1974 Land Rover Defender Series Iii 109 Military 4 Cyl Gas, 4 Spd, 44k Miles 4x4 on 2040-cars

Parker, Arizona, United States

|

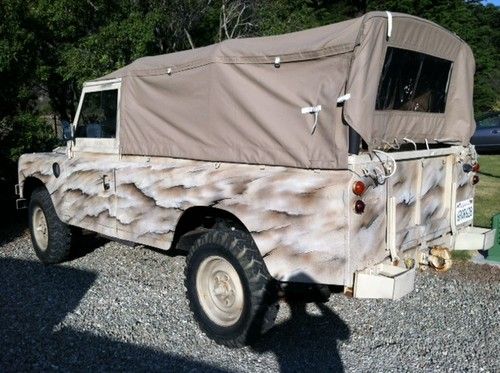

1974 Land Rover Series III 109 Military, Rt hand drive. Military, 4 Cyl Gas, 44K original miles, 4 X 4, 4 speed manual trans

Very fun to drive! People compliment this vehicle everywhere we go... full topless, canvas top and hard top. Aluminum rust free body, Military undercoat (best drive train protection), Professional camouflage paint job. These vehicles can sell for up $30K fully restored. $8900 Call or text or email Phil cell# 805-905-7393 Email, solimarbch@yahoo.com Parker Arizona |

Land Rover Defender for Sale

1986 land rover defender 110 country(US $34,999.00)

1986 land rover defender 110 country(US $34,999.00) Land rover d-90 defender. left hand drive 2.5 turbo diesel.(US $45,000.00)

Land rover d-90 defender. left hand drive 2.5 turbo diesel.(US $45,000.00) *** 1981 land rover series 109 wagon ***(US $22,990.00)

*** 1981 land rover series 109 wagon ***(US $22,990.00) 1994 land rover defender 90 base sport utility 2-door 3.9l(US $27,500.00)

1994 land rover defender 90 base sport utility 2-door 3.9l(US $27,500.00) 1975 land rover series 3 109 defender

1975 land rover series 3 109 defender -land rover defender station wagon 1980 special example-shipping service(US $8,950.00)

-land rover defender station wagon 1980 special example-shipping service(US $8,950.00)

Auto Services in Arizona

Vindictive Motorsports Inc. ★★★★★

Valley Express Auto Repair ★★★★★

Top Shop ★★★★★

TintAZ.com Mobile Window Tinting ★★★★★

Thunderbird Auto Repair ★★★★★

Super Discount Transmissions ★★★★★

Auto blog

Jaguars and Land Rovers to feature in 007's Spectre

Mon, Feb 9 2015James Bond may be more closely associated with Aston Martin, but Jaguars and Land Rovers have featured in 007 movies new and old. Skyfall, the most recent installment in the series, opened with Bond and Moneypenny ripping through the streets of Istanbul in a Defender and saw M being chauffeured around London in an XJ. And the upcoming feature Spectre is set to feature some of JLR's finest as well. While Bond himself will be piloting the new Aston Martin DB10, the movie will also feature a Jag and a couple of Landies. The Jaguar C-X75 concept, as we know, will be part of a chase scene against the DB10, now revealed to be set in Rome. But the movie will also include the new Range Rover Sport SVR (with what looks like some auxiliary lighting) and at least two Defenders modified by JLR Special Operations to "Big Foot" specifications with 37-inch off-road tires, upgraded suspensions and added bodywork protection. As you may recall, a couple of months ago a fleet of nine vehicles used in the film were stolen from a garage in Dusseldorf, including five Range Rover Sports. This is the first confirmation we're seeing of any of them being SVR models, or of the Big Foot Defenders being part of the mix as well. The scenes including the Land Rovers have already been filmed in Austria, and we're looking forward to seeing them all on the silver screen come November. Related Video: JAGUAR AND LAND ROVER ANNOUNCE PARTNERSHIP WITH SPECTRE, THE 24TH JAMES BOND ADVENTURE - Continuing Jaguar Land Rover's successful involvement with the Bond franchise, Jaguar C-X75, Range Rover Sport SVRandLand Rover Defender Big Foot to feature in new James Bond movie, SPECTRE - C-X75 concept vehicles will form part of spectacular chase scene in Rome Monday 9 Feb 2015 12:01 GMT: Jaguar Land Rover has announced its line-up of vehicles set to feature in SPECTRE, the 24th James Bond adventure, from Albert R. Broccoli's EON Productions, Metro-Goldwyn-Mayer Studios, and Sony Pictures Entertainment. These will include the Jaguar C-X75, Range Rover Sport SVR and Defender Big Foot, which have been provided by Jaguar Land Rover Special Operations. The Jaguar C-X75 will feature in a spectacular car chase sequence through Rome alongside the Aston Martin DB10. The C-X75 vehicles used in filming have been built in collaboration with Williams Advanced Engineering facility in Oxfordshire, England.

We compare 2021 Ford Bronco and Bronco Sport specifications to their ritzy Land Rover competiton

Tue, Jul 14 2020The 2021 Bronco and Bronco Sport are the spearheads for Ford's new 4x4 sub-brand, with the former taking the fight directly to the Jeep Wrangler and the latter providing Ford with a more rugged alternative to the Escape. We've already looked at how the new Bronco and Bronco Sport compare to their mainstream competition, but we'd like to see how the Bronco stacks up to another hotly anticipated returning nameplate: the Land Rover Defender. Not to leave its little sibling in the cold, I decided to browse Land Rover's lineup and see what might be a suitable counterpoint to the Bronco Sport. For better or worse, I found an almost-perfect fit in the Range Rover Evoque. So, how do these new American 4x4s compare to the Old Country's more-expensive alternatives? Let's dig in, starting with the big boys. As you might expect from the Bronco's robust credentials, it holds its own here against the more-expensive Brit. The Defender's higher price point brings along a good bit of power advantage with both engines, but that's to be expected. The Defender also has that trick adjustable-height suspension that the Bronco lacks, giving it an edge in practicality, and it can also tow quite a bit more. On the flip side, there are quite a few advantages to going with the Ford, including a greater number of choices in terms of powertrain. The available manual transmission on four-cylinder Broncos is a nice bonus, for instance, as is the option of getting either the base 2.3-liter or the optional 2.7-liter engine with either wheelbase. The Defender is a bit more restrictive in this regard offering only the inline-six on the short-wheelbase model. As an added bonus, the Bronco is a convertible. That may not necessarily be a "plus" for all shoppers, but it's certainly an added bit of versatility (and potential appeal) the Defender lacks. And of course, the Bronco can be had for as little as $30,000, whereas the Land Rover starts at $50,000. Now, on to the less-rugged siblings. The specs here are actually a little tighter in most respects, but the powertrain story is almost identical. The Evoque checks in where the Bronco Sport tops out, and the Range Rover gets an optional high-output variant of the 2.0-liter turbocharged four.

The UK votes for Brexit and it will impact automakers

Fri, Jun 24 2016It's the first morning after the United Kingdom voted for what's become known as Brexit – that is, to leave the European Union and its tariff-free internal market. Now begins a two-year process in which the UK will have to negotiate with the rest of the EU trading bloc, which is its largest export market, about many things. One of them may be tariffs, and that could severely impact any automaker that builds cars in the UK. This doesn't just mean companies that you think of as British, like Mini and Jaguar. Both of those automakers are owned by foreign companies, incidentally. Mini and Rolls-Royce are owned by BMW, Jaguar and Land Rover by Tata Motors of India, and Bentley by the VW Group. Many other automakers produce cars in the UK for sale within that country and also export to the EU. Tariffs could damage the profits of each of these companies, and perhaps cause them to shift manufacturing out of the UK, significantly damaging the country's resurgent manufacturing industry. Autonews Europe dug up some interesting numbers on that last point. Nissan, the country's second-largest auto producer, builds 475k or so cars in the UK but the vast majority are sent abroad. Toyota built 190k cars last year in Britain, of which 75 percent went to the EU and just 10 percent were sold in the country. Investors are skittish at the news. The value of the pound sterling has plummeted by 8 percent as of this writing, at one point yesterday reaching levels not seen since 1985. Shares at Tata Motors, which counts Jaguar and Land Rover as bright jewels in its portfolio, were off by nearly 12 percent according to Autonews Europe. So what happens next? No one's terribly sure, although the feeling seems to be that the jilted EU will impost tariffs of up to 10 percent on UK exports. It's likely that the UK will reciprocate, and thus it'll be more expensive to buy a European-made car in the UK. Both situations will likely negatively affect the country, as both production of new cars and sales to UK consumers will both fall. Evercore Automotive Research figures the combined damage will be roughly $9b in lost profits to automakers, and an as-of-yet unquantified impact on auto production jobs. Perhaps the EU's leaders in Brussels will be in a better mood in two years, and the process won't devolve into a trade war. In the immediate wake of the Brexit vote, though, the mood is grim, the EU leadership is angry, and investors are spooked.