2014 Jeep Grand Cherokee Overland on 2040-cars

8 N Locust St, Pana, Illinois, United States

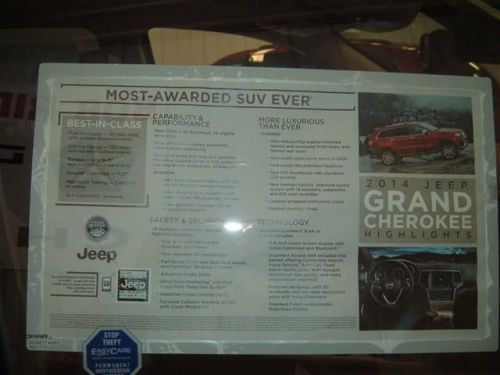

Engine:3.6L V6 24V MPFI DOHC

Transmission:8-Speed Automatic

VIN (Vehicle Identification Number): 1C4RJFCG5EC530602

Stock Num: 14135

Make: Jeep

Model: Grand Cherokee Overland

Year: 2014

Exterior Color: Bright White Clearcoat

Interior Color: Brown

Options: Drive Type: 4WD

Number of Doors: 4 Doors

Mileage: 10

This rugged Vehicle, with its grippy 4WD, will handle anything mother nature decides to throw at you!!! Does it all! You've been waiting for that one-time deal, and I think I've hit the nail on the head with this do-it-all Overland! $2,447 below MSRP** New Arrival** Oh, and did you notice that it's generously equipped with options: Advanced Brake Assist, Blind Spot & Cross Path Detection, Forward Collision Warning Plus, Advanced Technology Group - Includes Adaptive Cruise Control w/Stop... CALL ME RICK CALLISON AT 888-410-7455 TO SET YOUR APPOINTMENT TO PREVIEW THIS NEW VEHICLE TODAY!! We have a fine selection to choose from, in cars, trucks, vans and SUVS . Special APR financing available in lieu of rebates, call for details today!!

Jeep Grand Cherokee for Sale

2014 jeep grand cherokee limited(US $45,837.00)

2014 jeep grand cherokee limited(US $45,837.00) 2012 jeep grand cherokee laredo(US $28,490.00)

2012 jeep grand cherokee laredo(US $28,490.00) 2006 jeep grand cherokee laredo(US $9,654.00)

2006 jeep grand cherokee laredo(US $9,654.00) 2006 jeep grand cherokee laredo(US $11,781.00)

2006 jeep grand cherokee laredo(US $11,781.00) 2007 jeep grand cherokee laredo(US $12,481.00)

2007 jeep grand cherokee laredo(US $12,481.00) 2007 jeep grand cherokee laredo(US $12,481.00)

2007 jeep grand cherokee laredo(US $12,481.00)

Auto Services in Illinois

Waukegan-Gurnee Auto Body ★★★★★

Walker Tire & Exhaust ★★★★★

Twin City Upholstery ★★★★★

Tuffy Auto Service Centers ★★★★★

Top Line ★★★★★

Top Gun Red ★★★★★

Auto blog

FCA is setting a five-year strategy: Here's how the last one played out

Thu, May 31 2018We're slightly more than four years removed from Sergio Marchionne last five-year plan for FCA, a tell-all where the Italian-American automaker divulged its plans for the 2014 through 2018 model years. It was a grand affair, where Sergio told FCA investors that all was right in Auburn Hills, Alfa Romeo and Maserati were making comebacks, and the fifth-gen Dodge Viper received a mid-cycle refresh. You can read every last one of those past predictions right here. We're on our way to Europe to see Sergio's sequel, coming out Friday straight from FCA's Italian headquarters. (Bloomberg reports a plan to expand Jeep and Ram globally, combine Alfa Romeo and Maserati into a single division for an eventual spinoff, and downsizing Fiat and Chrysler. Also, EVs.) But before we arrive in Italy and find out exactly what Marchionne has planned for 2019 through 2023 as his last act as CEO, let's take a minute to tally up the results of his last term based on the same scoresheet we used in 2014. Now, we're only five months into 2018, so much of this — including vehicles like the Ram HD and Jeep Grand Wagoneer — could still debut this year. For those, we'll mark things TBD. We're not going to draw any conclusions or make any objectionable remarks. We're simply going to let the stats speak for themselves.

Jeep Cherokee appears in Chrysler's second Super Bowl spot

Mon, 03 Feb 2014The second of three spots produced by Fiat Chrysler Automobiles for this year's Super Bowl featured the all-new 2014 Jeep Cherokee. Aired during the game's half time show, the minute-long ad didn't strike as anything new or innovative from an automaker with a reputation for above average Super Bowl spots, but it did show the controversially styled Cherokee in the best light possible.

Called Restless, the commercial shows young, adventurous types doing the sorts of things that young, adventurous types do: surfing, skateboarding, cliff jumping, staring off into the sky with a pensive expression, etc. Scroll down to watch Restless for yourself and let us know in Comments if Jeep managed to hold your attention during half time.

2015 Jeep Renegade

Tue, 04 Mar 2014It's no secret that the midsize crossover segment is one of the most hotly contested battlegrounds in the automotive industry. Long have vehicles like the Ford Escape, Honda CR-V and Toyota RAV4 duked it out for those ever illusive consumer dollars. For many customers, though, even something like a Nissan Rogue is too big, whether in terms of price, fuel economy or just plain size.

For those customers, a growing market segment seems poised to fulfill their needs. Compact crossovers and tall wagons like the Nissan Juke and Kia Soul offer the high-riding driving experience with all the utility that comes from their two-box layout. It's an underrepresented segment among manufacturers, with big names like Toyota, Ford, General Motors and Honda lacking a true competitor.

To capitalize on this growing class, Chrysler's Jeep brand has readied this: the Renegade. That's right. Not Jeepster - Renegade. This diminutive off-roader, which rides on Fiat Chrysler's new small-wide 4x4 architecture, represents Jeep's first foray into the subcompact CUV segment as we know it, and it's making its official debut this week, on the floor of the 2014 Geneva Motor Show. Join us as we take a close look at one of Jeep's most important products in some time.