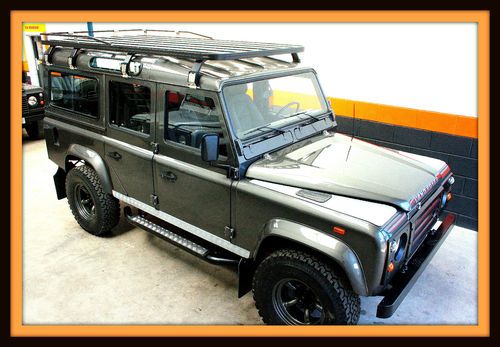

Land Rover Defender Tdi Diesel In Excellent Condition on 2040-cars

Venice, Florida, United States

Body Type:SUV

Engine:Turbo diesel

Vehicle Title:Clear

Fuel Type:Diesel

For Sale By:Private Seller

Model: Defender

Drive Type: 5 speed manual

Mileage: 160,000

Exterior Color: Yellow

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Gray

Year: 1986

Number of Cylinders: 4

Trim: swb SUV

The best 4x4 by far ! This perfect Defender is not only a pleasure to drive but is economical too with the Land Rover turbo diesel motor. Clear Florida title. RHD . Excellent Pirelli tires. Strong , tight and smooth suspension. Buying a property forces the sale of my baby. Garage kept. The vin number is Salldvab7aa278091. Rust free.

Land Rover Defender for Sale

D90 4x4 soft-top 5-speed roof rack $5k service just done at dealer!(US $32,900.00)

D90 4x4 soft-top 5-speed roof rack $5k service just done at dealer!(US $32,900.00) Completely restored land rover defender 110(US $60,000.00)

Completely restored land rover defender 110(US $60,000.00) Land rover d-110 defender. left hand drive 200tdi 2.5 diesel custom built(US $48,500.00)

Land rover d-110 defender. left hand drive 200tdi 2.5 diesel custom built(US $48,500.00) 1997 land rover defender 90(US $17,200.00)

1997 land rover defender 90(US $17,200.00) Super land rover defender county 6 -seater diesel-shipping service(US $12,000.00)

Super land rover defender county 6 -seater diesel-shipping service(US $12,000.00) 1986 land rover defender 90 3.5 v8 sw 4x4 off-roader !!

1986 land rover defender 90 3.5 v8 sw 4x4 off-roader !!

Auto Services in Florida

Zych Certified Auto Repair ★★★★★

Xtreme Automotive Repairs Inc ★★★★★

World Auto Spot Inc ★★★★★

Winter Haven Honda ★★★★★

Wing Motors Inc ★★★★★

Walton`s Auto Repair Inc ★★★★★

Auto blog

Jaguar Land Rover to recall 44,000 vehicles over excessive diesel emissions

Thu, Mar 14 2019Jaguar Land Rover is recalling 44,000 vehicles in the U.K. due to some of its vehicles emitting higher CO2 emissions than were officially stated. The recall is said to affect vehicles equipped with JLR's 2.0-liter diesel engine in cars built between 2014 and 2018. Quite a few models are affected, including the Jaguar XE, XF, E-Pace, F-Pace, along with the Land Rover Discovery Sport, Range Rover Evoque, Range Rover Velar and Range Rover Sport. The excessive CO2 emissions were discovered by the British vehicle certification agency, who then reported it to JLR. The company is reportedly working on a fix that will satisfy the agency and bring the cars back in line with their stated CO2 emissions. As of now, JLR is not saying what the fix will entail. A statement from JLR reads: "The modifications will be made free of charge, and every effort will be made to minimize inconvenience to the customer." The U.K. magazine Which? said JLR told them owners might experience minor changes to the "overall vehicle experience." Reading between the lines there, that sounds like there could be some pretty serious tampering with the engine software, but we'll leave the speculation to a minimum for now. CO2 emissions numbers are used in the U.K. to set tax levels for vehicles, which means JLR could have gotten out of some taxation with its artificially low CO2 numbers. At this point we don't know how badly the numbers are off, so it's impossible to know how egregious the mislabeling is. There also isn't any explanation for why the CO2 numbers are off, but this is all information that could be forthcoming. The 44,000 number could rise, too, because the UK vehicle standards agency says that some gasoline models could also be involved. That would open a whole new can of worms for JLR. Some Jaguar vehicles (XE, XF and F-Pace) offer a 2.0-liter diesel option for the U.S., but Land Rover's only diesel it sells here now is the 3.0-liter V6. For the time being there's no recall out on the diesel or gas engines from JLR in the U.S. There's no chatter surrounding emissions cheat devices like those involved with Volkswagen's diesel emissions scandal. Nor does the scale of whatever the problem is come anywhere near the amount of Volkswagen diesels that needed to be recalled or taken off the roads. We'll be keeping tabs on the situation to see if this expands any further than the U.K. Green Recalls Jaguar Land Rover SUV Diesel Vehicles Luxury Sedan

Honda and Chrysler EV news, and talking with GM's charging ecosystem boss | Autoblog Podcast #781

Fri, May 19 2023In this episode of the Autoblog Podcast, Editor-in-Chief Greg Migliore is joined by Senior Editor, Green, John Beltz Snyder. They're excited about the news of the possibility of an electric sports car being revealed for Honda's 75th anniversary, as well as the completely revamped — redesigned and renamed — Chrysler Airflow. They've been driving the Bentley Bentayga EWB, Range Rover, Toyota GR Corolla and the refreshed Buick Encore GX. We listen to a interview Greg conducted with GM's EV charging boss, Hoss Hassani. Finally, a reader is looking to help his in-laws choose an SUV, possibly a hybrid or EV, to replace a BMX X3. Send us your questions for the Mailbag and Spend My Money at: Podcast@Autoblog.com. Autoblog Podcast # 781 Get The Podcast Apple Podcasts – Subscribe to the Autoblog Podcast in iTunes Spotify – Subscribe to the Autoblog Podcast on Spotify RSS – Add the Autoblog Podcast feed to your RSS aggregator MP3 – Download the MP3 directly Rundown News Honda electric sports car could be unveiled this year Chrysler Airflow being redesigned and renamed for production Cars we're driving 2023 Bentley Bentayga EWB Azure First Edition 2023 Land Rover Range Rover SE LWB 2023 Toyota GR Corolla Morizo 2024 Buick Encore GX Avenir Interview with Hoss Hassani, General Motors Vice President and EV Charging Ecosystem Spend my Money Feedback Email – Podcast@Autoblog.com Review the show on Apple Podcasts Autoblog is now live on your smart speakers and voice assistants with the audio Autoblog Daily Digest. Say “Hey Google, play the news from Autoblog” or "Alexa, open Autoblog" to get your favorite car website in audio form every day. A narrator will take you through the biggest stories or break down one of our comprehensive test drives. Related video: Green Podcasts Bentley Buick Chrysler GM Honda Land Rover Toyota Green Automakers Crossover Hatchback SUV Electric Future Vehicles Luxury Performance Sedan

Land Rover will put a Covid-nuking air filtration system in future cars

Tue, Mar 16 2021Jaguar - Land Rover (JLR) is developing an air filtration system that inhibits up to 97% of viruses and airborne bacteria. Designed like a face mask for your car's HVAC system, it's built on Panasonic's Nanoe X technology. Most of the company's models (including the Land Rover Defender) currently come equipped with Panasonic's Nanoe technology and PM2.5 filtration. Nanoe X is 10 times more effective, according to the brand, because it relies on a high voltage to create trillions of hydroxyl (OH) radicals enveloped in nano-sized water molecules. Think of them as Roman guards in front of a fortress: they keep the bad out, and ensure only the good can come in. Viruses and bacteria proteins are denatured when they come into contact with the filtration system, meaning they can't reproduce or grow. The OH radicals also zap common allergens and mold, but they're harmless to humans. JLR stressed it's not relying on computer simulations to decide whether its filtration system works as designed. It asked British laboratory Perfectus Biomed to perform a test that simulates a ventilation system in recirculation mode for a 30-minute cycle in a sealed chamber. The results were encouraging: 97% of viruses and airborne bacteria were nuked. The carmaker pointed out Panasonic's Nanoe X technology has been independently proven to inhibit 99.995% of coronaviruses during a two-hour laboratory test carried out by French immunology lab Texcell. Future models from Jaguar and Land Rover will use this technology, though a representative for both companies declined to tell us when it will reach production, and which nameplate(s) will inaugurate it. Meanwhile, Honda launched its own coronavirus killer across the pond. It's a cabin air filter sold as a genuine replacement part that consists of four layers, including one coated with an active substance of fruit extract that inactivates nearly 100% of the viral aerosols it captures. It's available in Europe through Honda dealers, but it won't be sold in America. Jaguar Land Rover