2008 Jeep Patriot Sport on 2040-cars

535 N 6th St, Wood River, Illinois, United States

Engine:2.0L I4 16V MPFI DOHC

Transmission:Automatic CVT

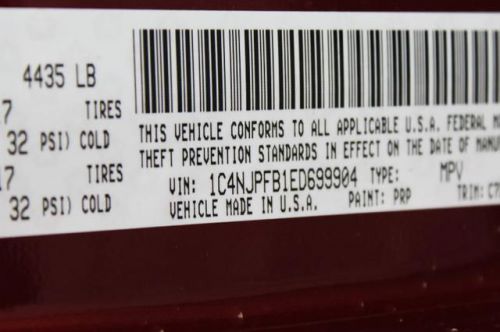

VIN (Vehicle Identification Number): 1J8FT28068D649316

Stock Num: 2956

Make: Jeep

Model: Patriot Sport

Year: 2008

Exterior Color: Bright Silver Clearcoat Metallic

Interior Color: Dark Slate Gray

Options: Drive Type: FWD

Number of Doors: 4 Doors

Mileage: 67143

If we cannot warranty it, we won't sell it. All vehicles come with a 3 month, unlimited miles warranty. BUY WITH CONFIDENCE - WARRANTY INCLUDED! CALL US TODAY FOR MORE INFORMATION 888-316-0591!

Jeep Patriot for Sale

2010 jeep patriot sport

2010 jeep patriot sport 2014 jeep patriot sport(US $19,799.00)

2014 jeep patriot sport(US $19,799.00) 2014 jeep patriot latitude(US $20,768.00)

2014 jeep patriot latitude(US $20,768.00) 2012 jeep patriot sport(US $16,894.00)

2012 jeep patriot sport(US $16,894.00) 2014 jeep patriot sport(US $19,799.00)

2014 jeep patriot sport(US $19,799.00) 2014 jeep patriot sport

2014 jeep patriot sport

Auto Services in Illinois

Xtreme City Motorsports ★★★★★

Westchester Automotive Repair Inc ★★★★★

Warson Auto Plaza ★★★★★

Voegtle`s Auto Service Inc ★★★★★

Thom`s Four Wheel & Auto Svc ★★★★★

Thomas Toyota ★★★★★

Auto blog

2014 Jeep Grand Cherokee SRT

Mon, 25 Feb 2013Jeep's Super 'Ute Is Fun Thrown In The Face Of Conventional Wisdom

Let's talk asses for a moment. What do they have to do with the 2014 Jeep Grand Cherokee SRT, you ask?

Well, we're here to tell you that this SRT can haul some. Lots of them, as a matter of fact: Jeep has increased the towing capacity of its most powerful SUV to 7,200 pounds. Assuming the average donkey weighs about 400 pounds, the Grand Cherokee SRT can haul ass to the tune of 18 burros, give or take a covered trailer or so, which is significantly more than it could in previous years. In 2013, the machine could manage 5,000 pounds, while the first generation was rated at just 3,500. The increase is mostly attributable to a new eight-speed automatic transmission and beefier rear axle, and it's a welcome update for those who'd like to use their SUV as, well, an SUV with an emphasis on utility.

Chrysler investing $20M in Toledo plant to support 9-speed auto production

Sun, 28 Apr 2013In 2011, Chrysler announced a $72-million investment in its Toledo Machining Plant to modernize production of the eight- and nine-speed torque-converters for automatic transmissions made there. That upgrade work won't be finished until Q3 of this year, but Chrysler has already announced a further $19.6-million investment to increase production capacity for the nine-speeders.

The extra units will be necessary because the nine-speed transmission they'll be mated to is going into three popular models: it will debut on the 2014 Jeep Cherokee, then go into the Chrysler 200 and Dodge Dart. The company predicted that this year alone it would sell 200,000 units equipped with the nine-speed tranny, and it is spending some $374 million in addition to the investment in Toledo to upgrade production capacity for it.

The work attached to this new investment won't begin until Q3 of 2014, and it will be finished by the end of that year. There's a press release below with all the details.

Chrysler says its 8-speed transmissions will save 700 million gallons

Thu, Jun 19 2014Chrysler Group's TorqueFlite eight-speed transmission could be earning some serious green bragging rights if the company's projections are correct. The recently widely proliferated automatic gearbox, which is now in more than a million vehicles around the world, is poised to save drivers an estimated 700+ million gallons of fuel over the vehicles' lifetimes (an expected cost savings of $2.5 billion). In addition, Chrysler expects a reduction in CO2 emissions by more than six million metric tons. According to Chrysler, and depending on the vehicle, the TorqueFlite can improve fuel economy. The TorqueFlite autobox features particularly close ratios from fifth to eighth gear (see the press release below for the specific numbers), and uses low-viscosity fluid that doesn't need to be replaced. Transmission software adapts to the driving situation to optimize efficiency based on driver behavior, temperature, grade, stability control, and longitudinal and lateral acceleration. The TorqueFlite is capable of handling a variety of duties. As evidenced by the wide range of vehicles Chrysler Group has seen fit to equip with the eight-speed transmission, the TorqueFlite is capable of handling a variety of duties. Since its 2012 introduction, the TorqueFlite has gone from performing cog-swapping duties in Dodge Charger and Chrysler 300 models equipped with the 3.6-liter Pentastar V6 to changing gears in vehicles such as the Pentastar- and Hemi-powered Dodge Durango, Jeep Grand Cherokee and even the Ram 1500 EcoDiesel. For the 2015 model year, the eight-speed is finding its way into even more vehicles with the addition of a third version. In addition to the American-made TorqueFlite 845RE and 8HP70, the new 8HP90 will be manufactured in Saarbrucken, Germany. The 8HP90 is designed for higher torque loads, making it ideal for high-performance vehicles like the 2015 Dodge Challenger SRT Hellcat. The already-in-use 8HP70 will expand its duties to be used in 2015 Hemi models such as the Dodge Charger, Challenger, and Challenger SRT8. You can see the list of those benchmarks in Chrysler's press release below.