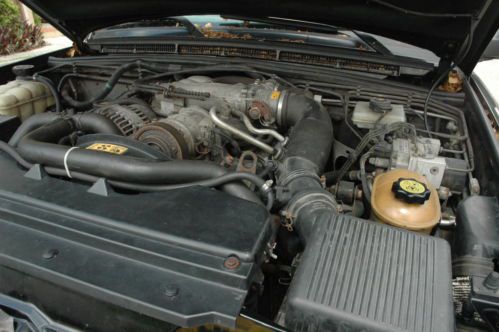

1999 Land Rover Discovery Series Ii Sport Utility 4-door 4.0l on 2040-cars

Miami, Florida, United States

|

THIS SUV IS SO NICE PLEASE SEE THE PICTURES NEW TIRES, VERY GOOD DRIVE LOOKE LIKE NEW ALL WAY CARE GOOD ENGINE, NICE LEATHER INSIDE TWO MOON ROOF

ANY PLEASE LET ME KNOW SO HAPPY TO ANSWER ANY QUESTIONS CAR WITH ME FOR THE LAST 10 YEARS |

Land Rover Discovery for Sale

One owner fresh head gaskets overheats leather sell no reserve mechanics special

One owner fresh head gaskets overheats leather sell no reserve mechanics special 1996 land rover discovery sd sport utility 4-door 4.0l(US $1,500.00)

1996 land rover discovery sd sport utility 4-door 4.0l(US $1,500.00) *must see* se free shipping / 5-yr warranty! dual sunroof leather power 4x4 se(US $8,995.00)

*must see* se free shipping / 5-yr warranty! dual sunroof leather power 4x4 se(US $8,995.00) *low miles* loaded! free 5-yr warranty / shipping! leather 4wd must see!(US $7,995.00)

*low miles* loaded! free 5-yr warranty / shipping! leather 4wd must see!(US $7,995.00) Awd celery hse navigation sunroofs heated leather backup sensors serviced

Awd celery hse navigation sunroofs heated leather backup sensors serviced 2003 land rover discovery se sport utility 4-door 4.6l low miles 4x4 suv(US $7,500.00)

2003 land rover discovery se sport utility 4-door 4.6l low miles 4x4 suv(US $7,500.00)

Auto Services in Florida

Zych`s Certified Auto Svc ★★★★★

Yachty Rentals, Inc. ★★★★★

www.orlando.nflcarsworldwide.com ★★★★★

Westbrook Paint And Body ★★★★★

Westbrook Paint & Body ★★★★★

Ulmerton Road Automotive ★★★★★

Auto blog

Here's today's round of auto plant closures in response to coronavirus

Fri, Mar 20 2020More automakers have shuttered factories, as businesses everywhere work to slow the spread of the Covid-19 coronavirus — and as the pandemic slows sales and disrupts parts supply chains. On Friday, the following closures were announced: • Volvo will close its factories in Sweden and the United States from March 26 to April 14. Volvo's U.S. facility, in Charleston, South Carolina, makes the S60 sedan. Its assembly plant in Torslanda, Sweden, turns out the XC90, SC60, and V90. Other Swedish facilities make engines and component parts. A Volvo factory in Ghent, Belgium, that builds the XC40 and V60 closed earlier this week and is expected to remain offline until April 6. Volvo's four factories in China have been reopened after a shutdown earlier this year. • Jaguar Land Rover announced that it will suspend production at its assembly plants in the UK over the coming week. The shutdown is expected to last until April 20. Elsewhere, production continues at the company's factories in India and Brazil, and JLR's joint-venture plant in China reopened at the end of February. • Bentley is closing its factory in Crewe, England, for four weeks, effective today. • Bugatti has put its atelier in Molsheim, France, on hiatus. No date was given for when assembly of its supercars might resume. • Mercedes-Benz on Monday will shut down its SUV factory in Alabama and its van assembly plant in South Carolina. Both will remain closed for a minimum of two weeks. Tesla yesterday revealed that it will suspend operations at its Fremont, California, vehicle assembly plant next week, on order from local officials there. Yesterday's factory closure announcements also included the U.S. assembly plants for Toyota (until April 6), Volkswagen (through March 29), Subaru (through March 29), and Hyundai (no time period specified). They join GM, Ford, Chrysler, Honda, Nissan, and Harley-Davidson, which earlier this week announced the suspension of production at their facilities. Plants/Manufacturing Bentley Bugatti Jaguar Land Rover Mercedes-Benz Volvo coronavirus

With a new Jaguar and the Shell app, your car can pay for its own gas

Wed, Feb 15 2017Contactless payments are making their way into the car. Jaguar and Shell have the first major rollout, allowing you to pay for fuel through the car's touchscreen. Of course you'll still have to get out of the car to actually pump the fuel into the car, but hey, progress, right? Apple Pay and PayPal will be available payment methods from the start, and Android Pay will be added later. For this all to work, you'll need a new Jaguar (or Land Rover) with the InControl infotainment system, a connected phone with the InControl app and Shell app, some space in your tank, and some electronic money. When you pull up to a Shell station and launch the Shell app through the touchscreen, the car will use geolocation to figure out which station you're at and then prompt you to enter the pump number you're next to (don't want to pay for someone else's fuel now do you?). Once that's done, you tell the system how much fuel you want (it's not clear if you can just fill the tank like most normal people do) and then the screen in the car shows you a receipt; one is also sent to you via email. While this might just seem like trading one screen for another and entering info through your car instead of at the pump, contactless payments also have an added level of security over pulling out a credit card. (Credit card skimmers, which steal card data when you go to swipe at a kiosk or ATM, have been popular at gas stations.) It will also be welcome in the winter months, when you can limit your exposure time. Plus you'll never again have to respond to this incomplete sentence, which greets us at Shell stations everywhere: "Is this debit card?" InControl is available on every Jaguar and Land Rover model. And if you get this Shell app working on an F-Pace with the Jaguar Activity Key, you'll have the latest in minimal-touch technology. The system will roll out to people in the UK first and should arrive in the US later this year. Related Video: Jaguar Land Rover Technology Smartphone Luxury shell paypal

Autoblog's ultimate holiday rides

Tue, Dec 16 2014Over the hills and through the woods, it's the time of year when many of us visit family and friends for the holidays. But getting there can be a chore. It's cold and snowy across much of the United States, and even if the climate is favorable, the drive to grandmother's house often is not. Think back to holiday road trips of yore: They probably included crying babies, antsy children, hungover adults and frequent bathrooms stops all around. Now, we're all at different life stages here at Autoblog, and the perfect car for one staffer might be as useful as a team of Budweiser Clydesdales to another. Some of us bounce from family event to family event with children and a labrador in tow, while others prefer a quieter, simpler holiday. But whatever the endeavor, we all need wheels. With that in mind, here is the unofficial Autoblog list of the ultimate cars in which to tackle the holiday season. 2015 Ferrari FF To borrow a chestnut from Top Gear presenter James May, "As you'd expect, I've done this properly." That oddly voluptuous ruby bolide in the photo above? It's a 2015 Ferrari FF – all 652 all-wheel-driven horsepower of it. What makes a Ferrari the ideal for holiday time in PaukertLand? My Midwestern winter breaks are wonderful, but they're typically frenetic and slushy, involving a lot of schlepping from house to house and even city to city, not to mention inevitable last-minute runs for forgotten presents and dinner ingredients. Needless to say, a powerful V12 is a welcome ally for such duties. And this one isn't just a friend when the road is clear. The FF has been gifted Ferrari's novel 4RM AWD system, and despite sitting lower to the ground than, say, an SUV, it's a pretty effective tool for real winter driving, especially when outfitted with a set of snow tires. Unlike other Ferraris, it's also a rather practical thing, with legitimate seating for four adults and 15.9 cubic feet of cargo space – that's precisely as much room as a Mercedes E-Class – and you can fold the rear chairs and cram 28.2 cubes-worth of holiday cheer in the back. Okay, so it's far from cheap and fuel economy isn't that great, but who cares? Just drop a paddle-shifted gear or two, bury the throttle and Repeat The Sounding Joy. Ain't the holidays grand? – Chris Paukert Executive Editor 2015 Chevrolet Tahoe My Mom gives out more presents than any other human being I've ever encountered.