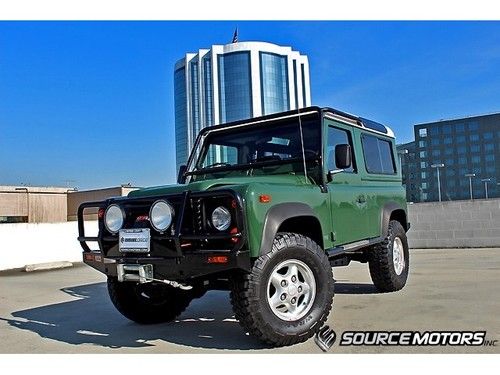

Land Rover: Defender 90 on 2040-cars

Belvedere Tiburon, California, United States

Body Type:Sport Utility

Engine:3.9L 8 Cylinder Gasoline Fuel

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Interior Color: Gray

Make: Land Rover

Number of Cylinders: 8

Model: Defender

Trim: 2 Door Wagon

Drive Type: 4WD

Options: Sunroof, 4-Wheel Drive, CD Player

Mileage: 155,000

Sub Model: 2 Door Wagon

Exterior Color: White

Warranty: Vehicle does NOT have an existing warranty

1994 Land Rover Defender 90 - 155,000 miles. Nice condition. Original white paint, original interior, all in respectable condition. Recently serviced and ready to go. Starts, runs and drives well with everything in working order. About $2,000 in recent services by a reputable British repair and restoration shop, including a new radiator, new alternator and new clutch slave cylinder. The gauges were upgraded by previous owner. Inspection welcomed.

This is a NAS (North American Specification) truck, not a gray market import. It was originally a soft top but was converted to a wagon by a previous owner with genuine Land Rover parts.

Modifications:

Tuffy locking center console

Alpine CD player

Front skid plate

Autometer cobalt gauges

Center dash console with switches

Mallory distributor

Upgraded oil cooler lines

Recent service:

Full head gasket service with machined heads ($1800 in work)

New alternator ($600)

Clutch slave cylinder ($600)

New radiator ($700)

The Good:

Clean Carfax, strong engine, clean inside and out and overall a good all around driving truck.

The bad:

Some corrosion as seen in pics

This D90 is fitted with the LT77 5 speed transmission, the synchros are all in great shape.

Land Rover Defender for Sale

1984 land rover defender 90 rebuild(US $46,500.00)

1984 land rover defender 90 rebuild(US $46,500.00) 1994 land rover defender 90(US $55,000.00)

1994 land rover defender 90(US $55,000.00) 1997 land rover defender 90(US $66,000.00)

1997 land rover defender 90(US $66,000.00) Land rover 90 1985 petrol rhd totally legal all states free shipping to port(US $9,640.00)

Land rover 90 1985 petrol rhd totally legal all states free shipping to port(US $9,640.00) 1985 land rover defender 90 county edition lhd diesel(US $22,000.00)

1985 land rover defender 90 county edition lhd diesel(US $22,000.00) D90 station wagon, 2 owner, automatic, winch, arb, hella, coniston green

D90 station wagon, 2 owner, automatic, winch, arb, hella, coniston green

Auto Services in California

Z Best Auto Sales ★★★★★

Woodland Hills Imports ★★★★★

Woodcrest Auto Service ★★★★★

Western Tire Co ★★★★★

Western Muffler ★★★★★

Western Motors ★★★★★

Auto blog

Jaguar Land Rover may build factory in Saudi Arabia

Tue, 11 Dec 2012The Middle East is one of the fastest-growing markets for Land Rover, so it makes sense that the automaker is looking to set up shop in the region. According to Automotive News, Jaguar Land Rover is in talks with the people of Saudi Arabia to build a factory in the country at an expected initial cost of $1.2 billion. Still in the early stage of talks, the proposed facility could start up by 2017 using locally sourced materials such as steel and aluminum.

Such an arrangement could be beneficial for both entities as Saudi Arabia looks to diversify its oil-reliant economy and Land Rover could get local production capacity of around 50,000 units. The report also says that the agreement talks about the possibility for Jaguar models to be built at the same plant further down the road.

This won't be the first vehicle produced in Saudi Arabia - that honor goes to the KSU Gazal-1 - but it will be the first from a major global automaker.

Rising aluminum costs cut into Ford's profit

Wed, Jan 24 2018When Ford reports fourth-quarter results on Wednesday afternoon, it is expected to fret that rising metals costs have cut into profits, even as rivals say they have the problem under control. Aluminum prices have risen 20 percent in the last year and nearly 11 percent since Dec. 11. Steel prices have risen just over 9 percent in the last year. Ford uses more aluminum in its vehicles than its rivals. Aluminum is lighter but far more expensive than steel, closing at $2,229 per tonne on Tuesday. U.S. steel futures closed at $677 per ton (0.91 metric tonnes). Republican U.S. President Donald Trump's administration is weighing whether to impose tariffs on imported steel and aluminum, which could push prices even higher. Ford gave a disappointing earnings estimate for 2017 and 2018 last week, saying the higher costs for steel, aluminum and other metals, as well as currency volatility, could cost the company $1.6 billion in 2018. Ford shares took a dive after the announcement. Ford Chief Financial Officer Bob Shanks told analysts at a conference in Detroit last week that while the company benefited from low commodity prices in 2016, rising steel prices were now the main cause of higher costs, followed by aluminum. Shanks said the automaker at times relies on foreign currencies as a "natural hedge" for some commodities but those are now going in the opposite direction, so they are not working. A Ford spokesman added that the automaker also uses a mix of contracts, hedges and indexed buying. Industry analysts point to the spike in aluminum versus steel prices as a plausible reason for Ford's problems, especially since it uses far more of the expensive metal than other major automakers. "When you look at Ford in the context of the other automakers, aluminum drives a lot of their volume and I think that is the cause" of their rising costs, said Jeff Schuster, senior vice president of forecasting at auto consultancy LMC Automotive. Other major automakers say rising commodity costs are not much of a problem. At last week's Detroit auto show, Fiat Chrysler Automobiles NV's Chief Executive Officer Sergio Marchionne reiterated its earnings guidance for 2018 and held forth on a number of topics, but did not mention metals prices. General Motors Co gave a well-received profit outlook last week and did not mention the subject. "We view changes in raw material costs as something that is manageable," a GM spokesman said in an email.

The UK votes for Brexit and it will impact automakers

Fri, Jun 24 2016It's the first morning after the United Kingdom voted for what's become known as Brexit – that is, to leave the European Union and its tariff-free internal market. Now begins a two-year process in which the UK will have to negotiate with the rest of the EU trading bloc, which is its largest export market, about many things. One of them may be tariffs, and that could severely impact any automaker that builds cars in the UK. This doesn't just mean companies that you think of as British, like Mini and Jaguar. Both of those automakers are owned by foreign companies, incidentally. Mini and Rolls-Royce are owned by BMW, Jaguar and Land Rover by Tata Motors of India, and Bentley by the VW Group. Many other automakers produce cars in the UK for sale within that country and also export to the EU. Tariffs could damage the profits of each of these companies, and perhaps cause them to shift manufacturing out of the UK, significantly damaging the country's resurgent manufacturing industry. Autonews Europe dug up some interesting numbers on that last point. Nissan, the country's second-largest auto producer, builds 475k or so cars in the UK but the vast majority are sent abroad. Toyota built 190k cars last year in Britain, of which 75 percent went to the EU and just 10 percent were sold in the country. Investors are skittish at the news. The value of the pound sterling has plummeted by 8 percent as of this writing, at one point yesterday reaching levels not seen since 1985. Shares at Tata Motors, which counts Jaguar and Land Rover as bright jewels in its portfolio, were off by nearly 12 percent according to Autonews Europe. So what happens next? No one's terribly sure, although the feeling seems to be that the jilted EU will impost tariffs of up to 10 percent on UK exports. It's likely that the UK will reciprocate, and thus it'll be more expensive to buy a European-made car in the UK. Both situations will likely negatively affect the country, as both production of new cars and sales to UK consumers will both fall. Evercore Automotive Research figures the combined damage will be roughly $9b in lost profits to automakers, and an as-of-yet unquantified impact on auto production jobs. Perhaps the EU's leaders in Brussels will be in a better mood in two years, and the process won't devolve into a trade war. In the immediate wake of the Brexit vote, though, the mood is grim, the EU leadership is angry, and investors are spooked.