2020 Land Rover Defender Se on 2040-cars

Greensboro, North Carolina, United States

Engine:3.0L I6

Fuel Type:Gasoline

Body Type:4D Sport Utility

Transmission:Automatic

For Sale By:Dealer

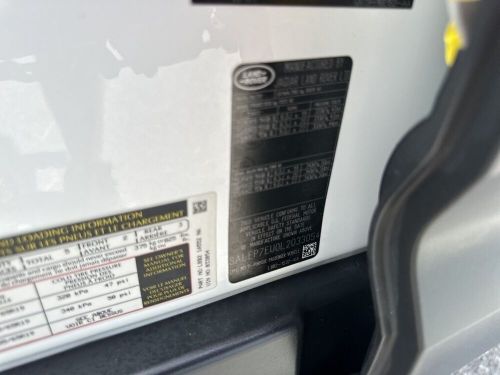

VIN (Vehicle Identification Number): SALEP7EU0L2033054

Mileage: 38783

Make: Land Rover

Trim: SE

Features: --

Power Options: --

Exterior Color: White

Interior Color: --

Warranty: Unspecified

Model: Defender

Land Rover Defender for Sale

1995 land rover defender 110 overlander rhd(US $79,995.00)

1995 land rover defender 110 overlander rhd(US $79,995.00) 1997 land rover defender 90(US $199,900.00)

1997 land rover defender 90(US $199,900.00) 1987 land rover defender(US $997.00)

1987 land rover defender(US $997.00) 2023 land rover defender(US $53,750.00)

2023 land rover defender(US $53,750.00) 1998 land rover defender(US $63,500.00)

1998 land rover defender(US $63,500.00) 1988 land rover defender 90 ls3(US $104,999.00)

1988 land rover defender 90 ls3(US $104,999.00)

Auto Services in North Carolina

Willmon Auto Sales ★★★★★

Westend Auto Service ★★★★★

West Ridge Auto Sales Inc ★★★★★

Valvoline Instant Oil Change ★★★★★

USA Automotive ★★★★★

Triangle Window Tinting ★★★★★

Auto blog

Jaguar Land Rover recalls Takata airbag-equipped cars

Fri, Aug 5 2016In the latest chapter of what feels like the never-ending recall, Jaguar Land Rover announced that it's calling back 2009-2011 Jaguar XFs and 2007-2011 Land Rover Range Rovers for defective Takata airbags on the front passenger side. These Takata airbags have propellant that may have degraded and, if activated, could release metal shrapnel. The company is breaking up the recall into four phases, since currently there are not enough parts to do a full recall. Since the airbags can be more seriously affected by high heat and humidity, the first phase will cover vehicles that were sold and/or registered in regions with high temperatures and humidity. The regions included are as follows: Alabama, California, Florida, Georgia, Hawaii, Louisiana, Mississippi, South Carolina, Texas, Puerto Rico, American Samoa, Guam, the Northern Mariana Islands, and the US Virgin Islands. Other phases will begin as parts become available, and priority will be given to regions at greater risk of having defective equipment. Jaguar Land Rover encourages owners of affected vehicles to go to www.SaferCar.gov to check if their vehicle is included in the current recall. The first phase includes 54,000 of 108,000 affected vehicles. The company is also notifying owners of the issue, who will eventually get a second notification when parts are available so they can schedule a time to have the airbags replaced. Related Video:

2016 Jaguar F-Type R at Monticello | AutoblogVR

Tue, Sep 27 2016This week we indulged in a bit of fun. We took one of our favorite sports cars, the 2016 Jaguar F-Type to Monticello Motor Club north of New York. Senior Editor Greg Migliore selected the 550-horsepower R variant and pushed this Jag to the limit at one of North America's prettiest tracks. He reveled in the supercharged V8's power and sound as he embraced Monticello's curves and long straightaways. Meanwhile, Consumer Editor Jeremy Korzeniewski had a similar experience. Kind of. He lapped Monticello in the 2016 Land Rover Range Rover Sport SVR and then went off-roading at a challenging course nearby. It's the best of both worlds. He gets to soak in the blown V8 – but also gets to splatter a little mud. Each week, new episodes will launch on the AutoblogVR App. We'll preview them here on Autoblog, but for the full immersive experience, head over to the app, which you can download for free from the App store and Google Play. Be sure to try it with a cardboard viewer, too! Jaguar Land Rover Driving Off-Road Vehicles Videos VR Original Video virtual reality 360video

Jaguar Land Rover opening its first U.S.-based classic center in Georgia

Sun, Aug 19 2018Jaguar Land Rover Classic currently operates two of its Works Centres, one in Coventry, England and the other in Essen-Kettwig, Germany (pictured). Just in time for Pebble Beach, the English carmaker has announced that it will bring its first facility to the United States next year, having signed a deal to open the latest Works operation in Savannah, Georgia. To be located in the Crossroads Business Park near Gulfstream Aerospace, the facility will engage in the sales, service, and restoration of Jaguar and Land Rover vehicles out of production for at least ten years. The 150,000-square-foot Coventry site opened two years ago and is said to be the largest dedicated factory workshop of its kind (the largest unaffiliated shop is in the Philippines). Jaguar builds its continuation cars there, like the D-Type and XKSS, while Land Rover uses it to build the Defender Works V8. Shoppers can also buy vintage models off the showroom floor, a variation of the Certified Pre-Owned program called Works Legends, that come with a 12-month warranty. Or, Jaguar Land Rover will locate, restore, and maintain one of the classic company products that a buyer chooses. In the UK, a Land Rover Series 1 starts at around $90,000, a Jaguar E-Type starts at around $400,000. The 48,000 Essen-Kettwig center opened last year with the same brief, and the U.S. center can provide those services to the world's largest classic car market. Construction on the 75,000-square-foot complex is scheduled to begin next August, and the facility will include a 42-bay workshop and showroom. The automaker will invest from $10 to $15 million, and predicts more than $45 million in revenue. Savannah Economic Development Authority President and CEO Trip Tollison told The Savannah Morning News that JLR will hire 75 workers at a starting salary of $80,000. Related Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.