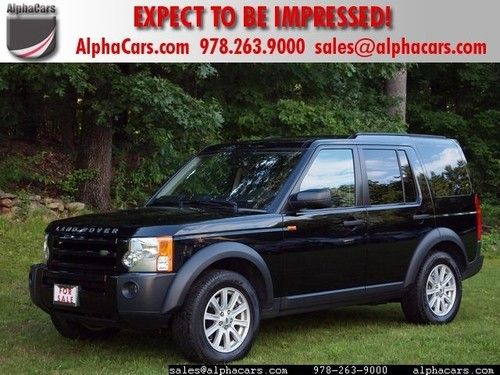

06 Land Rover Lr3 Se 4.0l V8 Awd Leather Colo Owned Suv No Rock Salt 80 Pics on 2040-cars

Parker, Colorado, United States

Body Type:SUV

Vehicle Title:Clear

Engine:4.0L 4009CC 245Cu. In. V6 GAS SOHC Naturally Aspirated

Fuel Type:Gasoline

For Sale By:Dealer

Number of Cylinders: 6

Make: Land Rover

Model: LR3

Trim: SE Sport Utility 4-Door

Options: Sunroof, 4-Wheel Drive, Leather Seats, CD Player

Drive Type: 4WD

Safety Features: Anti-Lock Brakes, Driver Airbag, Passenger Airbag

Mileage: 108,880

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows, Power Seats

Sub Model: SE

Exterior Color: Silver

Interior Color: Black

Warranty: Vehicle does NOT have an existing warranty

Land Rover LR3 for Sale

2007 landrover 4x4 lr3 se carfax certified 1-owner w/service records low reserve

2007 landrover 4x4 lr3 se carfax certified 1-owner w/service records low reserve 7-passenger, dual screen entertainment, leather, dual sunroofs!(US $25,995.00)

7-passenger, dual screen entertainment, leather, dual sunroofs!(US $25,995.00) 2006 land rover lr3 se sport utility 4-door 4.4l(US $13,000.00)

2006 land rover lr3 se sport utility 4-door 4.4l(US $13,000.00) 08 land rover lr3 hse 4.4l v8 awd navi roof 3rd row seat 19"(US $20,900.00)

08 land rover lr3 hse 4.4l v8 awd navi roof 3rd row seat 19"(US $20,900.00) 2005 land rover lr3

2005 land rover lr3 2005 land rover lr3 se one owner ,clean carfax records records!!

2005 land rover lr3 se one owner ,clean carfax records records!!

Auto Services in Colorado

We are West Vail Shell ★★★★★

Vanatta Auto Electric ★★★★★

Tim`s Transmission & Auto Repair ★★★★★

South Colorado Springs Nissan ★★★★★

Santos Muffler Auto ★★★★★

RV Four Seasons ★★★★★

Auto blog

Jaguar Land Rover posts profitable quarter amidst big yearly losses

Mon, May 20 2019Jaguar has posted its first profit in quite some time, as the financial quarter ending on March 31 brought in a net income of $151.6 million. However, that is the light in the end of the tunnel, as full year results through March showed a $4.58 billion loss (GBP3.6 billion). The losses are again attributable to declining sales in China, with a whiff of the still-lingering Brexit process. While JLR's annual U.S. sales were up 8.1 percent, and U.K. sales improved by 8.4%, overall sales came down 5.8% to 578,915 vehicles. For April, Chinese sales nearly halved as they dropped by 46 percent. Earlier this year, JLR's woes caused its owner Tata Motors to post the biggest ever quarterly loss in Indian corporate history, at nearly $4 billion. JLR's CEO Ralf Speth stated that the company is "reducing complexity" and transforming its business by cost savings and cash flow improvements, citing the fourth-quarter profits as an example of the ongoing turnaround. Speth said JLR has already managed to deliver $1.59 billion (GBP1.25 billion) of efficiencies and savings. JLR says its turnaround program, dubbed Charge, will drive it to at least $3.18 billion (GBP2.5 billion) of investment, working capital and profit improvements by March 2020, and that it currently has $4.84 billion (GBP3.8 billion) of cash. Speth continued that JLR will "go forward as a transformed company that's leaner and fitter," and that the sustained investment in new products and technologies will drive future demand. There has been earlier speculation of Tata Motors selling JLR to the PSA Group, but as Autocar reports, Tata's financial chief again refuted these rumors. JLR also announced today that its CFO of 11 years, Ken Gregor is stepping down after 22 years with the company, and that he will be succeeded by JLR's Chief Transformation Officer, Adrian Mardell.

2018 Range Rover Sport Coupe spied in Scotland

Wed, Jun 8 2016Sport utility vehicles are the rage. SUVs with coupe styling are pretty popular, too, as BMW and Mercedes have demonstrated. Now it's Land Rover's turn. Believed to be the upcoming Range Rover Sport Coupe, this ute was spied this week during top secret testing at a remote location in Scotland. The vehicle would slot between the Range Rover Sport and Evoque, giving Land Rover an answer to the Mercedes GLE and BMW X6. These shots show what appears to be a chopped roofline, giving the new model a sportier profile than the traditional upright silhouette of Rovers. We expect it will use a version of the aluminum Jaguar F-Pace platform and offer V6 and V8 engines. It could also offer a hybrid or full electric version. The new crossover might also be lower set in a bid to differentiate it from traditional Rovers and give it a performance vibe. The Range Rover Sport Coupe – or whatever it is ultimately called – would enter a strong segment that's found favor in the United States. Once derided for potentially offering less function than traditional utes, these lifestyle vehicles have developed a strong following for their style and capability. The X6 was so successful, BMW added the smaller X4, and this forced Mercedes to follow suit with the GLE and GLC coupe variants. In this context, it's about time for Land Rover to join the fray. Related Video: Featured Gallery 2018 Land Rover Range Rover Sport Coupe View 12 Photos Image Credit: KGP Photography Design/Style Spy Photos BMW Land Rover Mercedes-Benz

Jaguar Land Rover and Cambridge have developed a touchless touchscreen

Thu, Jul 23 2020Jaguar Land Rover and the University of Cambridge are working on new touchscreen technology that eliminates the need to touch the screen. Counterintuitive, right? It’s called “predictive touch” for now, in part because the system is able to predict what you might be aiming for on the screen. The video at the top of this post is the best way to understand how users will interact with the tech, but weÂ’ll do some more explaining here. You simply reach out with your finger pointing toward the item on screen that you want to select. ItÂ’ll highlight the item and then select it. HereÂ’s how it works, according to the University of Cambridge: “The technology uses machine intelligence to determine the item the user intends to select on the screen early in the pointing task, speeding up the interaction. It uses a gesture tracker, including vision-based or radio frequency-based sensors, which are increasingly common in consumer electronics; contextual information such as user profile, interface design, environmental conditions; and data available from other sensors, such as an eye-gaze tracker, to infer the userÂ’s intent in real time.” Cambridge claims that lab tests showed a 50 percent reduction in both effort and time by the driver in using the screen, which would theoretically translate to more time looking at the road and less time jabbing away at the screen. If the prediction and machine learning tech is good enough, we could see this resulting in a reduced number of accidental inputs. However, on a certain level it almost sounds more difficult to point at a screen while moving than it does to actually touch a section of that screen. Without using the tech and its supposedly great predictive abilities, we canÂ’t come to any grand conclusions. One comparison you may already be thinking of is BMWÂ’s Gesture Controls. ItÂ’s already been addressed with a subtle diss from Cambridge: “Our technology has numerous advantages over more basic mid-air interaction techniques or conventional gesture recognition, because it supports intuitive interactions with legacy interface designs and doesnÂ’t require any learning on the part of the user,” said Dr Bashar Ahmad of the University of Cambridge. Of course, this tech can be used for much more than just vehicle touchscreen control. Cambridge says it could be integrated into ATMs, airport check-in kiosks, grocery store self checkouts and more.