L@@k Video Of Suv 4x4 Navigation System 4x4 Chrome Rims Heated Leather Seats on 2040-cars

Tallmadge, Ohio, United States

Vehicle Title:Clear

For Sale By:Dealer

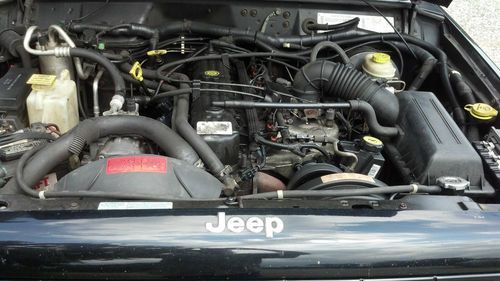

Engine:4.7L 285Cu. In. V8 GAS SOHC Naturally Aspirated

Body Type:Sport Utility

Fuel Type:GAS

Make: Jeep

Model: Grand Cherokee

Trim: Overland Sport Utility 4-Door

Transmission Description: 5-SPEED AUTOMATIC TRANSMISSION W/OD

Number of Doors: 4

Drive Type: 4WD

Drivetrain: 4 Wheel Drive

Mileage: 76,333

Sub Model: Overland

Number of Cylinders: 8

Exterior Color: Red

Interior Color: Red

Jeep Cherokee for Sale

Auto Services in Ohio

West Side Garage ★★★★★

Wally Armour Chrysler Dodge Jeep Ram ★★★★★

Valvoline Instant Oil Change ★★★★★

Tucker Bros Auto Wrecking Co ★★★★★

Tire Discounters Inc ★★★★★

Terry`s Auto Service ★★★★★

Auto blog

Mopar teases four of 'nearly 20' SEMA Show concepts

Fri, Oct 23 2015Yesterday it was Chevrolet. Today, Mopar has dropped some SEMA knowledge, releasing a quartet of teaser images that give us some indication of what kind of cars, trucks, and crossovers Fiat, Chrysler, Dodge, Jeep, and Ram will be showing in Las Vegas. Like Chevy, Mopar's concepts utilize both production and concept accessories, although Fiat Chrysler has gone a bit more indepth on at least one of its concepts. Immediately, the most tantalizing teaser is the one shown above. Yes, that's the back of a Challenger, and aside from the bright orange accents on the gray body, you should take notice of the badge mounted on the spoiler – yes, that says "GT AWD." To be honest, such a vehicle wouldn't be a huge shock, as both the Challenger's LX platform-mates, the Dodge Charger and Chrysler 300, are offered with all-wheel-drive options. Still, adding such a vehicle to the production cycle would give Dodge a leg up on the rear-drive only Ford Mustang and Chevrolet Camaro. Aside from that concept, FCA has also released teasers of a Ram-based concept, a 300-based concept, and what we're guessing is a Fiat 500X. We can't wait to see what the actual Fiat concept has to do with kiteboarding. As for the 300 and Ram, there's not a lot of hints on what sort of styling details they'll contain. The Chrysler has additional LED accents and what we're guessing is matte blue paint, while the Ram is based on a Hemi-powered 1500 with Rebel styling cues. This is just a very tiny sample of Mopar's final SEMA roster, which include "hundreds" of parts. There should also be a total of 20 vehicles covering all four former Chrysler Group brands, as well as Fiat. Naturally, we'll have plenty to report on each vehicle once the SEMA show kicks off in the next couple weeks.

Certain Chrysler owners eligible for buyback program

Mon, Jul 27 2015Certain car owners whose Chrysler vehicles contain dangerous defects will soon have a way to get rid of their lemons without losing money. As part of an agreement with federal regulators, Fiat Chrysler Automobiles has agreed to buy back more than 500,000 vehicles susceptible to veering out of control without warning at above market-value prices. The deal mainly covers certain models of RAM trucks, the Dodge Dakota pickup and Dodge Durango SUV. Further, owners of more than 1.5 million Jeep Liberty and Grand Cherokees at heightened risk for lethal fires are eligible to trade in their vehicles at above market value or, alternately, get a gift certificate if they prefer to have repairs made. Chrysler has "a heavy responsibility to make sure the products they make are safe for the traveling public," said Mark Rosekind, administrator of the National Highway Traffic Safety Administration. "... Here, we are sending an unambiguous signal to industry that if you skirt the laws or violate the law, or don't live up to the responsibility that consumers expect, we are going to penalize you." The buy-back and trade-in options for motorists come as part of an unprecedented penalty NHTSA slapped against Chrysler for violating federal motor-vehicle safety laws. Chrysler will pay a $105 million fine, the highest ever levied by the regulatory agency. In addition to the buy-backs, Chrysler also agreed to an independent monitor for three years. Investigators had outlined problems in the company's conduct in 23 recalls that affected more than 11 million defect vehicles. As part of a consent-order agreement, Chrysler acknowledged it did not notify vehicle owners of recalls in an effective manner and did not notify NHTSA of safety problems. Though those recalls affected millions of drivers, the buy-back and trade-in options are only for a small portion of the vehicles involved. Because Chrysler struggled to fix the problem and no repair was apparent, Rosekind said the buy-backs are reserved "for customers who didn't have a remedy." Buy-backs are for trucks and SUVs affected by three recalls that occurred in 2013 (recalls 13V-038, 13V-527 and 13V-529), that addressed a rear-axle pinion nut that could come loose and cause a loss of vehicle control. Those recalls covered 579,228 vehicles, including 2009-2012 Ram 1500, 2500, 3500, 4500 and 5500 trucks, 2009-2012 Dodge Dakotas, 2009 Chrysler Aspen and the 2009 Dodge Durango.

New England Patriots player helps driver of rollover crash

Tue, Jan 20 2015Winning the AFC Championship game to guarantee a spot in the Super Bowl would be a pretty major accomplishment for most people in a day. However, just hours after the victory, New England Patriots defensive tackle Vince Wilfork showed what he could do off the field, when he helped save a woman from an overturned car. Though, the player remained modest about what happened. Wilfork and his wife were driving home late at night when they spotted a flipped Jeep near Gillette Stadium in Foxborough, MA. Surveillance video showed Wilfork pulling over and running to the vehicle's aid to be among the first on the scene. Finding a woman trapped inside, Wilfork told her, "Don't panic," and according to Massachusetts State Police, the 325-pound player simply reached his arm into the vehicle and lifted the woman out to save her. She was later charged with driving under the influence. Hear Wilfork's description of what happened in the video above.

1998 jeep cherokee sport red 180k miles

1998 jeep cherokee sport red 180k miles 1996 jeep cherokee - 6" suspension lift, 35" bfg, 4x4 built for off-roading

1996 jeep cherokee - 6" suspension lift, 35" bfg, 4x4 built for off-roading 4x4 jeep cherokee xj

4x4 jeep cherokee xj 1998 jeep cherokee classic sport utility 4-door 4.0l

1998 jeep cherokee classic sport utility 4-door 4.0l 2001 jeep cherokee

2001 jeep cherokee 2000 jeep cherokee classic 4.0l

2000 jeep cherokee classic 4.0l