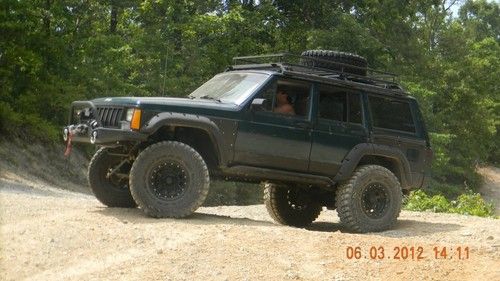

Cherokee Sport < Xj > Off Road 4x4 Truck 4.0 **no Reserve** on 2040-cars

Meyersdale, Pennsylvania, United States

Body Type:SUV

Vehicle Title:Clear

Engine:4.0 li 6 fi

Fuel Type:Gasoline

For Sale By:Private Seller

Make: Jeep

Model: Cherokee

Trim: Sport

Options: Cassette Player, 4-Wheel Drive

Safety Features: Driver Airbag, Passenger Airbag

Drive Type: ALL WHEEL DRIVE

Power Options: Air Conditioning, Cruise Control, Power Locks, Power Windows

Mileage: 98,260

Sub Model: Sport 4 Wheel Drive

Exterior Color: Red

Warranty: Vehicle does NOT have an existing warranty

Interior Color: Gray

Vehicle Inspection: Inspected (include details in your description)

Number of Cylinders: 6

Jeep Cherokee for Sale

Jeep cherokee sport 4.0l inline 6 engine kumho tires towing package no reserve

Jeep cherokee sport 4.0l inline 6 engine kumho tires towing package no reserve 96' jeep cherokee classic(US $800.00)

96' jeep cherokee classic(US $800.00) 2001 jeep cherokee xj 27k miles(US $8,500.00)

2001 jeep cherokee xj 27k miles(US $8,500.00) 1996 jeep cherokee se sport utility 4-door 4.0l built all around vehicle(US $7,000.00)

1996 jeep cherokee se sport utility 4-door 4.0l built all around vehicle(US $7,000.00) 1993 jeep cherokee blue(US $1,100.00)

1993 jeep cherokee blue(US $1,100.00) 2010 jeep grand cherokee laredo 4wd(US $16,995.00)

2010 jeep grand cherokee laredo 4wd(US $16,995.00)

Auto Services in Pennsylvania

West Penn Collision ★★★★★

Wallace Towing & Repair ★★★★★

Truck Accessories by TruckAmmo ★★★★★

Town Service Center ★★★★★

Tom`s Automotive Repair ★★★★★

Stottsville Automotive ★★★★★

Auto blog

FCA fibbed on sales according to internal report

Mon, Jul 25 2016Following last week's news that Fiat Chrysler Automobiles (FCA) is under investigation by the Department of Justice and Securities and Exchange Commission for allegedly fudging sales figures, a new report in Automotive News says an internal investigation at FCA uncovered misreported sales. According to the AN story, 5,000 to 6,000 vehicles from various FCA brands were reported sold by dealers, but no customers existed for those cars. FCA sales chief Reid Bigland has already put a stop to the practice. One potential reason for the practice was to maintain the company's month-to-month sales increase streak, currently at 75 months. In April, FCA added a lengthy disclaimer to its sales announcements: "FCA US reported vehicle sales represent sales of its vehicles to retail and fleet customers, as well as limited deliveries of vehicles to its officers, directors, employees and retirees. Sales from dealers to customers are reported to FCA US by dealers as sales are made on an ongoing basis through a new vehicle delivery reporting system that then compiles the reported data as of the end of each month. "Sales through dealers do not necessarily correspond to reported revenues, which are based on the sale and delivery of vehicles to the dealers. In certain limited circumstances where sales are made directly by FCA US, such sales are reported through its management reporting system." FCA did not provide comment to Automotive News. Click through for the full story and more details. Related Video: Earnings/Financials Government/Legal Chrysler Dodge Fiat Jeep RAM sales Sergio Marchionne FCA USDOJ reid bigland

Maserati Levante crossover not Jeep based after all?

Thu, 20 Feb 2014Maserati has been teasing its crossover project since 2011, which is when it first showed off the Kubang concept (pictured above). Still, the production version, rumored to be called the Levante, remains a complete mystery. The CUV was first rumored to borrow the platform from the Jeep Grand Cherokee, but new rumors indicate that the Italian, luxury crossover might actually take the underpinnings from the Quattroporte and Ghibli.

In a brief interview, Maserati CEO Harald Wester told CNN Money that the Levante wouldn't use Jeep's platform. Motor Trend spoke with an unnamed Maserati engineer who confirmed the rumor. Officially, the company says that no decision has been made.

We can add this to another long list of rumors about the Italian CUV. It was originally supposed to be built at Chrysler's Jefferson North assembly plant in Detroit. Then, plans were changed to build it in Italy.

Fiat Chrysler profit up as it closes in on retiring its debt

Thu, Apr 26 2018MILAN — Fiat Chrysler Automobiles reduced its debt by more than expected in the first quarter, putting the carmaker well on course to become cash positive later this year. Chief Executive Sergio Marchionne expects to cancel all debt during 2018 — possibly by the end of June — and generate around 4 billion euros ($5 billion) in net cash by the end of the year. Marchionne has said that forecast does not include any one-off measures, nor the impact of the planned spinoff of parts maker Magneti Marelli, which he hopes to execute by early 2019. The world's seventh-largest carmaker said on Thursday net debt had fallen to 1.3 billion euros ($1.6 billion) by the end of March, well below a consensus forecast of 2.6 billion euros in a Thomson Reuters poll of analysts. FCA said capital spending fell 900 million euros in the quarter due to "program timing," which analysts said implied higher investments for the rest of the year. The Italian-American group said first-quarter operating profit rose 5 percent to 1.61 billion euros, below a consensus forecast of 1.74 billion, as a weaker performance from its North American profit center weighed. Shipments there were higher due to the new Jeep Wrangler and Compass models. But currency moves hit revenues and earnings, and costs related to new product launches added to the pressure. FCA's shift to sell more trucks and SUVs boosted margins yet again in North America to 7.4 percent from 7.3 percent in the same quarter a year ago, although they were down from the 8 percent recorded in the preceding three months. Marchionne, preparing to hand over to an internal successor next year, is close to his goal of ending a margin gap with larger U.S. rivals General Motors and Ford. The 65-year-old has said becoming debt free and being able to compete on a par with U.S. peers would mean FCA no longer needed a partner to survive and could well succeed on its own. The CEO has previously said tying up with another carmaker would help to meet the huge costs in an industry investing in electric vehicles and automated driving. FCA shares fell immediately after the results, but recovered to trade up 3 percent at 19.71 euros by 1150 GMT, outperforming a 0.4 percent rise in Europe's blue-chip stock index. ($1 = 0.8214 euros) Reporting by Agnieszka FlakRelated Video: This content is hosted by a third party. To view it, please update your privacy preferences. Manage Settings.