2021 Jeep Grand Cherokee L Limited 4x4 on 2040-cars

Tomball, Texas, United States

Engine:6 Cylinder Engine

Fuel Type:Gasoline

Body Type:--

Transmission:Automatic

For Sale By:Dealer

VIN (Vehicle Identification Number): 1C4RJKBG7M8107290

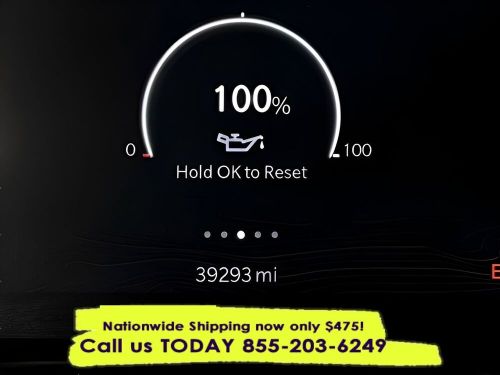

Mileage: 39306

Make: Jeep

Model: Grand Cherokee L

Trim: Limited 4x4

Drive Type: 4WD

Features: --

Power Options: --

Exterior Color: Black

Interior Color: Black

Warranty: Unspecified

Jeep Grand Cherokee L for Sale

2022 jeep grand cherokee l limited 4x2(US $22,463.70)

2022 jeep grand cherokee l limited 4x2(US $22,463.70) 2021 jeep grand cherokee l summit reserve 4x4(US $29,855.00)

2021 jeep grand cherokee l summit reserve 4x4(US $29,855.00) 2022 jeep grand cherokee l altitude 4x4(US $24,551.10)

2022 jeep grand cherokee l altitude 4x4(US $24,551.10) 2021 jeep grand cherokee l limited 4x4(US $24,761.10)

2021 jeep grand cherokee l limited 4x4(US $24,761.10) 2023 jeep grand cherokee l laredo 4x4(US $25,431.00)

2023 jeep grand cherokee l laredo 4x4(US $25,431.00) 2024 jeep grand cherokee l limited(US $500.00)

2024 jeep grand cherokee l limited(US $500.00)

Auto Services in Texas

Youniversal Auto Care & Tire Center ★★★★★

Xtreme Window Tinting & Alarms ★★★★★

Vision Auto`s ★★★★★

Velocity Auto Care LLC ★★★★★

US Auto House ★★★★★

Unique Creations Paint & Body Shop Clinic ★★★★★

Auto blog

Stellantis wants to trim 3,500 hourly U.S. jobs, UAW says

Wed, Apr 26 2023WASHINGTON — Chrysler-parent Stellantis NV wants to cut approximately 3,500 hourly U.S. jobs and is offering voluntary exit packages, according to a United Auto Workers union letter made public Tuesday. The automaker is looking to reduce its hourly workforce offering incentive packages that include $50,000 payments for workers hired before 2007, UAW Local 1264 said in a letter dated Monday posted on its Facebook page. Stellantis spokeswoman Jodi Tinson declined to comment. A person briefed on the matter said the figure might be lower than the figure cited in the UAW letter. In late February, Stellantis indefinitely halted operations at an assembly plant in Illinois, citing rising costs of electric vehicle production. The action impacted about 1,350 workers at the Belvidere, Illinois, plant that built the Jeep Cherokee SUV and resulted in indefinite layoffs. The automaker has warned it may not resume operations as it considers other options. The UAW letter said openings created by workers leaving would be filled by workers on indefinite layoff. Stellantis said in February that about 40,000 U.S. hourly workers were eligible for profit sharing. Last week, UAW President Shawn Fain said Stellantis' decision to idle the Illinois plant was "a flat-out violation" of the union's contract with the UAW and is unacceptable. The UAW will enter talks with the Detroit Three before labor contracts expire in mid-September. Earlier this month, General Motors said about 5,000 salaried workers accepted buyouts to leave the automaker. GM CEO Mary Barra said February job cuts of a few hundred jobs and the 5,000 buyouts "provided approximately $1 billion towards" a $2 billion cost cutting target. Ford Motor Co recently announced significant job cuts in Spain, Germany and other parts of Europe and in August said it would cut a total of 3,000 salaried and contract jobs, mostly in North America and India. Hirings/Firings/Layoffs UAW/Unions Chrysler Dodge Fiat Jeep Maserati RAM Stellantis

Toledo gets proactive in fight to keep Jeep Wrangler

Wed, 08 Oct 2014Let's make this very plain - the city of Toledo, OH loves its Jeeps. It loves them so fervently that the very rumor of the Jeep Wrangler moving out of its traditional home prompted the city's mayor, D. Michael Collins, and Ohio Gov. John Kasich to hold a weekend conference call with Chrysler CEO Sergio Marchionne.

"The purpose of this call was for the mayor and governor to gain clarity on Mr. Marchionne's comments last week regarding the possibility of the next generation of Jeep Wrangler being built at a location other than the Toledo North Assembly Plant," a spokesman for the mayor's office told The Toledo Blade.

While no further commitments were made by any party, Collins and Kasich's statement was quite unequivocal about keeping Toledo's unwillingness to let the Wrangler go, saying "the city and its partners will again rise to the occasion to ensure that the new Wrangler is made in Toledo." According to the newspaper, the next step is for face-to-face meetings between officials from Ohio and FCA.

VW, Rivian, Nissan, BMW, Genesis, Audi and Volvo lose EV tax credits starting tomorrow

Mon, Apr 17 2023The U.S. Treasury said Monday that Volkswagen, BMW, Nissan, Rivian, Hyundai and Volvo electric vehicles will lose access to a $7,500 tax credit under new battery sourcing rules. The Treasury said the new requirements effective Tuesday will also cut by half credits for the Tesla Model 3 Standard Range Rear Wheel Drive to $3,750 but other Tesla models will retain the full $7,500 credit. Vehicles losing credits Tuesday are the BMW 330e, BMW X5 xDrive45e, Genesis Electrified GV70, Nissan Leaf , Rivian R1S and R1T, Volkswagen ID.4 as well as the plug-in hybrid electric Audi Q5 TFSI e Quattro and plug-in hybrid (PHEV) electric Volvo S60. The Swedish carmaker is 82%-owned by China’s Zhejiang Geely Holding Group. The rules are aimed at weaning the United States off dependence on China for EV battery supply chains and are part of President Joe Biden's effort to make 50% of U.S. new vehicle sales by 2030 EVs or PHEVs. Hyundai said in a statement it was committed to its long-range EV plans and that it "will utilize key provisions in the Inflation Reduction Act to accelerate the transition to electrification." Rivian declined to comment and the other automakers could not immediately be reached for comment. Treasury also disclosed General Motors electric Chevrolet Bolt and Bolt EUV will qualify for the full $7,500 tax credit. GM said earlier it expected at least some of its EVS would qualify for the $7,500 tax credit under the new rules, including the 2023 Cadillac Lyriq and forthcoming Chevrolet Equinox EV SUV and Blazer EV SUV. Treasury said all GM EVs will qualify. Earlier, Ford Motor and Chrysler-parent Stellantis said most of their electric and PHEV models would see tax credits halved to $3,750 on April 18. Treasury confirmed the automakers' calculations. The rules were announced last month and mandated by Congress in August as part of the $430 billion Inflation Reduction Act (IRA). The IRA requires 50% of the value of battery components be produced or assembled in North America to qualify for $3,750, and 40% of the value of critical minerals sourced from the United States or a free trade partner for a $3,750 credit. The law required vehicles to be assembled in North America to qualify for any tax credits, which in August eliminated nearly 70% of eligible models and on Jan. 1 new price caps and limits on buyers income took effect.