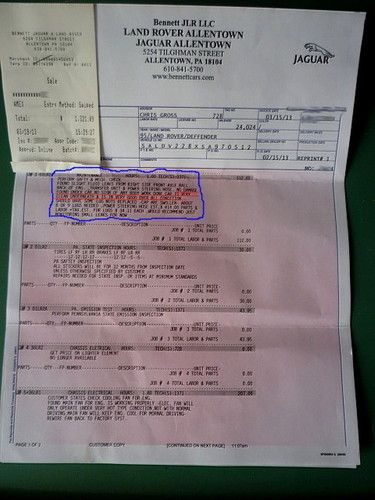

1995 Land Rover Defender 90 Base Sport Utility 2-door 3.9l on 2040-cars

Quakertown, Pennsylvania, United States

Body Type:Sport Utility

Engine:3.9L 3950CC V8 GAS OHV Naturally Aspirated

Vehicle Title:Clear

Fuel Type:GAS

For Sale By:Private Seller

Number of Cylinders: 8

Model: Defender

Trim: Base Sport Utility 2-Door

Drive Type: 4 wheel Drive

Options: 4-Wheel Drive, CD Player

Mileage: 39,240

Safety Features: Anti-Lock Brakes

Sub Model: 90

Power Options: Air Conditioning

Exterior Color: White

Interior Color: Gray

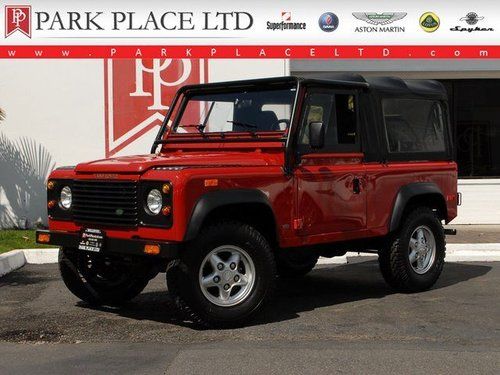

Land Rover Defender for Sale

Defender 130(US $25,000.00)

Defender 130(US $25,000.00) 1994 land rover d90, soft-top, 5-speed(US $41,950.00)

1994 land rover d90, soft-top, 5-speed(US $41,950.00) 1997 land rover defender “wolf” edition - extremely rare!

1997 land rover defender “wolf” edition - extremely rare! 1988 land rover defender county 6 seater-low miles-delivery service

1988 land rover defender county 6 seater-low miles-delivery service 1997 land rover defender 90(US $34,000.00)

1997 land rover defender 90(US $34,000.00) 1997 land rover d90 limited addition "low mileage, excellent, rare!!!"

1997 land rover d90 limited addition "low mileage, excellent, rare!!!"

Auto Services in Pennsylvania

Young`s Auto Body Inc ★★★★★

World Class Transmission Svc ★★★★★

Wood`s Locksmithing ★★★★★

Trust Auto Sales ★★★★★

Steele`s Truck & Auto Repair ★★★★★

South Hills Lincoln Mercury ★★★★★

Auto blog

Jaguar Land Rover to cut more U.K. jobs as it moves Discovery output to Slovakia

Mon, Jun 11 2018LONDON — Jaguar Land Rover (JLR) is set to cut more jobs in Britain as it moves all production of its Discovery car to lower-cost Slovakia before building its new Range Rover at an English factory. Britain's biggest automaker, JLR has previously said its next-generation Discovery will be built at its Slovakia plant and on Monday announced there could be some job cuts in Britain as a result. "The potential losses of some agency employed staff in the UK is a tough one but forms part of our long-term manufacturing strategy as we transform our business globally," the company said in a statement. Moving production from Britain will slash several thousands of pounds off the cost per vehicle, the firm's Chief Finance Officer Ken Gregor said last year. The new Range Rover and Range Rover Sport will however be built at the firm's central English Solihull plant on an architecture which is designed to allow for diesel, petrol, electric and hybrid models to be produced. Monday's announcement comes after the firm said this year it will cut 1,000 jobs and reduce production at two of its English factories as demand for diesel cars slumps in the face of higher taxes and a regulatory crackdown. The firm has also blamed Brexit for hitting demand in Europe's second-largest autos market, where demand fell 6 percent last year, a source told Reuters in April. JLR said in January it would decide this year whether to build electric cars in its home market after announcing all of its new cars will be available in an electric or hybrid version from 2020. The company, owned by India's Tata Motors, builds nearly one in three of Britain's 1.7 millions cars but is producing its first electric vehicle, the I-Pace, in Austria. JLR's new factory in the Slovak city of Nitra is due to begin production by the end of the year and will have a capacity of up to 300,000 vehicles. It already employs 1,400 people there as it gears up to open. In Britain, the firm built just over 530,000 vehicles last year at three production facilities and also has a separate engine site and headquarters, employing roughly 40,000 people in total. Related Video: Image Credit: Reuters/Paul Ellis Hirings/Firings/Layoffs Plants/Manufacturing Jaguar Land Rover SUV Luxury Off-Road Vehicles jaguar land rover jobs jlr slovakia

Michael Jordan's cars showcased in 'The Last Dance' documentary

Sun, May 10 2020After the masses begged and pleaded for an early release, ESPN finally unlocked the doors to the biggest production in company history last month. Episodes 1 and 2 of The Last Dance, a 10-part documentary special about Michael Jordan, the Chicago Bulls, and the 1997-1998 season, was released at last on April 19, 2020. Each week since, two new episodes have aired on Sunday nights, and the next two, episodes 7 and 8 are scheduled to drop this weekend on May 10. With unprecedented video access to MJ, who became averse to the media during his playing days, a byproduct from The Last Dance is a look at some of Jordan's cars. The Goat's taste ranges across a number of brands, but they all had one thing in common: performance as a top priority. Below, we have listed the rides that have already appeared in the series, and each week, we will update with new car cameos. Chevrolet Corvette C4 The photo above somewhat epitomizes one of the themes of The Last Dance. Everybody, whether that was men, women, children, franchise owners, reporters, coaches, teammates, or opponents, wanted a piece of Jordan. If that meant stopping in the middle of the road to get an autograph, then so be it. Around town, MJ was fairly easy to spot due to his flashy cars that occasionally wore Bulls red. Jordan has driven numerous Corvettes throughout the years, but the C4 is unique in that it was Chevy's top ride when Jordan signed an endorsement deal with the American company during his rookie year in 1984. Two famous photos, one in front of the Chicago skyline, show him standing next to a C4 with the license plate "Jump 23." This exact car, however, came later, as indicated by the squared-off taillights. He went on to star in a number of Chevrolet commercials with vehicles such as the Blazer and S-10 pickup truck. Chevrolet Corvette C5 The most notable Corvette His Airness ever owned was likely the C4 40th Anniversary ZR-1, but he also drove a C5 coupe at one point. Roughly nine minutes into the first episode, Jordan is seen driving the chrome-wheeled targa top into the parking lot at the Berto Center, the Bulls old practice facility.  Ferrari 550 Maranello Roughly three minutes into episode four, viewers get a glimpse of Jordan's exotic taste in the form of a red Ferrari 550 Maranello.

Weekly Recap: Hyundai scores NFL sponsorship after GM exits

Sat, Jul 4 2015Hyundai replaced General Motors as the official automotive sponsor of the NFL with a four-season deal that was announced this week. Hyundai gets exclusive sponsorship rights for mainstream and luxury cars, though not for pickups – as it doesn't have one in its current portfolio. "There may be another automotive truck sponsor, but not one that competes with our vehicle lineup," a Hyundai spokesman said in an email. That leaves the door open for another truckmaker to enter the fray. GM used the NFL to promote its GMC division, which makes pickups and sport-utility vehicles. The Detroit automaker decided to quit the sponsorship, which it had held since 2001, a GM spokesman said. Financials were not released, but ESPN said the sponsorship will cost Hyundai $50 million a year, double what GM paid. It gives Hyundai access to NFL trademarks for use in its marketing and advertising, and Hyundai will provide promotional vehicles to the league for the Super Bowl and other events. Hyundai celebrated the agreement by lighting up its Fountain Valley, CA, headquarters this week with a football field and the NFL logo. Hyundai's sister company, Kia, is the official automotive sponsor of the NBA. "We are huge football fans at Hyundai and feel there is no better venue to reach consumers, increase consideration, and tell the Hyundai brand story," Hyundai Motor America CEO Dave Zuchowski said in a statement. Hyundai will officially kick off its sponsorship when the NFL season begins on Sept. 10 with a primetime game featuring the Pittsburgh Steelers and the Super Bowl champion New England Patriots. OTHER NEWS & NOTES Toyota Mirai rated at 67 mpge, 312-mile range The Environmental Protection Agency gave the Toyota Mirai hydrogen fuel cell electric car a 67-miles-per-gallon-equivalent rating. The figure is for city, highway, and combined driving. The EPA also said the Mirai will have a 312-mile range. The sedan will arrive in dealerships in California this fall and will cost $57,500, though incentives can drop the price significantly. The Mirai will also be offered as a $499-per-month lease. Both come with three years or $15,000 worth of free fuel. Toyota plans to expand sales to the Northeast United States later. Toyota's top female exec resigns in wake of arrest Meanwhile, in other Toyota news, the automaker's communications chief and top female executive, Julie Hamp, resigned.