2015 Jeep Wrangler Unlimited Sahara Sport Utility 4d on 2040-cars

Engine:V6, 3.6 Liter

Fuel Type:Gasoline

Body Type:SUV

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1C4BJWEG1FL560566

Mileage: 98876

Make: Jeep

Trim: Unlimited Sahara Sport Utility 4D

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

Warranty: Unspecified

Model: Wrangler

Jeep Wrangler for Sale

2021 jeep wrangler unlimited willys(US $30,000.00)

2021 jeep wrangler unlimited willys(US $30,000.00) 2024 jeep wrangler sport 4x4(US $45,381.00)

2024 jeep wrangler sport 4x4(US $45,381.00) 2024 jeep wrangler sport(US $33,852.00)

2024 jeep wrangler sport(US $33,852.00) 2019 jeep wrangler rubicon 1-touch sky power top 4x4(US $43,357.00)

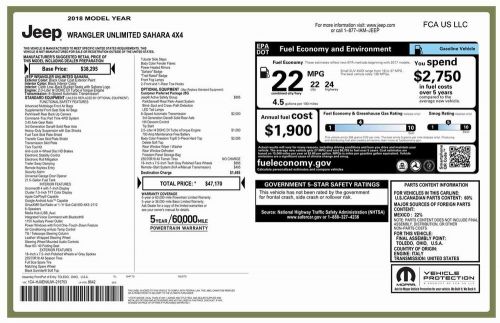

2019 jeep wrangler rubicon 1-touch sky power top 4x4(US $43,357.00) 2018 jeep wrangler unlimited sahara(US $33,985.00)

2018 jeep wrangler unlimited sahara(US $33,985.00) 2024 jeep wrangler rubicon 4x4(US $61,132.00)

2024 jeep wrangler rubicon 4x4(US $61,132.00)

Auto blog

These cars are headed to the Great Crusher In The Sky

Fri, 24 Aug 2012It happens every year. We bid adieu to some cars and trucks that will be missed, and say good riddance to others wondering how they stayed around so long. Whether they're being killed off for slow sales or due to a new product coming along to replace them, the list of vehicles being discontinued after 2012 is surprisingly long and diverse.

CNN Money has compiled a list of departing vehicles, to which we've added a few more of our own. In the slow sales column, cars like the Lexus HS 250h, Mercedes-Benz R-Class and the full Maybach lineup appear, while the Ford Escape Hybrid, Mazda CX-7 and Hyundai Veracruz are all having their gaps filled with more modern and more fuel-efficient alternatives. Obvious exceptions to the rule include models that still sell in decent numbers like the Jeep Liberty and the Chrysler Town & Country (which will eventually be replaced by a crossover-like vehicle).

Check out our gallery of discontinued cars above, then scroll down for more information.

2014 Jeep Cherokee

Thu, 19 Sep 2013The Cherokee Is Dead. Long Live The Cherokee.

There are three sentences that, for this reviewer, define what needs to be conveyed about the 2014 Jeep Cherokee. The first: it is very good.

Jeep spent 27 years building the Cherokee and its brand, from 1974 to 2001. Twelve years ago, the Cherokee nameplate rolled away into the distant hills and retirement, at least here in the NAFTA colonies, and it was replaced by a loaded word we knew as "Liberty."

Chrysler teases upcoming outlay of SEMA cars

Wed, 15 Oct 2014Fiat Chrysler Automobiles is hauling a multitude of modified models to the annual SEMA show in Las Vegas this November, and the company is releasing the first teasing sketches of many of them.

Unfortunately, FCA isn't giving many solid details on any of the concepts other than saying the vehicles from Chrysler, Jeep, Dodge, Ram and Fiat all benefit from tuning from its Mopar performance brand. The teaser photos include a sinister-looking Chrysler 200S, Fiat 500 Abarth with two-tone paint and a scorpion on the hood, a red and black 500L, seemingly two different takes on the Jeep Renegade, a green Dodge Challenger wearing the T/A badge, an orange and black Dart, a very neon Charger, just the outline of a red and black Viper, a Ram ProMaster in Mopar livery and a Ram pickup called the Outdoorsman.

Take a look through the gallery to see what you think of the sketches for these concepts, and scroll down for the full announcement from FCA.